Silver Forecast: To Continue Finding Buyers

Did you know? Silver is not only a precious metal, but it is also an industrial one. Industrial demand is going to plummet going forward, so that is a little bit of a weight around the neck of silver.

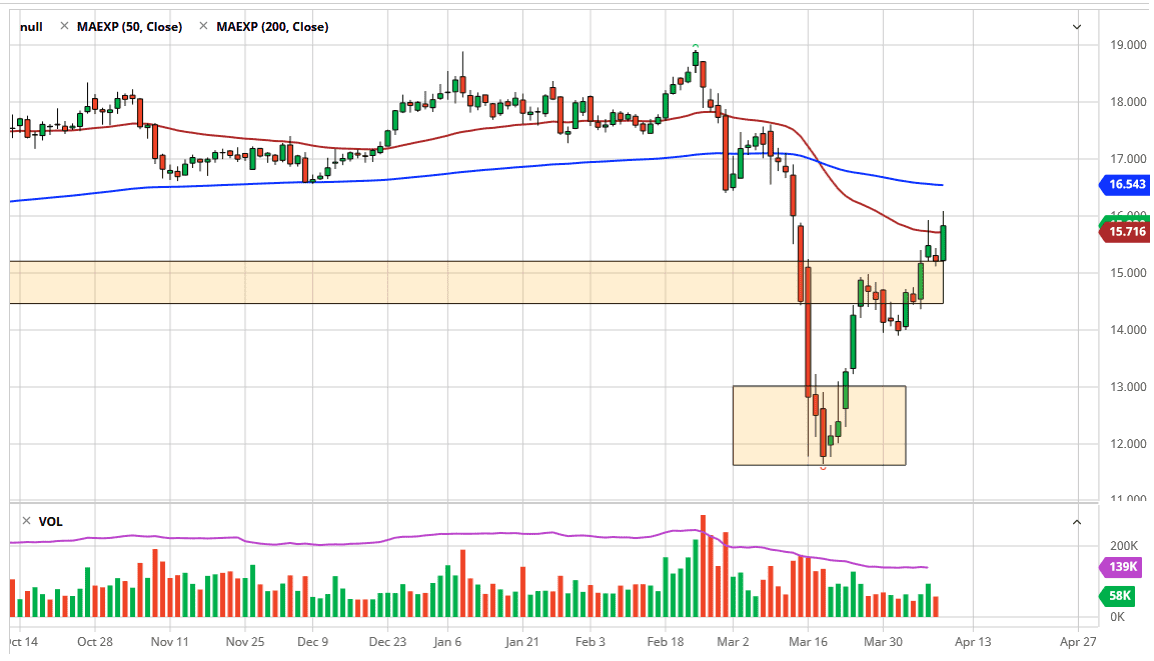

Silver markets broke higher during the trading session on Thursday, breaking above the 50 day EMA during the session but pulling back a bit from the $16 level. It is obvious that the $16 level is offering a significant amount of resistance, as the level continues to find plenty of sellers. Ultimately, the market has continued to show signs of strength, and the fact that we have closed relatively high in the length of the candlestick also helps the idea of the silver market going much higher.

Looking at this chart, I do believe that there is a significant amount of support near the $15.00 level underneath which was previous resistance. With that in mind, is very likely that the market continues to go back and forth between $16 level on the top and the $15 level on the bottom. Because of this, it’s very likely that we will see short-term traders continue to go back and forth but eventually finding buyers underneath to take advantage of the trend. After all, central banks around the world continue to be very loose with monetary policy and of course of the Federal Reserve came out on Thursday with $2 trillion worth of stimulus, which of course works against the value of fiat currencies in general.

All things being equal, you should also take a look at the daily chart where we had formed a flag that had broken out of four days ago, which should send this market much higher. The $17.50 level should be the target longer-term, perhaps even $18.50 over the longer term. Nonetheless, silver is very volatile, and it doesn’t go up in a straight line. With that being the case, you should keep in mind also that silver is not only a precious metal, but it is also an industrial one. Industrial demand is going to plummet going forward, so that is a little bit of a weight around the neck of silver. However, the precious metal aspect of silver will continue to cause quite a bit of upward pressure. I do think that selling silver is going to be very difficult at this point but quite frankly gold will probably outperform because it doesn’t suffer from the ill effects of the industrial demand, or in this case the lack of. Keep your position size small and only add as the position moves in your favor because the leverage in silver is quite high.

(Click on image to enlarge)

Disclaimer: DailyForex will not be held liable for any loss or damage resulting from reliance on the information contained within this website including market news, analysis, trading signals ...

more