Silver Price Targets: XAG Surges To Fresh Yearly Highs– Trade Levels

Silver prices have surged to fresh yearly highs with XAG/USD rallying six of the past seven weeks. These are the updated targets and invalidation levels that matter on the XAG/USD charts heading into the close of the week.

SILVER PRICE CHART – XAG/USD DAILY CHART

(Click on image to enlarge)

Prepared by Michael Boutros, Technical Strategist; Silver (XAG/USD) on Tradingview

Technical Outlook: In my last Silver Price Outlook we noted that XAG/USD was, “testing confluence uptrend resistance here and leaves the long-bias vulnerable while below the upper parallel.” Prices pulled back nearly 3% last week before stabilizing with the subsequent breakout taking Silver to fresh 20-month highs. The advance hit initial resistance objectives at 17.74 today after gapping higher into the open with the daily chart highlighting ongoing momentum divergence into these highs- risk for topside exhaustion is mounting.

A breach higher from here exposes channel resistance / the 1.618% extension of the November advance at 18.04 backed closely by the 61.8% retracement / August 2016 swing low at 18.37/40. Daily support rests at 16.95 with a broader bullish invalidation now raised to 16.61.

SILVER PRICE CHART – XAG/USD 120MIN

(Click on image to enlarge)

Chart Prepared by Michael Boutros, Technical Strategist; Silver (XAG/USD) on Tradingview

Notes: A closer look at silver price action shows XAG/USD continuing to trade within the confines of ascending pitchfork formation extending off the late-June / July lows. The weekly opening-range is taking shape just below the 17.74 resistance target with initial support eyed at 17.52. Look for losses to be limited to the median-line / Friday’s close at 17.39 IF prices are indeed heading higher on this stretch.

Bottom line: The Silver price breakout is maturing at fresh yearly highs and while the broader outlook remains constructive, the advance may be vulnerable near-term on the back of this three-week advance. From at trading standpoint, a good place to raise protective stops- look to reduce long-exposure on a stretch towards slope resistance- expect a bigger reaction there IF reached. Be on the lookout for possible downside exhaustion ahead of the Friday close to keep the immediate long-bias viable. Review my latest Silver Weekly Price Outlook for a longer-term look at the technical trading levels for GBP/USD heading.

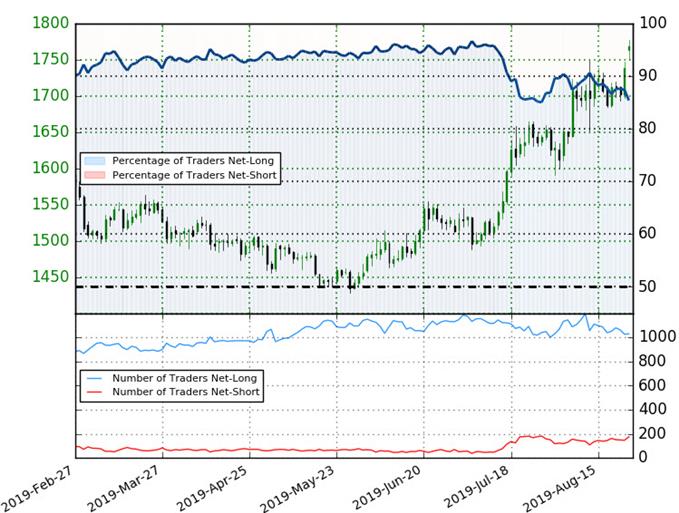

SILVER TRADER SENTIMENT (XAG/USD)

(Click on image to enlarge)

- A summary of IG Client Sentiment shows traders are net-long Silver - the ratio stands at +5.85 (85.4% of traders are long) – bearish reading

- The percentage of traders net-long is now its lowest since July 26th

- Long positions are 1.0% lower than yesterday and 1.9% lower from last week

- Short positions are 10.0% higher than yesterday and 12.8% higher from last week

- We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests Spot Silver prices may continue to fall. Yet traders are less net-long than yesterday & compared with last week. From a sentiment standpoint, the recent changes in positioning warn that the current Spot Silver price trend may soon reverse higher despite the fact traders remain net-long.