Silver Quarterly And 6-Month Closes Confirm Upward Trend

There continues to be a heavy amount of pessimism toward silver on social media these days, but if you've noticed, most of these analysts are speculators trading on very short term charts. I prefer the long-term investment view, and in my opinion, the outlook for silver has never been brighter from a technical perspective. We're coming up on both the quarterly and 6-month close, so this week we'll look at those charts.

(Click on image to enlarge)

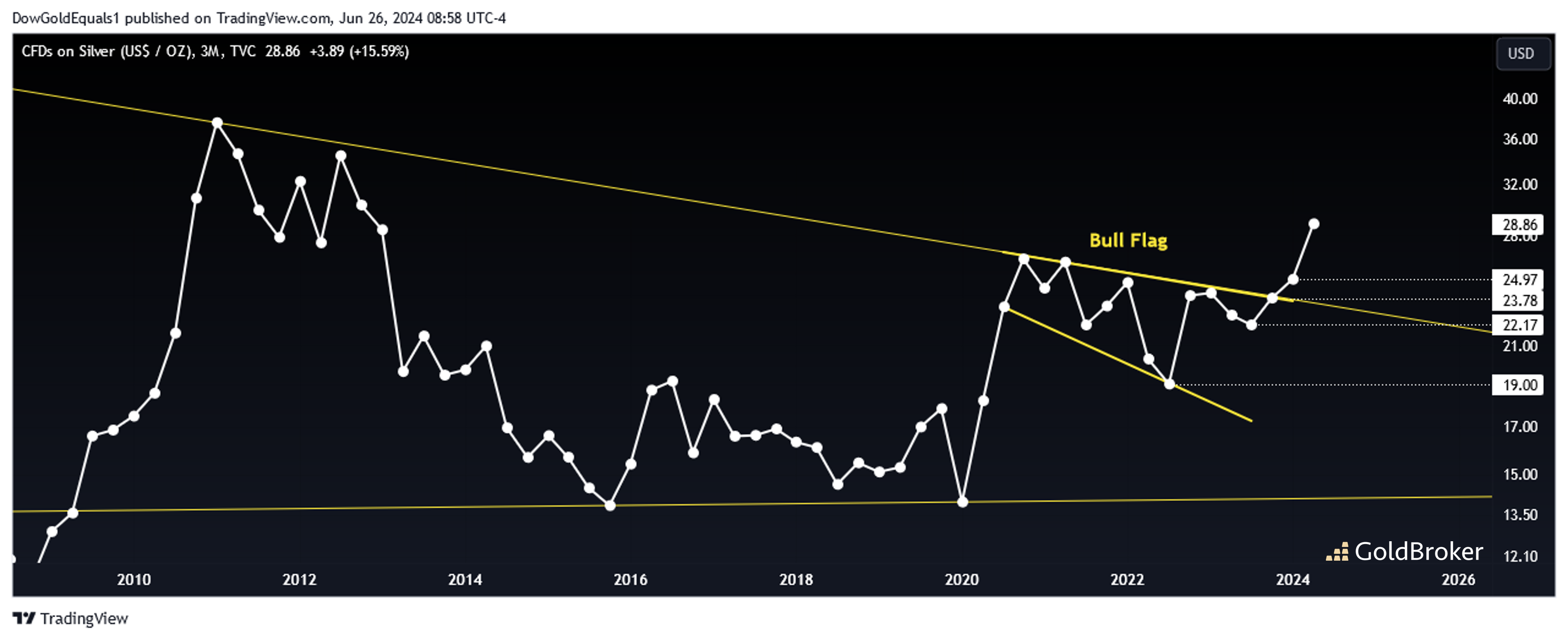

Starting with the quarterly view, we see that silver price has continued its major breakout from a bull flag that first formed off the COVID lows. It should be noted that, despite a lot of naysayers out there, silver is poised to close $4 higher than last quarter and about $10 higher than its 2022 low! It seems that no matter how fast silver rockets higher, there are traders determined to be left behind.

(Click on image to enlarge)

Looking at the 6-month view, silver looks to be breaking out of a much larger flag with a measured move to around $100! This is an historic development with the only question in my mind being whether we backtest the flag or continue higher from here. Silver's battle with the $30-$32 area will likely answer that question. I also want to point out that silver is set up for its 4th highest 6-month close in its history. The previous three highest closes were at the blow-off top of a major bull run, but this time silver is just getting started.

(Click on image to enlarge)

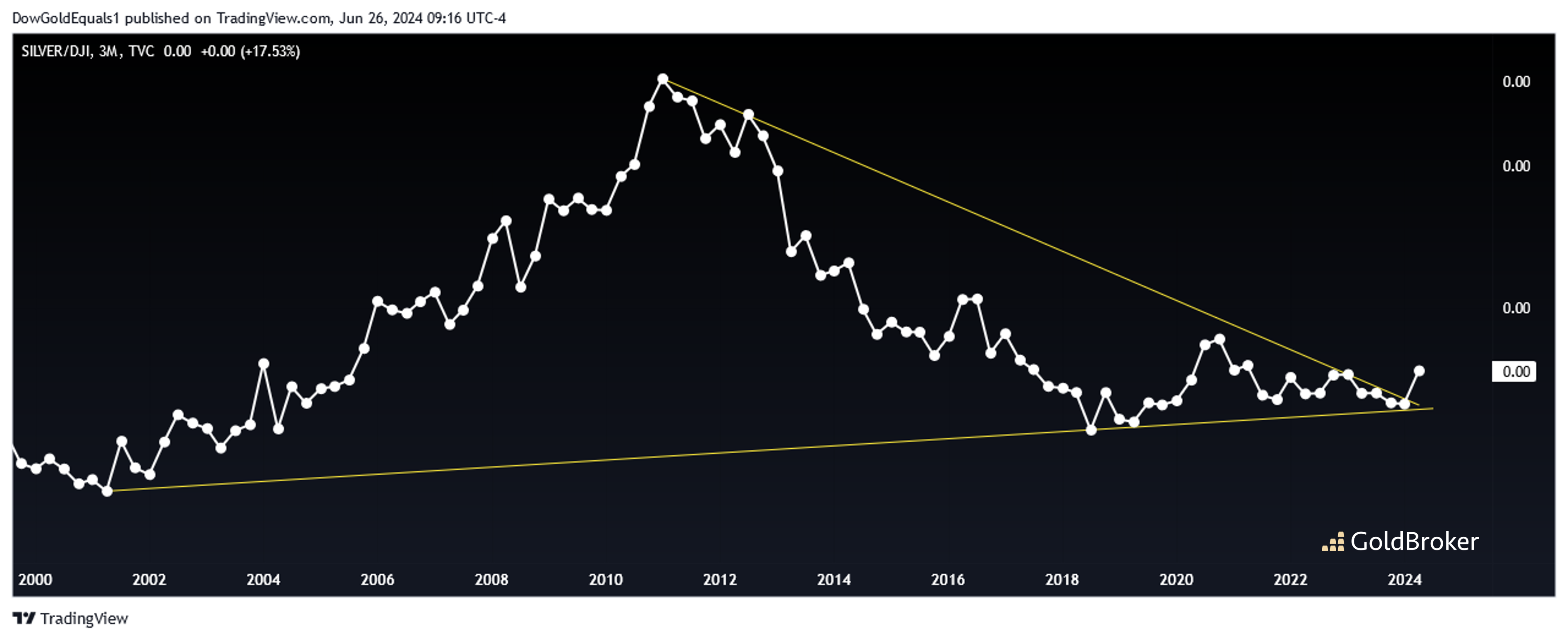

Finally, as a bonus chart this week, let's look at an exciting quarterly chart of the silver/dow ratio, and note too that it will confirm a major breakout. Historically when silver has outperformed stocks, silver has been in a huge bull market.

More By This Author:

Acceleration Of The Silver Price Rise In The Short Term

We Can Dissolve The National Assembly, But Not The Debt

The Dollar Holds Steady Thanks To A Firm Fed And The Crisis In France

Disclosure: GoldBroker.com, all rights reserved.