Silver Price Forecast: XAG/USD Jumps To Near $23 As U.S. Dollar Corrects Sharply Despite Sticky Inflation

Image Source: Pixabay

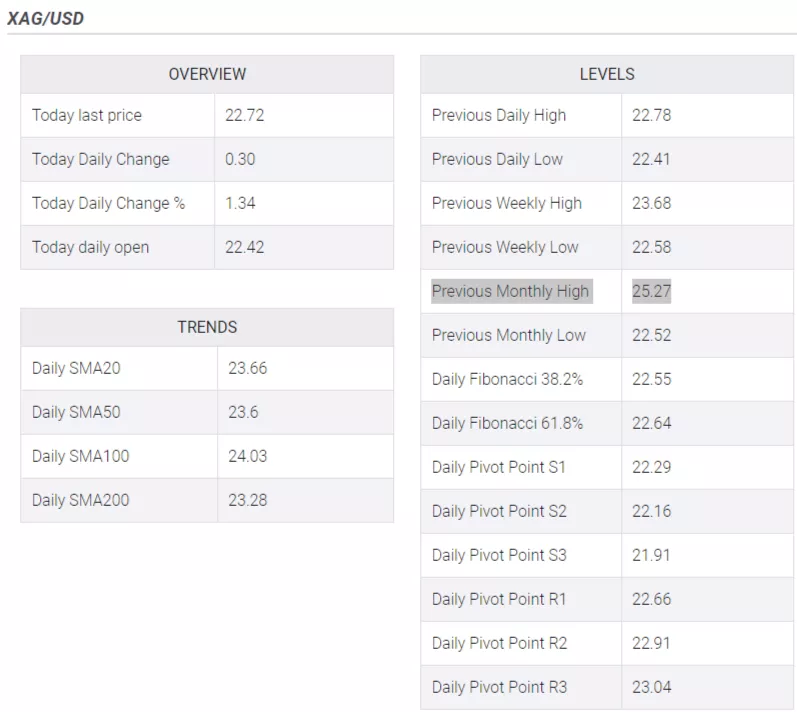

Silver price (XAG/USD) extends upside sharply to near the crucial resistance of $23.00 as the upside momentum in the US Dollar Index (DXY) fades after failing to sustain above 103.50. The white metal strengthens as investors hope that the impact of higher interest rates by the Federal Reserve (Fed) will be lower than keeping them higher for a longer period.

S&P500 opens on a mildly positive note as investors’ risk appetite improves. Overall market mood is still cautious as the United States inflation outlook turns extremely sticky due to stronger wage growth. The 10-year US Treasury yields continue to trade around 4.30% as robust consumer spending momentum elevates upside risks to inflation.

The US Dollar Index (DXY) finds some support near 103.00 as the US Department of Labor reported lower-than-expected jobless claims. Individuals claiming jobless benefits for the first time dropped to 239K vs. expectations of 240K and the former release of 250K for the week ending August 11.

Meanwhile, Federal Open Market Committee (FOMC) minutes released on Wednesday delivered a clear message that the inflationary environment is still uncertain and further policy action will be more dependent on the incoming data.

Silver technical analysis

Silver price delivers a breakout of the Falling Wedge chart pattern formed on an hourly scale. A breakout of the aforementioned chart pattern results in a bullish reversal. Silver price climbs above the 50-period Exponential Moving Average (EMA) around $22.63.

A break by the Relative Strength Index (RSI) (14) above 60.00 will activate the bullish momentum.

Silver hourly chart

(Click on image to enlarge)

More By This Author:

US Philadelphia Fed Manufacturing Index Rises To 12 In August Vs. -10 Expected

US weekly Initial Jobless Claims decline to 239K vs. 240K expected

US Dollar Hits Home Run As Fed Remains Hawkish

Disclaimer: Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only ...

more

-638278786940438151.png)