Silver Forecast: Stabilizes A Bit During The Trading Session On Thursday

At the end of the day, the silver market remains uncertain, with various factors at play, including interest rates, industrial demand, and market volatility.

- Silver exhibited minimal activity during the early hours of Thursday, reflecting a market grappling with uncertainty about its next move.

- Silver has historically been characterized by considerable volatility, and the current environment is no exception, making it a challenging asset to trade.

- I expect this to be the story for most of the year.

One significant factor to monitor is the prevailing interest rates in the United States, as they exert a substantial influence on the broader precious metals sector. Additionally, silver's performance is intricately linked to industrial demand, which can vary and impact market dynamics. Given these inherent complexities, a cautious approach is advisable when dealing with silver.

Well-defined range

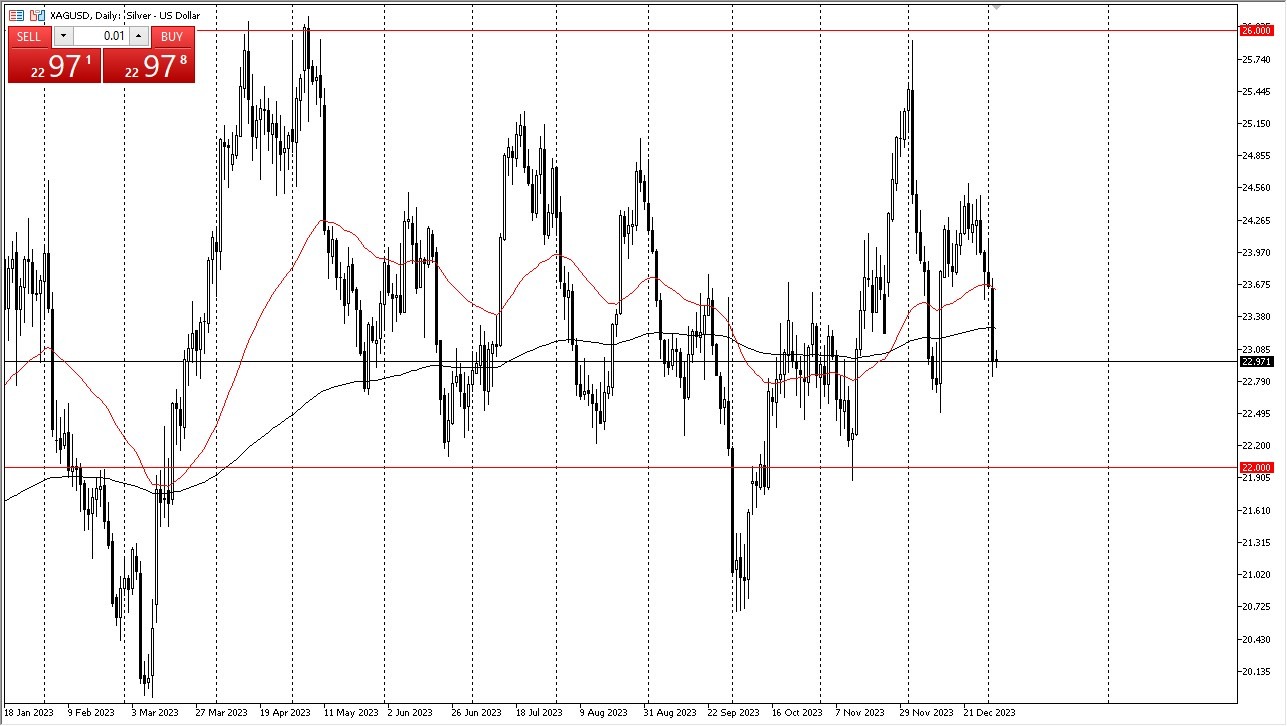

Presently, it appears that silver is confined within a well-defined range. The $22 level beneath it stands as a robust support level, while the $26 level above poses a formidable resistance. Considering our proximity to the lower end of this range, it will be interesting to observe the market's response to Friday's non-farm payroll announcement. Until then, market participants may exercise caution, leading to a subdued market.

(Click on image to enlarge)

The non-farm payroll announcement in the United States is expected to have a significant impact on the American bond markets, which, in turn, will reverberate through the silver market. As we approach the $22 level, I may consider initiating buying positions following a bounce. Nevertheless, it is crucial to exercise restraint, as silver carries inherent risks and should constitute a portion of a diversified investment portfolio rather than a dominant position. After all, the massive swings that you see in the silver market can have a detrimental effect on your overall profit and loss statement if you are not cautious. That being said, you can see that there is a clear range that we have been in over the last couple of years, so therefore it might be worth paying attention to when we get close to those outer edges.

At the end of the day, the silver market remains uncertain, with various factors at play, including interest rates, industrial demand, and market volatility. Traders and investors should approach silver with caution and consider its role within their broader investment strategy. The upcoming non-farm payroll announcement is poised to provide further insights into market direction, potentially guiding decision-making in the days ahead.

More By This Author:

S&P 500 Forecast: Waits For NFP FridayCrude Oil Signal: Trades In A Range

Bitcoin Forecast: Stands Firm Despite Recent Selloff

Disclosure: DailyForex will not be held liable for any loss or damage resulting from reliance on the information contained within this website including market news, analysis, trading signals ...

more