Silver, Fibonacci And Hyperinflation

This is the increase that traders were anticipating for Silver in February 2026 through their "CALL" positions on Monday 8/12:

There were only 25 contracts positioned for a rise to $73.

There were 152 targeting $75.

This has to be compared to 4,845 contracts anticipating $80, and 4,277 contracts already targeting $85 per ounce of silver.

As a reminder, the Fibonacci sequence is a sequence of integers where each term is the sum of the two preceding terms. It begins with 0.

The first ten digits are: 0, 1, 1, 2, 3, 5, 8, 13, 21, 34.

The sequence continues with: 13, 21, 34, 55, 89, 144, 233, 377, 610, 987, 1597, 2584, 4181, 6765, 10946.

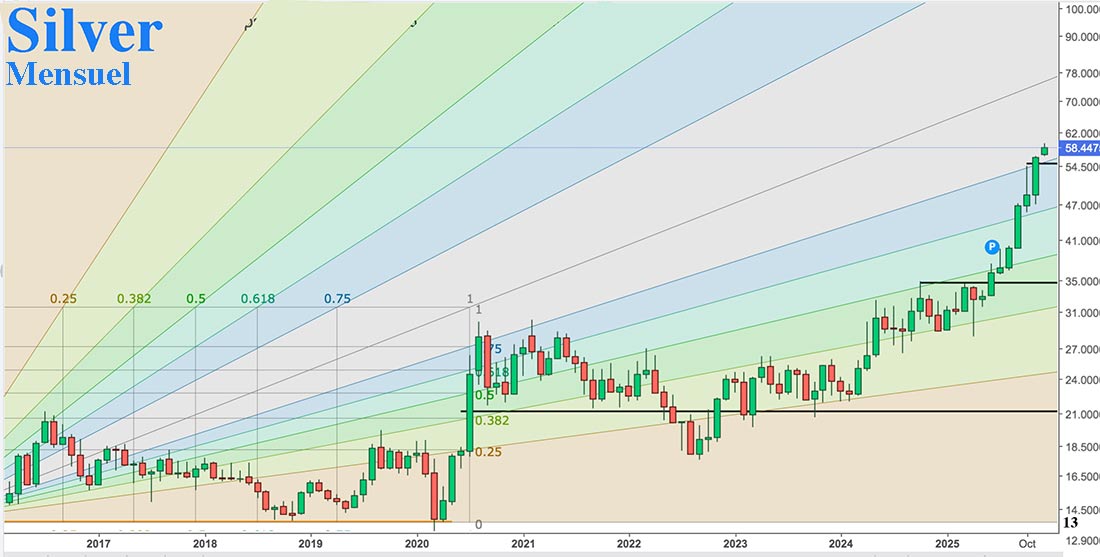

If we compare the silver price to the Fibonacci spiral:

- Prices stagnated around the $13 level for 60 months.

- They were then stuck around the $21 support level for 45 months.

- Then they climbed to the $34 resistance level over a period of 15 months.

- The move towards the $55 resistance level, however, lasted only 5 months.

We are now entering the $89 phase, which should be even shorter—in months or even weeks.

Then, logically, prices should head towards the next resistance level: $144.

Silver prices may be revealing signs that we are heading towards a phase of hyperinflation.

I don't claim to be an expert in Fibonacci-based trading tools; however, on the monthly chart below, if silver closes December above $55, the next upward leg could be extremely powerful – throughout the area highlighted in purple.

There are several possible reasons for this.

The first is obvious

For several years, demand for physical silver has far exceeded supply. The Silver Institute's figures are skewed because they mix physical silver with the "paper" silver held in ETFs, while those of the LBMA and COMEX are distorted by the confusion between metal simply stored in authorized warehouses and metal actually available for sale.

The LBMA's delivery failure in early October – which led to a complete market freeze – provided the clearest demonstration of this shortage.

What Does the Disruption of the Silver Market Mean? (@LaurentMaurel_)

— GoldBroker (@Goldbroker_com) October 17, 2025

▶ https://t.co/Dols72pne8 pic.twitter.com/yC7uLmfWwq

The Thanksgiving panic on the COMEX is another illustration. The simultaneous demand for 7,330 5,000-oz contracts, which came in on the last day of trading, led to a ten-hour market closure. This delivery proved impossible: the stocks officially listed as « registered" were not available. It took ten hours of negotiation for the buyer to agree to settle 6,816 contracts in cash, with a $65 million premium.

These two markets have thus just defaulted, one after the other. They are doomed in the short term.

This implies that all the maneuvers of the "Cartel" over the past 50 years – aimed at diverting demand for physical metal toward “futures” substitutes or ETFs – are also doomed. If the banks that leased their ingots to these ETFs (like SLV or GLD) stop playing the game and prefer to export their stocks to Shanghai, then Western metals markets will no longer have any weight in setting precious metal prices.

However, the gold stock on the SHFE, the Shanghai futures market, has seen a vertical surge in recent months, with a very marked acceleration since July 2025:

Jamie Dimon, the CEO of JP Morgan, moved his entire gold trading office (more than 50 traders and their families) from New York to Singapore last Thursday – without any official announcement.

These are two strong indications that the center of gravity of precious metals trading has now shifted to Asia.

The second reason is more secretive

For half a century, the Federal Reserve and the Office of the Comptroller of the Currency have been trying to control the price of gold and silver using derivatives through the bullion banks under their influence. According to BIS statistics, there are $993 billion in gold-related derivatives, compared to $152 billion for silver. Some experts believe that beyond $55 an ounce of silver, it will cost the bullion banks an exponential fortune in derivatives. This explains the current battle to prevent prices from rising to $60.

In August 2009, after the U.S. Treasury defaulted on the return of silver bullion borrowed from China, Beijing informed its government agencies and companies that they were no longer bound by commitments related to Western derivatives. JP Morgan's management immediately laid off its silver trading team. These former traders then banded together to collectively bet on the rise of silver, aware of the bank's extremely uncomfortable position on derivatives – the equivalent of seven years of mining production. They began demanding physical delivery, knowing that JP Morgan would be forced to buy back their contracts at a premium. Month after month, they repeated the operation, their winnings growing as the premiums accumulated. In September 2010, they were trading 483 contracts; in December 2010, 3,583; and in March 2011, 49,725 contracts.

By comparison, the figure for Friday, November 30th, of 7,330 contracts was 7 times smaller and the COMEX defaulted.

It is highly likely that delivery requests similar to the one on November 30th will multiply month after month, exposing the reality of the paper silver markets, both in London and New York.

The $152 billion in silver derivatives could cripple the banks that, for years, have been trying to curb the rise in the price of the metal on behalf of the Fed and the OCC.

The third reason is obvious

All financial experts witnessed the impossibility of delivering to the LBMA in October, then to the COMEX in November. They saw prices sustainably surpass their historical highs, in a now resolutely upward trend.

Silver: A Perfectly Organized Short Squeeze (Cyrille Jubert)

— GoldBroker (@Goldbroker_com) December 2, 2025

▶ https://t.co/FgVvHWpXUx pic.twitter.com/HtH2HBu9qw

Financiers operate like sharks: they can detect a drop of blood from miles away. We should therefore expect a rush of capital into silver, even though the market is tiny. The arrival of this new capital will further destabilize the market, causing an acceleration in the price increase – especially since bullion banks, which have accumulated short positions through derivatives, will have to buy them back in a panic, mechanically amplifying the movement, as in any short squeeze.

The proof is already visible: on Monday the 8th of December, there were 4,845 call options targeting $80 an ounce in February 2026, and 4,277 call options targeting $85.

Here's the same COMEX report 48 hours later:

- $80 CALL orders increased from 4,845 contracts to 7,104.

- $85 CALL orders increased from 4,277 contracts to 6,546.

The sharks are rushing in.

Why these two values?

Because if we look at the weekly silver chart on a logarithmic scale, the resistance seems pointing above $80 at the beginning of 2026, then above $85 in mid-February.

The fourth reason is industrial

Cars contain increasingly more electronics, and therefore more silver connections. Silver is also found in mobile phones, computers, and consumer electronics: in each item, the amount of silver is minimal and represents only a tiny fraction of the finished product's cost.

Since the 1980s, industry has applied the same supply policy everywhere: just-in-time. In other words, the necessary materials are delivered only the day before they are needed, without building up any upstream stock.

However, the recent example of the European automotive industry, paralyzed by the lack of a simple electronic chip, remains very much in people's minds. The silver delivery disruptions observed in London and New York over the past two months have certainly not escaped the attention of manufacturers. They have good reason to be concerned: a silver shortage could lead to the abrupt shutdown of their production lines. It is therefore likely that some are already looking to build up precautionary stocks.

This is precisely what is happening in Shanghai, where we see pallets of silver bars leaving SGE warehouses daily to be stored directly at industrial sites.

China Chengtong Group, a vast holding company encompassing both refineries and subsidiaries producing finished goods containing silver – the latter companies boasting significantly higher profit margins – is adopting the same strategy. Like other integrated world players, Chengtong Group is now prioritizing the supply of its own upstream subsidiaries, anticipating a severe shortage, rather than supplying exchange markets, whether in Shanghai, London, or New York.

The fifth reason is more hypothetical

Following Western sanctions in 2022, oil trade between India and Russia skyrocketed, reaching record levels – between $52 and $67 billion annually. But a major problem quickly arose: India attempted to pay Russia in Indian rupees (INR), which Moscow refused because the INR is not a convertible currency. Russia even declared the currency “useless outside of India” in May 2023. With over $40 billion frozen in Indian banks, Russia found itself in a bind:

- unable to repatriate the INR,

- unable to convert it into dollars (due to sanctions),

- unable to use it in India.

India therefore needed a solution to preserve the value of its exports: this is where a silent monetary revolution began.

India then turned to payments in United Arab Emirates dirhams (AED) and Chinese yuan (CNY). The AED, liquid and freely convertible, now plays a strategic role: China uses it to buy Gulf oil, and the UAE is becoming a new neutral clearing center. Russia can thus receive and exchange dirhams without going through the US dollar (USD) networks.

Starting in July 2024, an unexpected phenomenon appeared on the charts: the price of silver (XAG) began to move in correlation with the INR/CNY exchange rate.

This correlation is entirely unprecedented. Silver has detached itself from COMEX exchange rates and begun to follow settlement currency flows. This is a sign of sovereign accumulation – not a speculative move by investors.

Why would silver suddenly follow the INR/CNY exchange rate? The mechanism is as follows:

India buys oil → pays Russia in Emirati dirhams (AED). Russia converts the AED into yuan (CNY) and uses the CNY to buy physical silver from China. Silver thus becomes the reserve asset used to store the value of India-Russia trade outside the US dollar system.

At the end of September 2024, Russia published its 2025–2027 federal budget: for the first time in its history, it explicitly allocated funds for the purchase of critical minerals – including silver.

The sixth reason...and not the last

Those who follow the financial markets have likely already heard this news: the Reserve Bank of India has published new guidelines for loans secured by gold or silver, setting a 1:10 ratio between the two metals. These rules will come into effect on April 1st.

Logically, in India, the price of silver should converge towards a 1:10 ratio relative to that of gold starting April 1st.

If this silver/gold ratio were to truly take hold, it should, for the sake of market consistency, be applied everywhere else in the world.

Under these circumstances, the rise in the price of silver over the next three and a half months would need to be absolutely spectacular to reach one-tenth of the price of gold.

Gold in the accumulation phase

As the chart below shows, gold experiences accumulation phases, where volatility is compressed and prices fluctuate only slightly between support and resistance levels. This continues until the resistance breaks and volatility surges sharply, triggering another significant rise of the gold price.

We are currently in this compression phase for a few more days or weeks before a strong upward move.

When gold enters a phase of rapid acceleration, silver – historically more volatile and reactive – will logically have to rise even faster.

And if we use the Fibonacci sequence, employed by many technical analysts to identify major market levels, the following theoretical levels would be:

$34,... $55, … $89, … $144, … $233, … $377, … $610, ….

For example, the Economic Times of India, in a December 10 article, boldly suggests the possibility of silver exceeding $600 an ounce.

If these projections, even partial ones, materialize, the purchasing power of fiat currencies would suffer a historic shock.

More By This Author:

Gold/Euro: Major Inflection Point, But Higher Prices Still LikelySilver, The Metal Of The Year 2025

Individuals Favor Gold Over Bitcoin