Silver: Focus On Resilience

Resilience is the capacity to recover quickly from difficulties. In other words, toughness. Looking back over the last year, the world has experienced and displayed such toughness. Unfortunately, this isn’t over yet. Maybe it’s just the beginning, and there is more to come? We believe preparation is the wisest course of action, but that begins with a plan.

Silver’s price faces the same strain. It is essential to stay focused on the prime fundamentals and the clear, long-term case for the shiny metal. Numbers for demand are overwhelmingly positive, and the strong news coverage doesn’t justify the temporary price dip. We firmly believe this to be another rare opportunity to add to one’s physical holdings of silver.

The four cornerstones of resilience are:

- You. Take care of yourself first. A year of the pandemic took a toll. Make sure you are balanced.

- People. We all went through this. As a result, people are worn out, making more mistakes, and have changed. Don’t take your loved ones for granted. They are your backbone. Accept that people essential to your business might not be as reliable as they used to be. Reevaluate partnerships and supply chains and have a watchful eye where your business is vulnerable. This is especially important if you trade with other people’s money.

- Technology. With supply chains banged up, it is wise to have backup systems in place and not expect smooth operations in case of extraordinary circumstances. Have necessary parts stockpiled and be self-dependent.

- Operations. Check your operations for their processes, people, and technology. Think risk control over efficiency. Form KYC to regulatory changes and increased fraud; this isn’t the time to streamline and maximize. Instead, set up systems to monitor compliance, strengthen your partnerships and supply chain reliance.

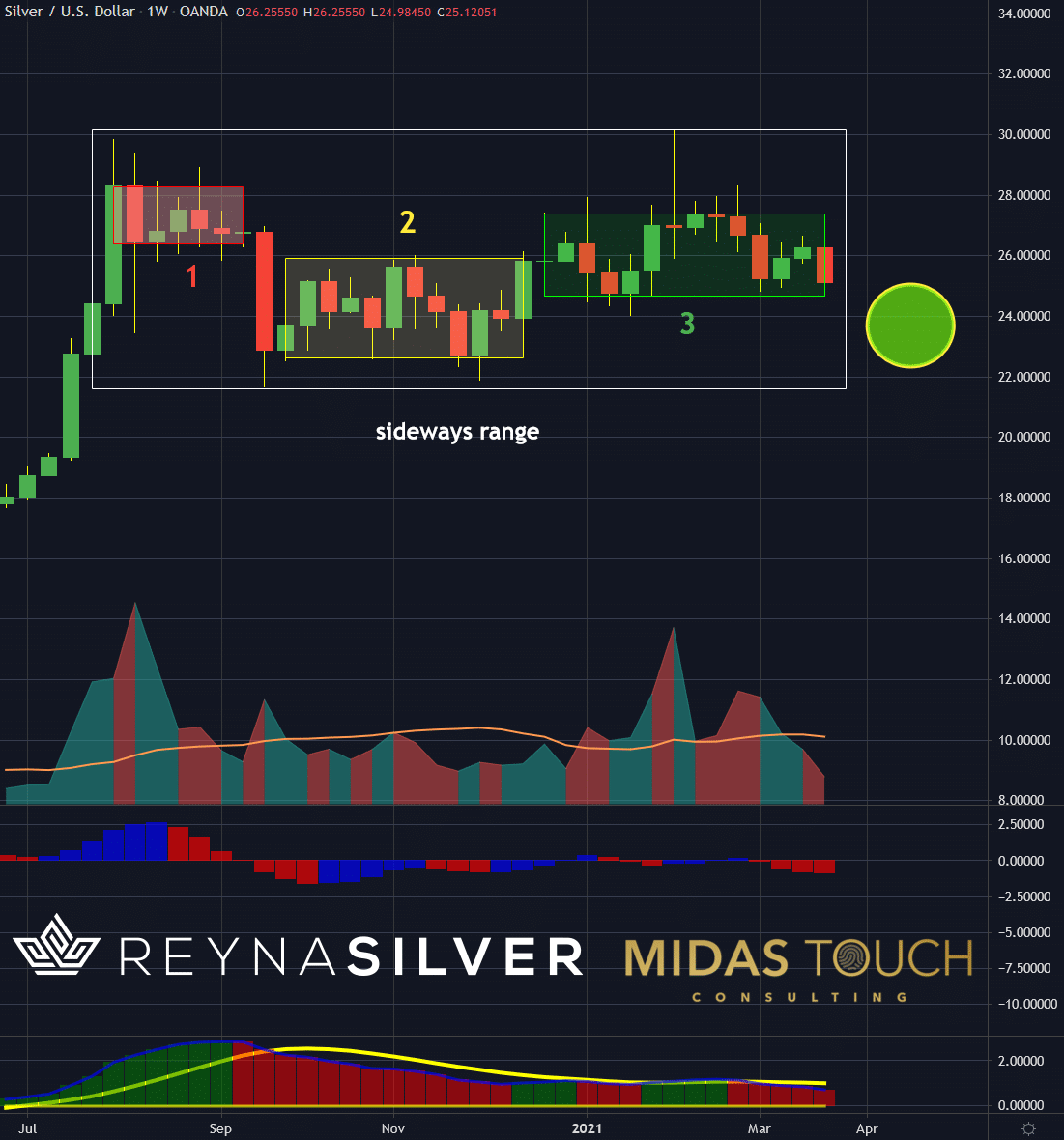

Weekly Chart, Silver in US-Dollar, Last Week's Setup:

Silver in US-Dollar, weekly chart as of March 24, 2021.

We posted this chart in last week's publication.

Weekly Chart, Silver in US-Dollar, Execution on the Plan:

Silver in US-Dollar, weekly chart as of April 1, 2021.

Since prices moved into our pre-planned entry zone of the yellow circle. We were already able to take partial profits based on our Quad-exit strategy, and we are now holding two runners.

Sideways range entries with quick risk elimination like these are representative of resilience. One doesn’t need to know which one of these entries will be the one where the remainder position size will break through the upper boundary of the range. As long as the entries are low risk, this engagement in a tough sideways zone supports persistent efforts.

Monthly Chart, Silver in US-Dollar, Silver-Focus on Resilience, The Edge on our Side:

Silver in US-Dollar, monthly chart as of April 1, 2021.

It is a misconception that one needs to be right to make money. But the ego constantly suggests that we should find that best entry price. However, there is no such thing. We need to try resiliently until we get it right, and manage risk and reward ratios over sample sizes; an effort that requires a resilient mindset.

A look at the most critical time frame chart above shows three crucial factors:

- A preceding strong directional leg from US$12 to US$30 indicating a trend.

- A very favorable risk-reward ratio for the large time frame players.

- If you have a closer look within the red box, you will find excellent volume transaction support below the price we are trading at.

Trading is a business no matter what the time frame. You are in charge of wealth preservation and creation, and you are the core anchor. Hence, you need to be in the best shape. Review your business plan and be aware that resilience requires a review of your breaking points.

While we typically streamline business for efficiency, resilience points towards risk control and a look at dependencies. Ask yourself what can be learned from last year’s challenges and what can be done so that similar surprising events do not negatively impact your business.

Disclaimer: All published information represents the opinion and analysis of Mr Florian Grummes & his partners, based on data available to him, at the time of writing. Mr. Grummes’s ...

more