Silver Reaches Highest Level Since September Of 2011

Image Source: Pixabay

It was silver’s turn to take the spotlight on Thursday, as the silver futures rose by a dollar to not only break through the $37 level, but surge past it to $37.63.

(Click on image to enlarge)

This was also a new high for silver for the current rally, as you can see below how both the day and 52-week range were set today at $37.68.

Based on Investing.com data, today’s move also eclipses the February 2012 $37.58 mark, and is the highest silver price since silver’s spectacular fall from over $40 on September 19, 2011, to under $31 just 2 weeks later on October 4, 2011 (hopefully I’m not bringing up any traumatic memories for the long-timers here).

(Click on image to enlarge)

The move was even more impressive given how the gold futures were higher, but only by a more modest $12 (0.36%).

(Click on image to enlarge)

Yet on Thursday silver continued to trade more like copper, which has surged this week following Trump’s announcement of a 50% tariff.

(Click on image to enlarge)

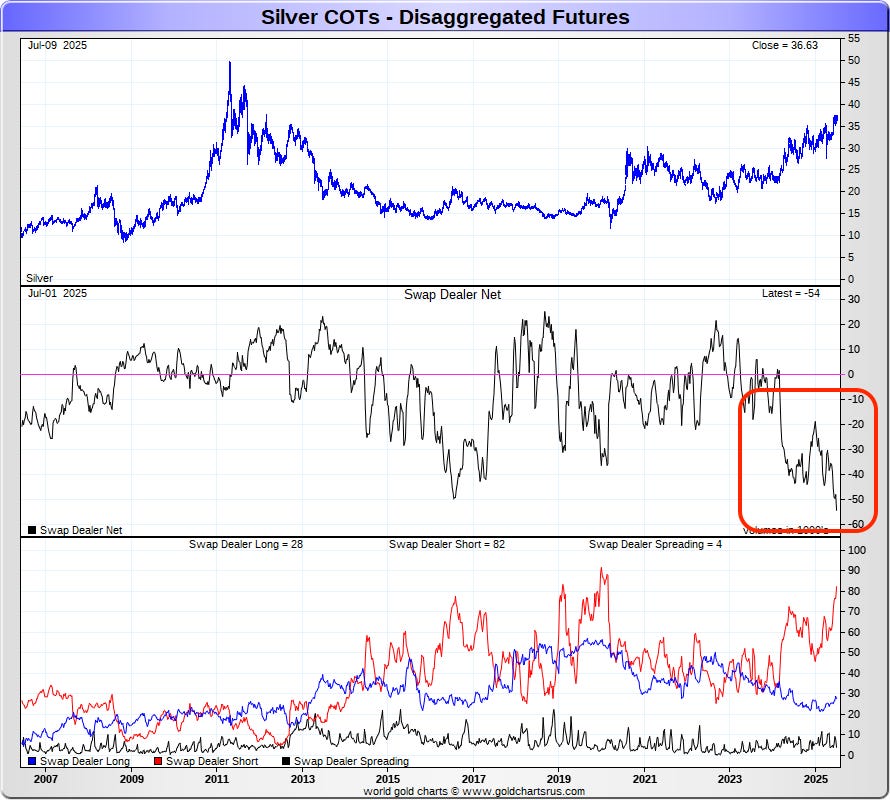

It’s also worth noting that silver is hitting this peak in the week following the banks setting a new all-time record for the largest silver short position ever at 54,388 net collectively short.

(Click on image to enlarge)

Of course while all of this is happening, Donald Trump has now put a number on just how far he thinks rates need to be cut.

So not only has silver just hit its highest mark since September of 2011, while the banks have just set a new record for the largest short position ever, but when we look ahead, the man in charge of picking the next Fed chair seems highly inclined to select someone who’s going to cut rates ‘more than just a little.’

We actually talked a bit about today’s rally, and also how money has now started trickling down to even the junior portion of the silver mining equities market on our Youtube channel. And for some more insight into the already fragile supply dynamics facing the market, I think you would enjoy this.

But if you’re already getting excited to wake up tomorrow to see what happens, you’re not alone.

Especially after watching gold soar to repeated new all-time highs over the past year and a half, while silver often feels like it’s lagging behind, it’s another nice day for the silver investors. And I’ll look forward to recapping the week with you tomorrow, and I’ll also have an update with the latest COT numbers.

More By This Author:

Money Has Finally Even Started Returning To The Junior Mining Explorers & Developers

The Difference In Gold & Silver In The US Vs. China

Gold And Silver Rebound After Sunday Night Selloff, While Trump Administration Offers Trade Deal Updates