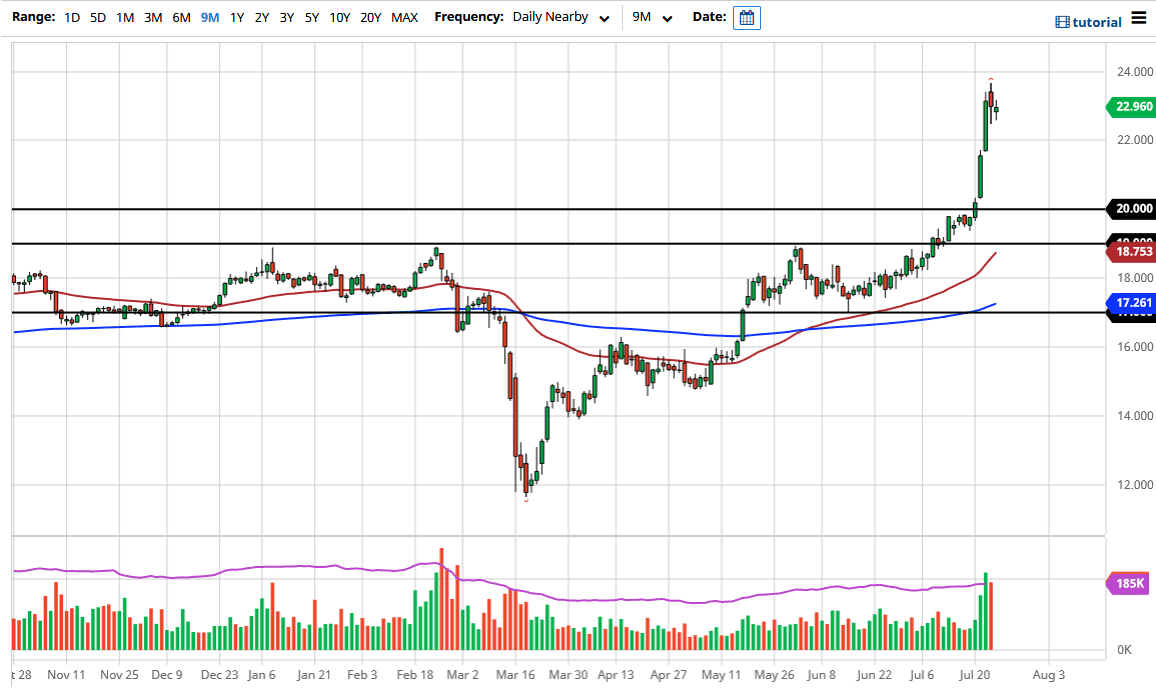

Silver Forecast: Setting Up For Significant Pullback

As traders bet on a recovering economy and cheaper US dollars, this is essentially a “perfect storm” for the silver markets.

Silver markets have dropped a bit during the trading session on Friday only to turn around and show signs of life again. The market seems to be hovering around the $23 level, which is crucial to pay attention to. That being said, if we pull back from here, I think that there will be plenty of people looking to get involved in order to take advantage of value. The first place I look for it is near the $22 level, perhaps even down at the $21 level after that. Quite frankly, I would love to see this market pullback to the $20 level which was the scene of a major breakout, but that might be asking a bit too much considering just how explosive the move in silver has been.

This is all about the US dollar losing value the way it has, as the Federal Reserve continues to liquefy and flood the markets with cheap dollars. As long as that is going to be the case, silver will continue to rally and the breaking of the $20 level has been a significant turn of events. After all, gold already had broken out slightly, and then finally silver joined the party. Silver does tend to work in the same way as gold longer-term, although there is a bit of an industrial demand question when it comes to silver.

As traders bet on a recovering economy and cheaper US dollars, this is essentially a “perfect storm” for the silver markets. Silver does tend to be very volatile though so you will need to be cautious about your position size and build as it works out in your favor. Buying silver up here is like asking to lose money because these parabolic moves normally end in tears for those who join at the end. Think of the phrase “bag holder.” There are a lot of people out there looking for the next bag holder so they can collect their profit. Make sure you are not one of those people and understand that you may have to wait several days in order to get a decent price for silver. It is like anything else, if you get a better price on it you should be willing to buy it. However, those who are impulsive like to pay the high prices, and that is where losses began.

(Click on image to enlarge)

Disclaimer: DailyForex will not be held liable for any loss or damage resulting from reliance on the information contained within this website including market news, analysis, trading signals ...

more

Nah look at the 2011 run-up. There was no significant pull back. Conditions are WAY WORSE for the US economy and dollar today... and the world economy. I think we are going to challenge the 2011 highs.