Silver Forex Signal: Finding Buyers

Image Source: Pixabay

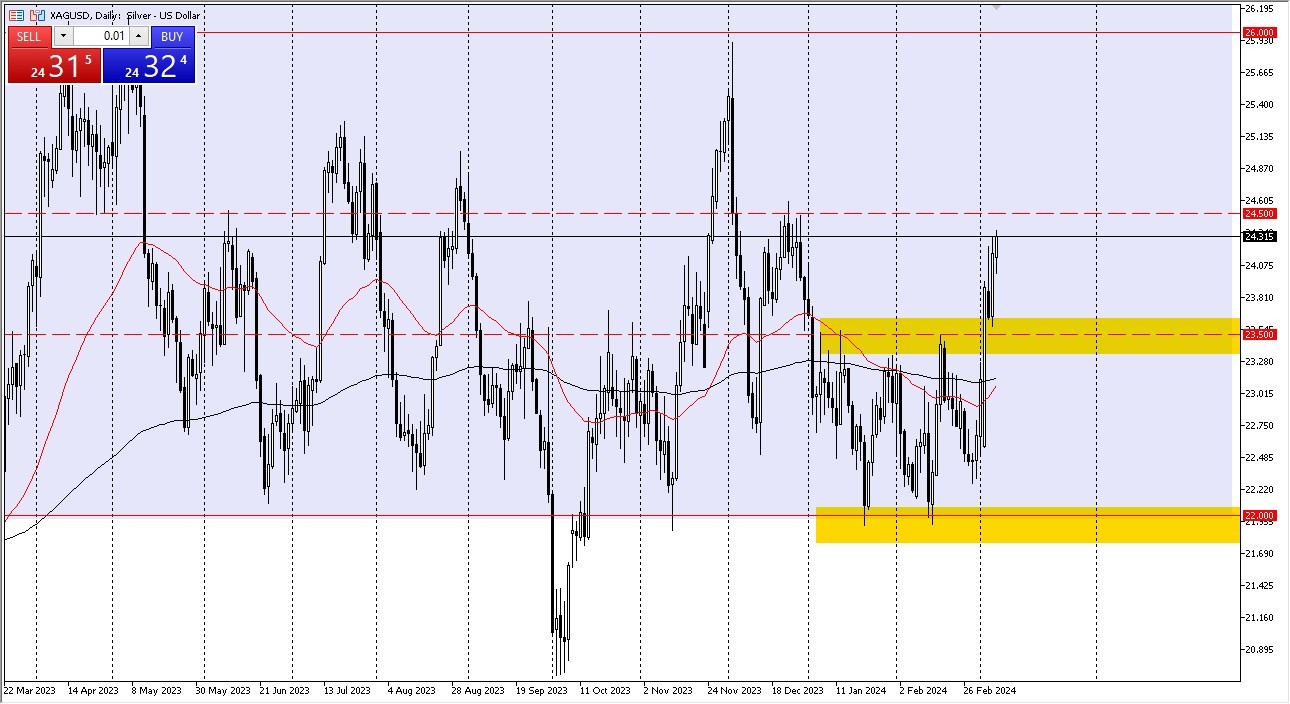

Potential signal: If silver can stay above $24.50 for more than an hour – I am buying with a stop at the $23.80 level, and aiming for $25.57 above.

- During Thursday's trading session, the silver markets first declined, but they later recovered and began to show signs of life as buyers continued to hunt for value.

- With the nonfarm payroll report due on Friday, I believe that the current level of volatility in silver will only continue going forward.

- After all, this is what the market is known for most of the time.

During Thursday's trading session, silver first slightly declined before turning around and demonstrating buying pressure once more. Although I believe there will be a lot of noise in this market going forward, you also need to consider whether or not we can break above the $24.50 mark. When we get there, pay special attention to that area since it has proven to be significant on several occasions.

The Area Above Could Be Important

Given that it has historically provided strong resistance, the $24.50 level is one that many traders will be closely monitoring. It is probable that the market will surge higher and aim for the $26 level, which has historically been a notable swing high on longer-term charts, if we are able to break above that level.

I think buying dips is a good idea. Finding a value is definitely preferable to chasing it. Having said that, we also need to view this through the lens of a market that raises questions about its ability to hold onto gains if we were to see a breakdown below the $23.50 mark. The 50-day EMA will have to be dealt with as possible support for anything below that point, but the 200-day EMA is also located in that same neighborhood. Therefore, I believe that the drawback is probably not as great. And as of right now, I continue to see this as a perfect opportunity to buy on the dip. However, I also understand that silver is extremely susceptible to US interest rates. Naturally, the jobs number on Friday will most likely blow those out of the water. Having said that, I am still bullish and would rather find a way to profit from a dip of some kind.

More By This Author:

BTC/USD Forecast: Small Rise As Wall Street Drives GrowthCrude Oil: Tests For Support In Bullish Movement

BTC/USD Forecast: Continues To Power Higher In Relentless Buying Pressure