Silver Breaks $40 For First Time Since 2011

Image Source: Pixabay

If you're a long-time silver investor, well then congratulations on today's price action, as the silver futures have just crossed the $40 mark for the first time since September 20th, 2011!

As if to put the exclamation point on the event, after getting up to $40.27, the price went back down to the $40 level, before one last burst higher to $40.30.

Although this was hardly a silver-only affair, as the gold futures also had a big day, rising $43 to $3,517.

As a reminder, the all-time high for the gold futures is $3,534.1.

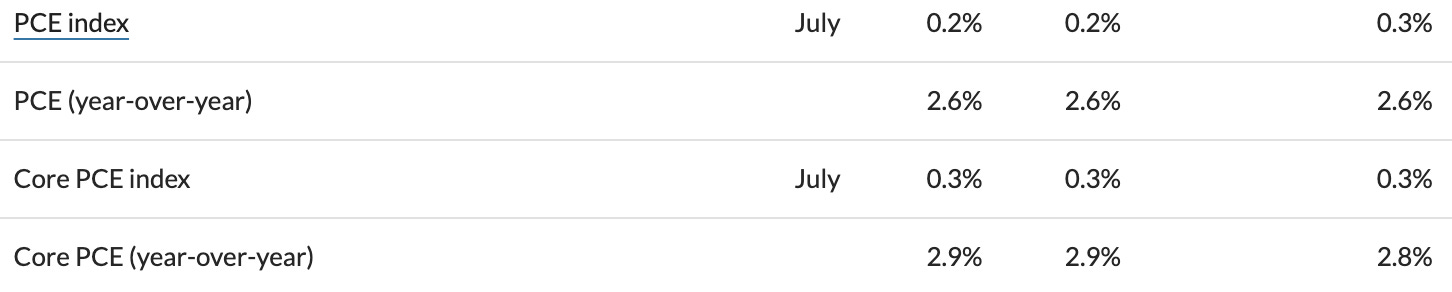

Both precious metals prices started climbing after this morning's PCE inflation report was released, which was largely in line with expectations (for whatever those are worth), although the core year-over-year PCE did rise to 2.9%, its highest level since February.

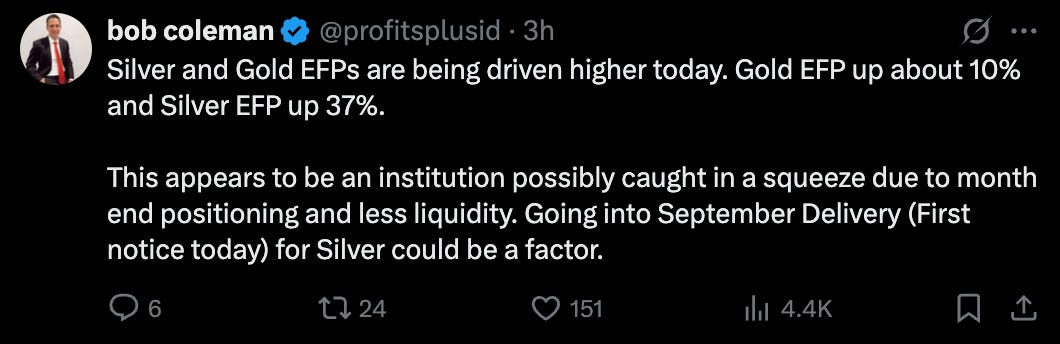

Bob Coleman of Idaho Armored Vaults notes that the EFP spreads (the spread between the London spot market and the Comex futures in New York) also rose on Friday.

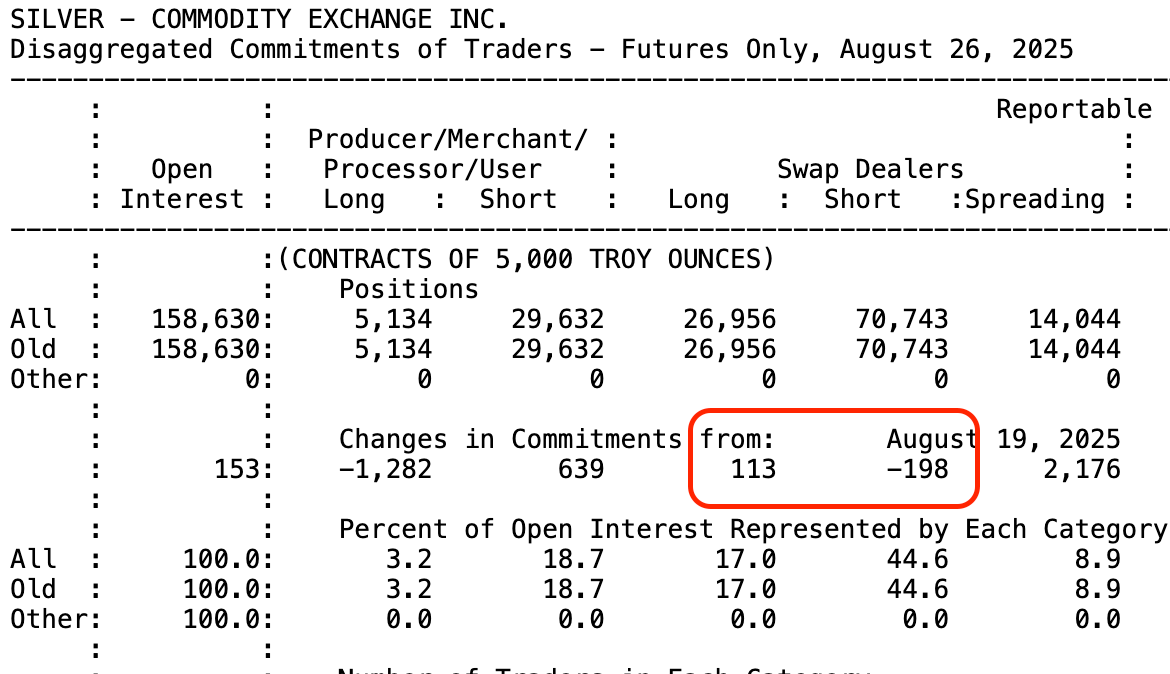

The latest COT Report is also out, and it showed minimal changes for the banks. Although after today's rally, there's an incredibly good chance that the short position increases when next Friday's report is released.

However that next report is a week away, and is far from the most important thing to be focusing on today. Because especially if you've been following or investing in silver for years or even decades, today is another one of those days where I do hope you just find at least a minute or two over the holiday weekend to think about your journey, and how the silver price is now at a level it has only reached twice before in history.

Hopefully this also helps to put into perspective some of these sell-offs from the past year. They are not always all that fun on the day that they happen, yet just remember that it was only a month ago when the silver price dropped from $39.91 to $36.28, and there was at least some amount of panic out there. Maybe not from you personally, but I'm guessing you know a friend or two who was wondering if the price was about to get crushed and dark days were ahead.

I imagine we will continue to have volatility like this going forward, and certainly for the rest of 2025. If you bought silver, mining shares, or other precious metals-related assets back in the fall of 2022, obviously you're doing pretty well on those right now. And depending on one’s strategy and positioning, I'm sure there will be some people who are thrilled to be closing out a gain.

Although if you're investing in silver because of the longer-term concern about the U.S. and foreign government balance sheets, perhaps you could sum it up simply by saying ‘everything remains on track,’ as this is still before there has been any resolution, or even discussion of resolving the ever-expanding debt loads.

So hopefully this is the perfect way for you to begin a holiday weekend, and appreciate what the labor of this nation was able to leave behind for us. As well as the great things that you're creating with your own labor, that one day we will all be leaving behind to future generations.

I'll be grateful if this commentary about gold and silver each day has helped to have a positive impact in anyone else's journey, and I do sincerely hope that you have a wonderful, safe, happy, and healthy holiday weekend.

More By This Author:

LBMA Silver Inventory Draws Closer To Critical LevelsSilver Gets Added To US Critical Minerals Draft List

What Jerome Powell Won't Talk About Tomorrow (But Should)