Silver Just Flashed A Crisis Warning

Image Source: Pixabay

I was looking at silver volatility this morning and had to do a double-take.

Silver's at $75+. Up more than 160% this year. With crisis-level volatility I haven't seen since 2011.

You know what happened in 2011?

Silver crashed from $43 to $26 in four months. Right before Ben Bernanke became "Helicopter Ben" and started throwing money at everything.

The Math That Screams Danger

Here's what's really nuts: CME just hiked silver futures margins 10% on December 12th. They don't do that unless they're scared.

If you want to trade ONE silver contract right now, you need massive margin. And SLV - the equity version - is nearly impossible to borrow. Borrow costs hit 14% annualized. That's short squeeze territory.

How do I know this is real? 62 million SLV shares traded in the first three hours of today’s session.

On the day after Christmas. While silver futures only did 116k contracts.

The tail is wagging the dog.

What Everyone's Missing

While you're celebrating S&P futures approaching 7,000, silver just gained more in one year than most stocks gain in a decade.

This isn't sustainable. It's not about inflation or government debt. This is a massive short squeeze happening in real time.

SLV shares available to borrow dropped from 10 million to 10,000 in two weeks earlier this year. Physical silver lease rates are spiking. People are getting blown apart.

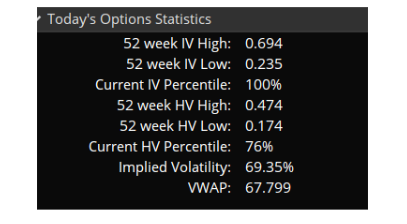

SLV Option Stats

The 2011 Playbook

Remember what happened last time silver hit crisis volatility? It didn't end well.

September 2011: Silver volatility exploded just like now. Then it collapsed 40% in weeks while everyone thought we were heading into another financial meltdown.

This thing could easily drop back to $50 in three weeks. Or explode even higher first. Either way, it's chaos.

Watch this: When silver moves like this, broader markets follow. Set alerts for SLV borrow costs above 15% and silver futures margin hikes. The party in everything else might be ending sooner than anyone thinks.

More By This Author:

The $71 Hedge Institutions Just DeployedConsumer Sentiment Crashes To 20-Year Low

The SLV Trade Everyone's Getting Backwards Right Now