Silver Flows Back To London, But Was It Enough...

.webp)

Photo by Zlaťáky.cz on Unsplash

The gold and silver prices are mixed after a choppy morning of trading on Tuesday.

The gold futures had been rallying again, although they fell about $30 in the past two hours, and are now down $5 on the day to $4,117.

Both the silver futures and the silver spot price had crossed over the $51 level this morning, although they have also sold off, but remain in positive territory on the day.

As I mentioned yesterday, Bloomberg published an article about the silver that returned to London following the breakage in the market on October 9th.

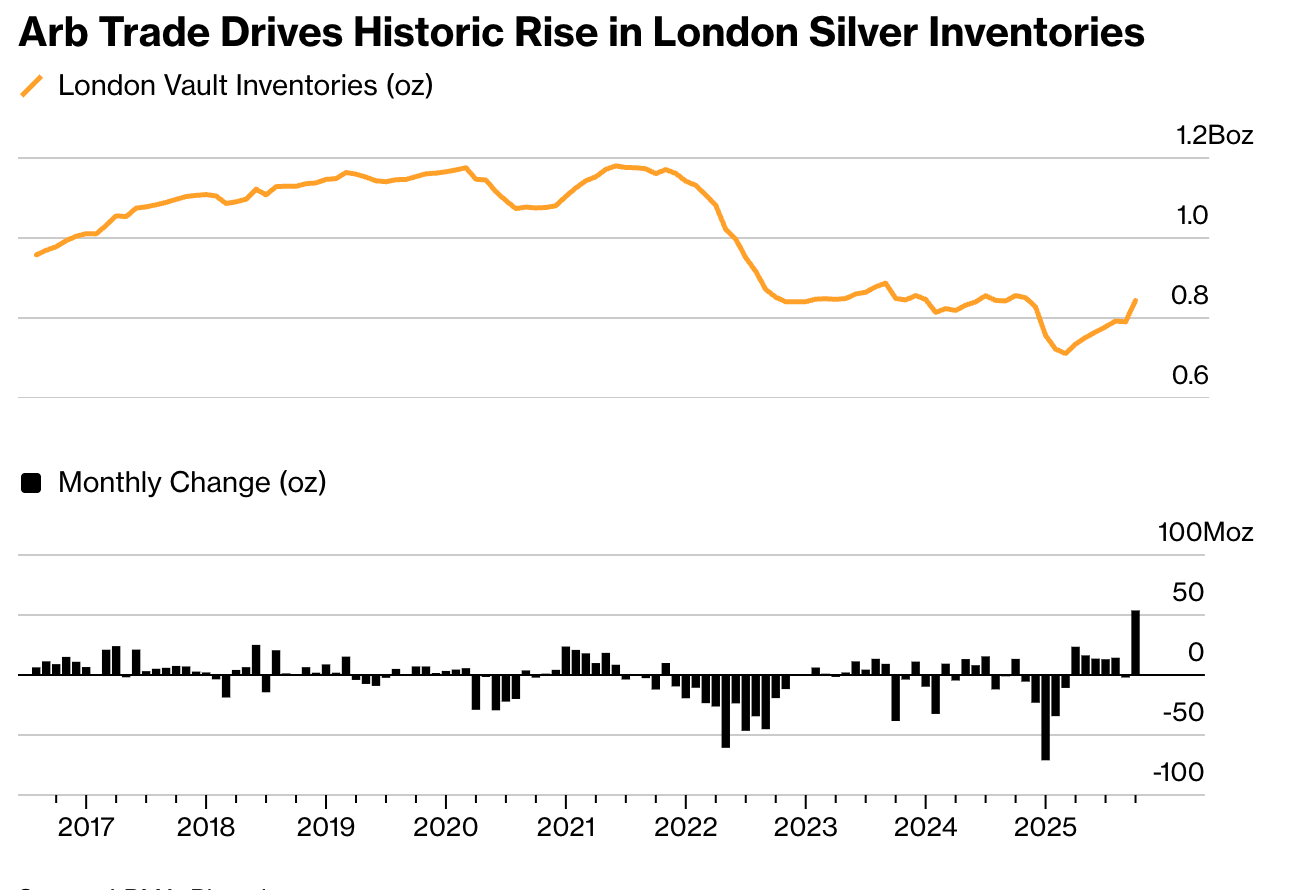

Vaults underpinning the London market added nearly 54 million troy ounces of silver in October, an amount weighing more than 100 of the UK capital’s iconic double-decker buses.

As impressive as the weight of the silver and London’s double-decker buses may be, that still leaves the LBMA inventory significantly below the daily turnover. And especially if silver continues to go into the ETFs, which becomes a greater possibility if the price should continue to rise, ruling out a more severe repeat of what we just witnessed would be premature in my opinion.

The massive increase in London vault holdings “certainly suggests that the arbitrage has worked by pulling metal across the pond,” Rhona O’Connell, head of market analysis at StoneX Financial Ltd., wrote in a note.

The arbitrage, as reflected by the inverted London/New York spread, did indeed pull metal back to the LBMA. But the question remains, was it enough?

The latest inflow of metal has eased tightness in the London market, with spot prices now trading just below New York futures. Approximately 48 million ounces of metal were withdrawn from Comex vaults in October, while nearly 17 million ounces of on-warrant silver stocks were taken from the Shanghai Futures Exchange. Silver-backed exchange-traded funds, most of which store the majority of their metal in London, also saw net outflows of about 15 million ounces in October.

The metal that flowed back to London did ease the tightness, although again, for how long?

It’s also interesting how Bloomberg notes that 15 million ounces came out of the ETFs, which could be expected on the price decline. But if the price does continue to rally, we could see the direction of those flows change quickly.

All that has injected a flood of silver back into a market that was extremely tight just a month ago. TD Securities commodity strategist Daniel Ghali, who had warned of demand outstripping supply earlier this year, now estimates there are nearly 200 million ounces of silver freely available to buy or borrow.

According to the latest data, there are actually more than 200 million ounces in the free float at this point. But what Bloomberg did not mention is the rest of what Daniel Ghali said in his January 2025 report where he warned months ago about what we just witnessed.

With only 305 million ounces remaining in the LBMA’s free float as of December, the world’s largest stockpile is nearing critical thresholds that could disrupt silver’s market structure. After all, 250 million ounces of silver have been required on average for trading on any given day over the last five years, leaving a critically low buffer before everyday physical transactions are impacted. This leaves only about 50 million ounces in the ‘free float’ before it winds to levels below average daily trading volumes.

So if that was a problem before, it would seemingly stand to still be a problem now. And it also makes the flows to India and the ETFs all the more important in the weeks and months ahead.

Still, the cost of borrowing silver in London remains elevated at an annualized rate of roughly 5% for a one-month loan — even though it’s well below rates of over 30% at the peak of the squeeze in October.

Here Bloomberg mentions how while the tightness has eased, it has not gone away entirely, as evidenced by the lease rates. I would also suggest that the resumption of the rally is at least in part due to a reflection of the situation not being resolved, which Bloomberg touches on in the next quote.

“With the onset of the Indian wedding seasons imminent, which is always a strong tool for silver demand, it is perfectly possible that this market will remain tight for the time being,” O’Connell said.

Although at least one positive to come out of the whole ordeal is that the LBMA is now going to publish silver inventory levels every week, rather than the previous monthly schedule.

The period of tightness accelerated proposals by the London Bullion Market Association to publish silver inventory levels every week, chief executive Ruth Crowell said at a recent conference. Inventories of both metals in the London market are currently published monthly.

Of course, in the background remains the Section 232 report, that has been delayed by the government shutdown, but is expected to clarify the tariff status of silver after it was added to the critical minerals list.

Tariffs on the white metal also pose risks. The US added silver to a government list of critical minerals included in the Trump administration’s Section 232 probe, which could lead to levies and trade restrictions.

Lastly, remember that this rally in silver has taken place with the largest investment customer, U.S. retail, still in the midst of record amounts of selling. So should that change at some point and those sellers turn into buyers, that would also have a significant impact on the current dynamics.

Of course, we’ll be keeping you posted here (and if you are not yet a daily subscriber, that’s another great reason to upgrade now for only $10/month), and I’ll look forward to checking back in with you tomorrow.

More By This Author:

Silver Now Up Over $2 On The Day As Rate Cut Expectations RiseGold & Silver Rally Early While Bessent Doubles Down On Perplexing 'Falling Inflation' Comment

LBMA Forecasts $5,000 Gold & $59.10 Silver By Oct 2026