Silver Breaks $35... Then Breaks $36... For The First Time Since March Of 2012

Image Source: Pixabay

Well... for all of the long-suffering silver bugs out there, today was your day.

As the silver price not only crossed the $35 level, but kept on going (as is often the case once it really starts moving), and broke over $36 per ounce as well.

As you can see on the long-term chart below, this is only the third time in history that silver has been above $36 (that’s assuming you lump the brief March 2012 spike into the 2011 move, otherwise I guess you can call it the fourth time in history).

The silver futures were up $1.15 on the day to $35.80. Although you can see the price crossed above the $36 level a few times during the session.

Somewhat surprisingly, the gold futures were down $23 on the day to $3,376, continuing the recent pattern of gold/silver divergence that emerged over the past two months.

Maybe it wasn’t quite as extreme as what we saw on April 23 when gold was down $120 while silver was up 60 cents.

(Gold and Silver divergence on April 23)

Although today’s divergence is still in pretty rare territory.

In terms of what was driving the move, I think it would be hard to top the 24 second explanation that Vince Lanci offers here in what was the intro to his show on our channel this morning.

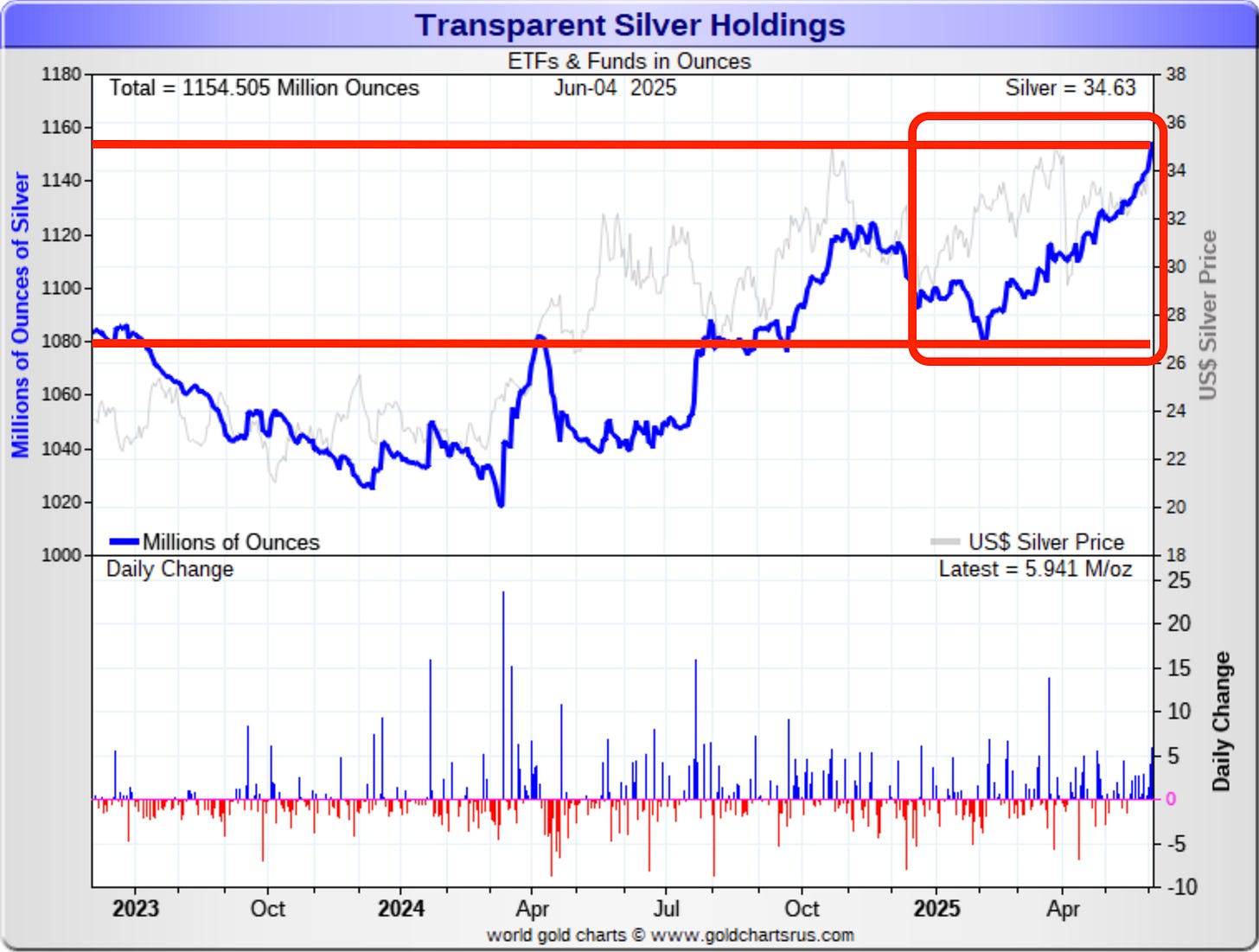

Also putting pressure on the silver market is that there’s been metal flowing back into the silver ETFs since February.

About 85 million ounces have been added in the past 4 months, with 22 million coming in the last 4 weeks.

Interestingly, we have started to see a small amount of silver leave the COMEX. Not much, and it’s minuscule compared to the roughly 200 million ounces that have been added in the past half year.

Although about 10 million ounces have left since the peak, with most of that coming out of the ‘registered’ category.

Meanwhile, you can see that there was a small addition to the LBMA stockpiles in April, at least stemming the decline for one month.

The ECB and the European Union, that are not in all that much better economic shape than the Fed and the US, cut interest rates again on Thursday.

Which is just the latest reminder that we remain on track to see the dollar lose purchasing power, yet maintain the perception of stability to those who judge its performance by simply looking at the dollar index.

Trump and Xi Jinping are scheduled to talk again soon.

Although let’s hope it goes a little better than the last few conversations.

So we’ll have one more trading day before we close out the week, which will also bring the latest set of government numbers regarding what their computer models and telephone calling services came back with regarding the labor market.

If the number’s really low, that could make for a fun Friday in the silver market.

But hopefully you can take a few moments to enjoy today’s historic rally, and thanks as always for reading.

More By This Author:

What The BRICS Have Planned For This Year's Summit In JulyDon't Count On Any 'Summer Doldrums' This Year In The Gold Market

Bloomberg: 'Bond Buyers On Strike'