Silver Continues Its Rally To Finish Week, Even As Gold Falls...

The gold price fell again on Friday, although silver did extend its gains following its furious rally on Thursday.

Here you can see that the gold futures were down $42 to $3,333 to close out the week, declining almost $100 from Thursday’s peak of $3,426.

(Click on image to enlarge)

As you can see in the silver chart, it was a much different picture, as silver continued rising on Friday, finishing 31 cents higher at $36.11.

(Click on image to enlarge)

This morning’s labor data came in better than expected, so we did not get a boost for gold and silver based on a weaker number that would have increased the Fed’s odds of cutting rates.

It sure would have been interesting to see how the metals would have reacted if the number had been weaker.

But I suppose I’ll hope this latest set of government data has some connection to reality, and that at least a few more people were able to get work in the past month.

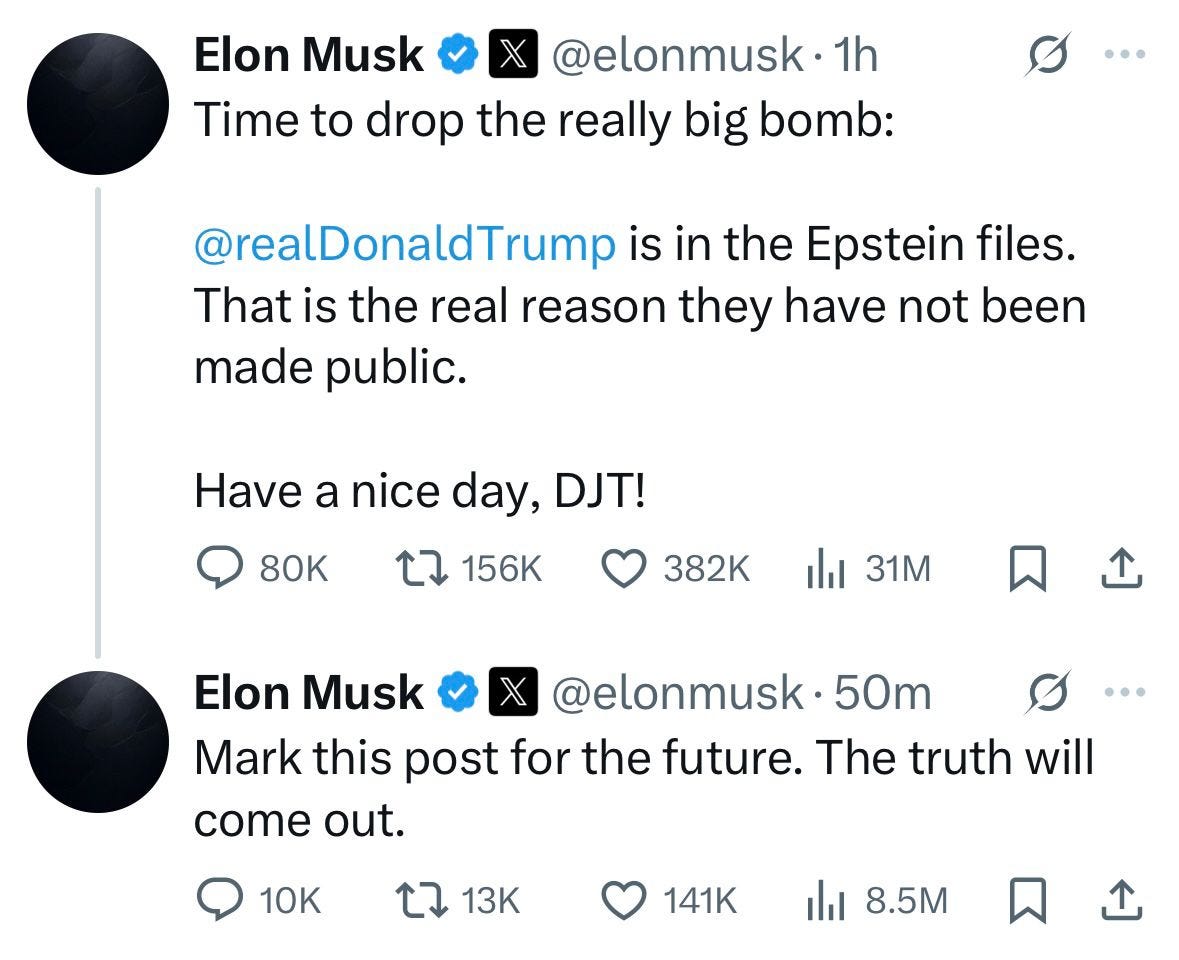

I mentioned last week how I thought Elon Musk’s comments about the Big Beautiful Bill represented more than just a series of words, but rather a milepost that shows just how unlikely it is that the government is ever able to curtail its finances until a much more severe outcome is forced upon it by the markets.

I also thought the bluntness of his comments was somewhat surprising, given how it appeared that he was close with Trump, and Trump is not known to take it too well when he feels someone on his team has betrayed him.

And sure enough, a week later, it’s getting ugly.

As expected, Trump didn’t take all to well to that one.

It sure sounds like in this message, that Trump is implying that Musk’s projects are not that important, and are an easy way to cut money from the budget. But if that’s really the case, why didn’t he advocate for that earlier if we’re really all that serious about cutting the fat?

Although obviously we know in reality they’re not.

Yet it’s amazing how as they argue, Trump either confirms that Musk’s projects are costing a lot of money without sufficient ROI, or else he’s saying something that isn’t true to make a personal attack.

To which Musk responded:

Then Musk went a step further with his own threat, to decommission his Dragon spacecraft, which had ‘brought two NASA astronauts back to Earth in March after they were stranded for months at an International Space Station.

Earlier this week on our YouTube show I also mentioned the comments Trump made about Rand Paul, even despite what Tom Woods pointed out here about how Paul was a supporter of Trump, even when it was a very unpopular thing to do.

Now I try, and will continue to keep my own personal politics to a minimum in this column. But as someone who voted for Trump (perhaps more so because I saw even less of a chance of a positive outcome for our country with what was being presented by the other side), it’s hard to hear some of these comments.

I'm not a big fan of Jerome Powell or the Federal Reserve. But I also don't think it helps an already inflamed situation for Trump to be calling senators or the Fed chairman ‘losers,’ while we're also simultaneously in the middle of alienating our largest creditors around the globe.

In my own opinion, it takes an already fragile situation, and makes the US look like even more of a circus than the rest of the world might already think. So now to see him get involved in a public spat with Musk, it's just a bit disappointing to me personally.

But perhaps that’s just how politics goes. Or maybe how they’ve always gone, and will continue to go.

I try to point out from time to time how markets are usually never as simple as governments like to infer.

They tend to take the view that if they do X, then they will get result Y. But what they usually leave out are the other unintended consequences of taking action X, which usually influence A, B, and C, that have their own ability to distort result Y that was sold as a simple equation.

Which is certainly representative of some of the consequences of the current tariff war. And along those lines, Bloomberg recently published a great piece that describes in detail some of the turmoil that has already emerged in the international currency markets, the parallels to the Asian crisis in 1997, and some of the consequences that one can only hope the Trump administration is prepared to handle.

So should you find yourself looking for an interesting article to read this weekend that's a little more in depth, you can find that here.

So all in all, I hope it was a great week for you, especially if you're a silver investor.

It's an exciting time, especially if you've waited a long time to see this, and I will look forward to picking this back up with you on Monday.

More By This Author:

Silver Breaks $35... Then Breaks $36... For The First Time Since March Of 2012What The BRICS Have Planned For This Year's Summit In July

Don't Count On Any 'Summer Doldrums' This Year In The Gold Market