Silver Breaks $47 As Signs Of Short-Squeeze Continue To Emerge...

Image Source: Pixabay

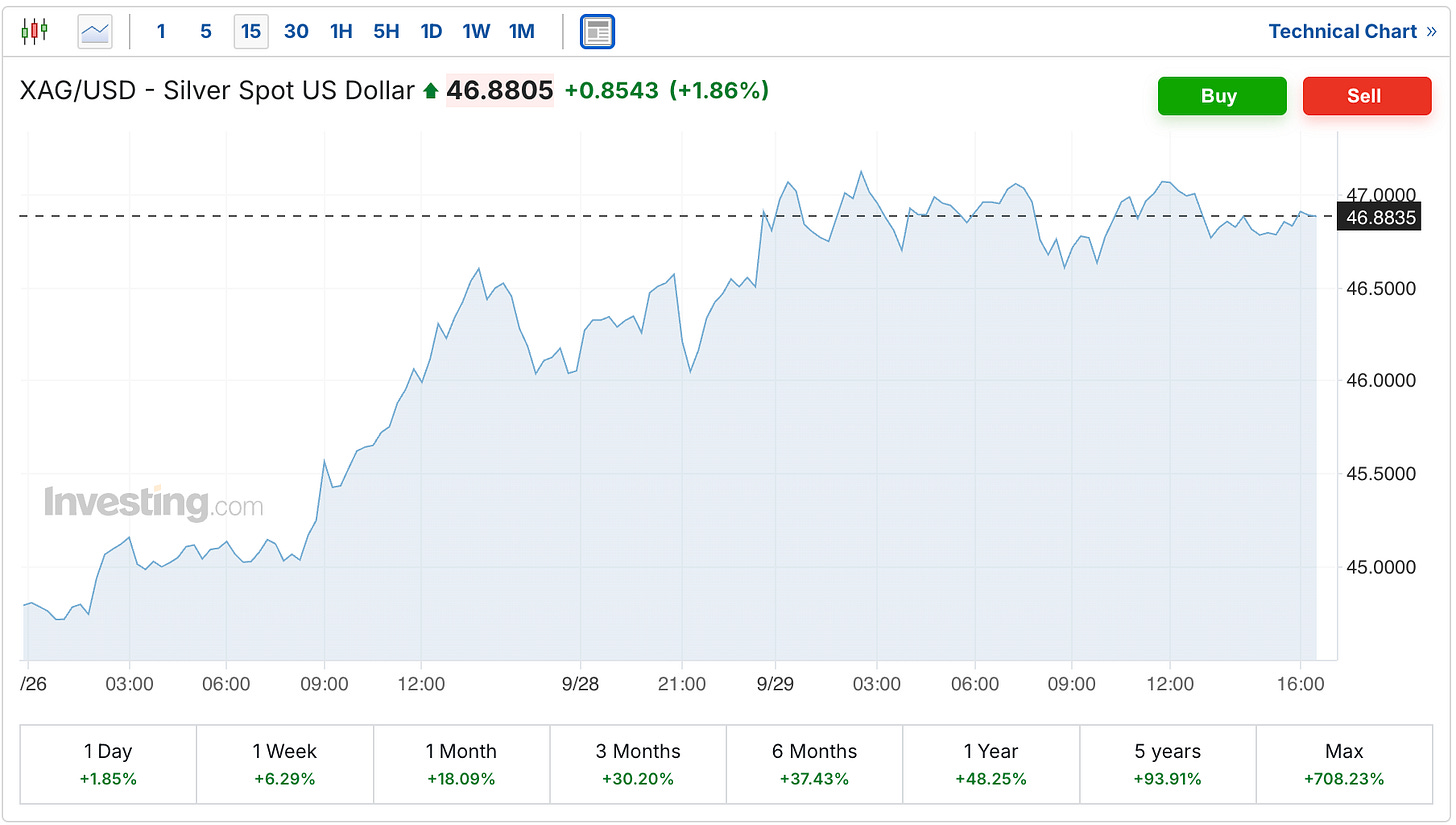

It seems like we’re at the point now where seeing the silver futures cross the next dollar handle higher is becoming almost a daily occurrence. As on Monday, the silver futures broke through the $47 level and are currently trading at $47.03.

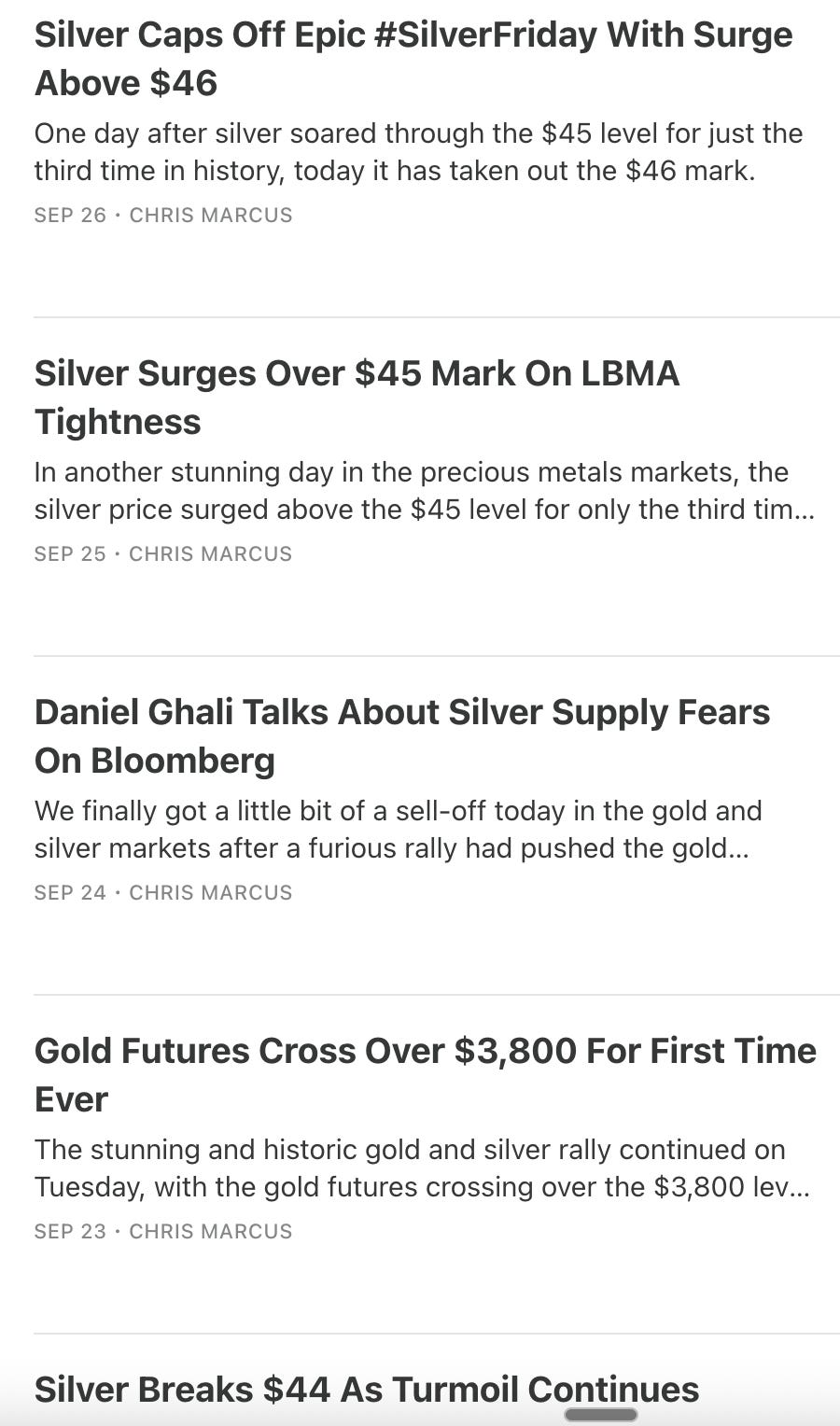

As you can see in the below screenshot of our recent columns, this has become almost a daily occurrence.

Silver’s high of the day, and of this current rally clocks in at $47.40.

Spot silver is currently just below the $47 level.

Although you can see that it did break the $47 level earlier in the session.

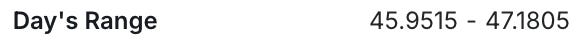

It also seems like we’re at the point where it’s safe to start calling this a short squeeze. With one of the latest pieces of evidence being what Bob Coleman reports here about how the lease rate to borrow SLV shares spiked again and is near the highs of last summer.

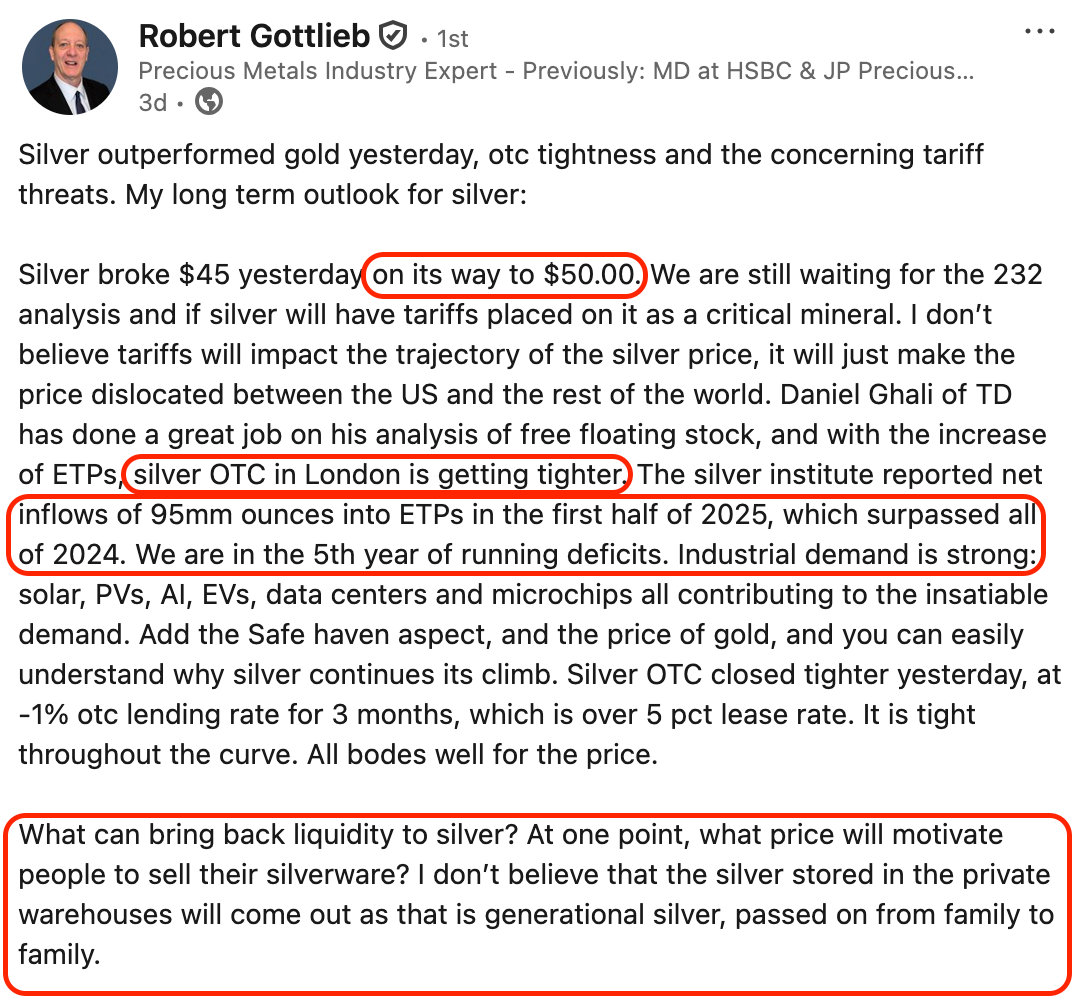

Then we have the following stunning comments from former JP Morgan Precious Metals Managing Director Robert Gottlieb:

So basically, either the spot market in London needs to rally above the Comex futures in New York, or else it sounds like we’re counting on Grandma turning in enough sets of silverware to continue feeding Chinese industrial demand.

Although in terms of that industrial demand, the chances that it drops this year are not looking so good, especially with solar once again outpacing projections, with Ember currently reporting installations being 64% ahead of last year’s pace.

There does continue to be a lot of thrifting with the amount of silver that goes into these solar panels, with Bloomberg even suggesting that net solar silver demand will be down this year.

Based on Ember’s report, I am guessing that the silver demand ends up being well above Bloomberg’s estimate. Although at the same time, if Ember is saying solar growth is up 64% due to the thrifting, I would expect an increase in silver demand to be somewhat less than that number.

I did call a few industry contacts this afternoon, and I am hearing consistently that the level of thriftiness continues to be extreme. I’ll see if I can find out any more concrete data to report back on soon, but at least that’s what I am being told so far.

Meanwhile, we also have the Wall Street Journal reporting on how Donald Trump has posted a cartoon of him firing Jerome Powell.

What that actually means about what the President may do is unknown. But I’m guessing it’s hard to imagine that this is reducing any of the current uncertainty in the markets, some of which is currently being reflected in the silver price. And as you may have noticed in Robert Gottlieb’s column, he also talked about how the remaining uncertainty around the silver tariffs has continued to be a problem with the metal flows.

A day from now, we’ll see if silver continues its torrid pace and maybe even breaks above the $48 level. I’m guessing it will likely be quite fantastic to watch what happens if and when it does get to that $50 mark. Maybe it will be similar to the big swings we saw around the $30 mark, or maybe not. But I sure hope we get to find out soon enough.

Lastly, the gold futures also had a big day on Monday, as they were up another $54 to $3,863.

That $3863 price is also the high of the current rally, and of all time.

Fortunately, we still have 4 trading days left this week, and a labor report on Friday. It sure will be fun to see how everything develops.

More By This Author:

Why Silver’s Surging Towards Its $50 Its Time HighSilver Caps Off Epic Silver Friday With Surge Above $46

Silver Surges Over $45 Mark On LBMA Tightness