Silver Futures Set New All-Time Record High, Then Fall By $2

Image Source: Unsplash

In case you’re the kind of investor who likes some action, today was your day. As the precious metals were soaring this morning, but not only lost their gains, but are now into significant negative territory on the day.

The gold futures got as high as $4,250, before two sharp sell-offs brought it $89 lower from its peak to $4,161.

(Click on image to enlarge)

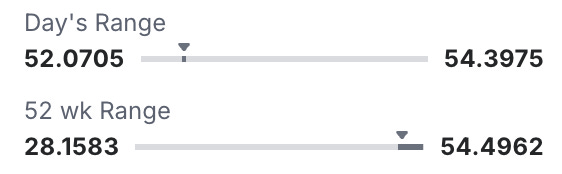

There was a similar pattern in the silver chart today, where the price got as high as $54.40, before declining to its current level of $52.36.

(Click on image to enlarge)

The $54.40 peak was a new record high for the silver futures.

The silver spot price also peaked at $54.40, and is currently down to $52.29.

(Click on image to enlarge)

The $54.40 peak today was a dime off of the all-time spot price high, which was $54.50 last month.

Much as I’ve discussed repeatedly over the past few months, and really ever since silver broke through the $30 level last year, it’s wise to expect this kind of volatility once the price really starts moving like it did again this week.

I know there’s a tendency to think that the smart money knows exactly what’s going to happen and is picking everyone else off. Although I think what you’re really seeing happen here is the realization that no one really knows how this is going to unfold, which can be evidenced by the fact that the price has had an $8.50 range over the past month in both directions (both the futures and the spot price had brief lows in the $45.60s at the end of October).

Some market participants think the silver supply crisis has been resolved, while others, such as myself, have pointed to ample evidence suggesting that what we just saw was highly likely to be more of a temporary band-aid than a long-term resolution.

We’re seeing the silver supply run low in China now, and while the LBMA has had about 55 million ounces of silver return, I went through the math earlier this week of why that still leaves them in the danger zone, even if it does buy them some more time.

More than anything, the fact that the price crossed over $54 last month, then went below $46, and once again just crossed over the $54 level today, would be to me by far the bigger takeaway. It may be down from its highs of earlier this morning, but that’s a significant piece of confirming evidence that the surge past the $50 level was not just a random accident.

I’m getting ready to head into New York City for the Silver Institute dinner tonight, and it’s hard to think of a more exciting day for that to have ended up occurring. Like I mentioned yesterday, my understanding is that there is a large banking component to the crowd, so it will be interesting to have some conversations and get an even better feel for what they’re thinking and seeing.

Lastly, as I was thinking about the Trump administration plan to give everyone $2,000, I had the amusing thought to ponder what if they just gave everyone in the population an ounce of silver. Or $2,000 worth of silver.

Obviously that’s not going to happen, especially now that even the U.S. has recognized silver as a strategic metal. And of course, the fact that if they tried to give everybody $2,000 worth of silver, that would finish off the LBMA AND the Comex.

So just something fun to think about for a minute or two, and even if you’re a bit disappointed by today’s sell-off, just remember that silver is still trading at a price level that it took planet Earth a couple thousand years to reach. And I’ll look forward to checking back in with you tomorrow with some thoughts from the dinner.

More By This Author:

Silver Flows Back To London, But Was It Enough...Silver Now Up Over $2 On The Day As Rate Cut Expectations Rise

Gold & Silver Rally Early While Bessent Doubles Down On Perplexing 'Falling Inflation' Comment