Silver Price Analysis: Bulls Step In And Help The XAG/USD Clear Daily Losses

Image Source: Pixabay

On Tuesday, the XAG/USD cleared daily gains and its losses were limited by the USD consolidating its previous day’s gains. Focus now shifts to the July meeting's Federal Open Market Committee (FOMC) minutes.

US Retail Sales showed the US economy is holding firm. The headline Sales rose by 0.7% MoM, higher than the 0.4% expected, while the ones excluding the Automobile sector also came in strong and came in at 1% vs the 0.4% expected.

Regarding the next Federal Reserve (Fed) meeting, there's a prevailing market expectation of a no hike in September. However, the chances of a 25 basis point adjustment in November reach a peak of around 40%. That said, the focus now pivots to Wednesday's Federal Open Market Committee (FOMC) gathering, as investors seek hints in the forward guidance to attain a distinct perspective on the officials' position.

Considering this, the US bond yields, considered the opportunity cost of holding Silver, are edging lower. The 10-year bond yield trades at 4.18%, down by 0.62 % losses on the day. The 2-year yield stands at 4.95% with 0.81 % losses, and the 5-year yield is at 4.33% with 0.62 % losses.

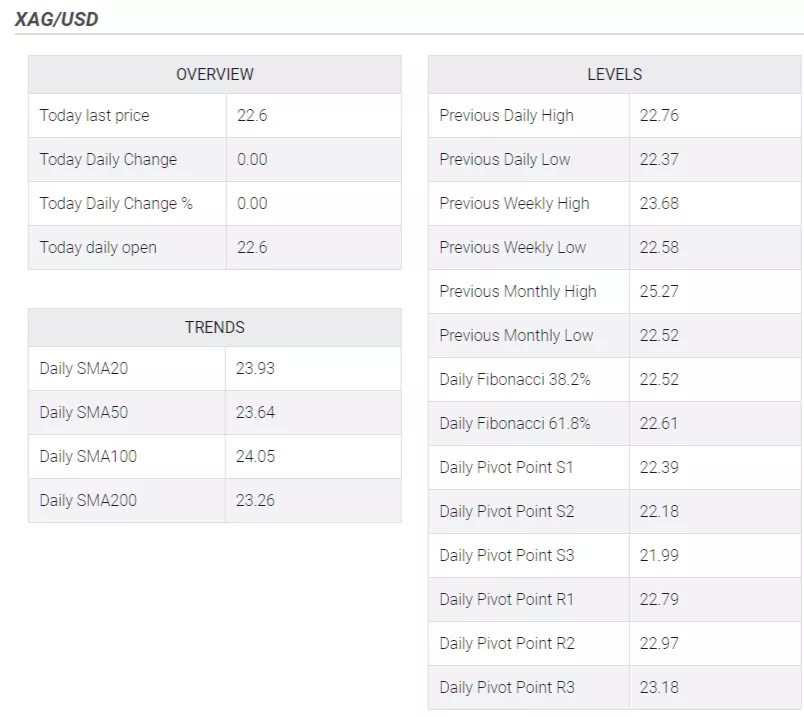

XAG/USD Levels to watch

The technical analysis of the daily chart suggests a neutral to bearish stance for XAG/USD as the bears work on staging a recovery and exerting their influence. Having turned flat in negative territory, the Relative Strength Index (RSI) suggests a potential market equilibrium with balanced selling and buying pressure. At the same time, the Moving Average Convergence (MACD) shows flat red bars. In addition, the pair is below the 20,100 and 200-day Simple Moving Averages (SMAs), highlighting the continued dominance of bears on the broader scale, requiring the buyers to take action.

Support levels: $22.15, $22.00, $21.80.

Resistance levels:$23.30 (200-day SMA), $23.50, $24.00.

XAG/USD Daily chart

(Click on image to enlarge)

-638277176385847785.png)

More By This Author:

USD/CAD Drops Near 1.3450 As US Dollar Extends Losses, Canadian CPI Turns Out Persistent

USD/JPY Price Analysis: Bulls Could Pause Near Ascending Channel Hurdle, Around 146.00

EUR/USD Recovers Its Recent Losses, Investors Await US Retail Sales

Disclaimer: Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only ...

more