Silver Breaks $100 In New York As The Market Starts To Unravel Globally

Image Source: Pixabay

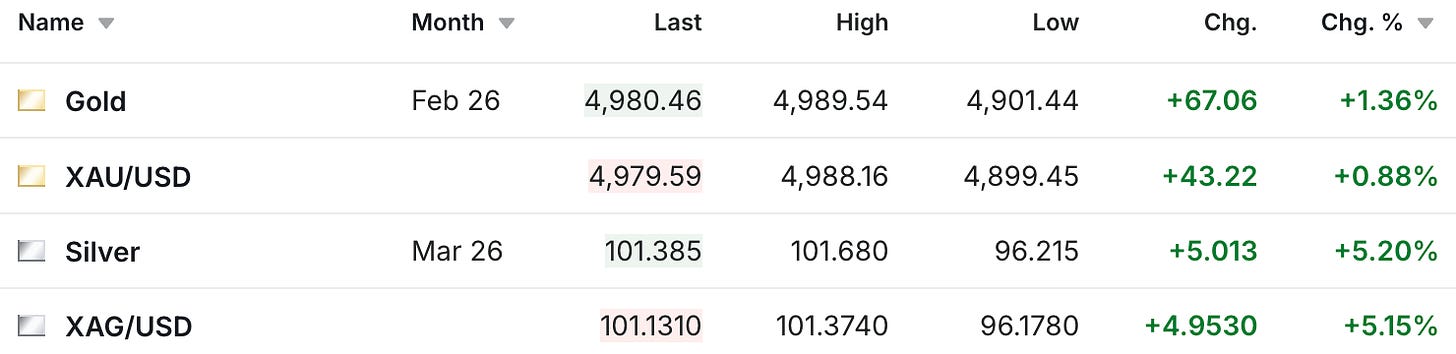

What better way to close out another historic week in the gold and silver markets than with gold on the verge of $5,000 per ounce, while the silver price just crossed over the $101 mark?

(Click on image to enlarge)

The current high for the day, and of all time, for the silver futures is $101.68, which of course is truly stunning in its own right.

But in just case you want to have your socks blown off, consider what’s happening around the globe, where two of the other major silver prices are soaring substantially higher than what we’re seeing on the Comex.

I mentioned yesterday how the silver premium in India had surged over the past week up to $8 over the Comex, although this morning when the COMEX price first crossed $100, silver was trading at $113 in India!

At the same time, silver was trading at $112.81 in Shanghai (it closed at $114.45).

This also further supports what I suggested in yesterday’s column, and also recapped succinctly in this brief video below, about why I believe this is a physically driven rally, that left one Indian solar panel manufacturer saying, ‘China is soaking up all the silver and making it difficult for India to get the raw materials they need for manufacturing.’

Over the past few weeks I speculated in this column, and on our Youtube channel, whether we were at, or nearing, a situation in which industrial silver users basically reached the point where the normally available supply of silver was just not sufficient to fill demand. And in that scenario, whether we would start to see companies front-run each other and just pay whatever premium was necessary to secure their supply.

But today I’ll go a step further and introduce the idea that in terms of the market possibly being at, or close to that moment, perhaps it’s already happened. Because when you consider that the silver price has doubled in the past two months, AFTER it had just broken through the $50 level for the first time in 45 years, the type of price action we’ve seen in the last few weeks is pretty much what you would expect in the type of scenario introduced above.

Also supporting that is the way that the premiums in India and China continue to rise, even as the Comex price is still going up $5 or more in a day. I still also wouldn’t say that the London market has been entirely ‘normalized,’ and with the Indian premiums rising, while the commentary on the ground also indicates extremely tight conditions, how long will it be before there is increased demand on the London supply?

It’s like a real-life game of global silver whack-a-mole!

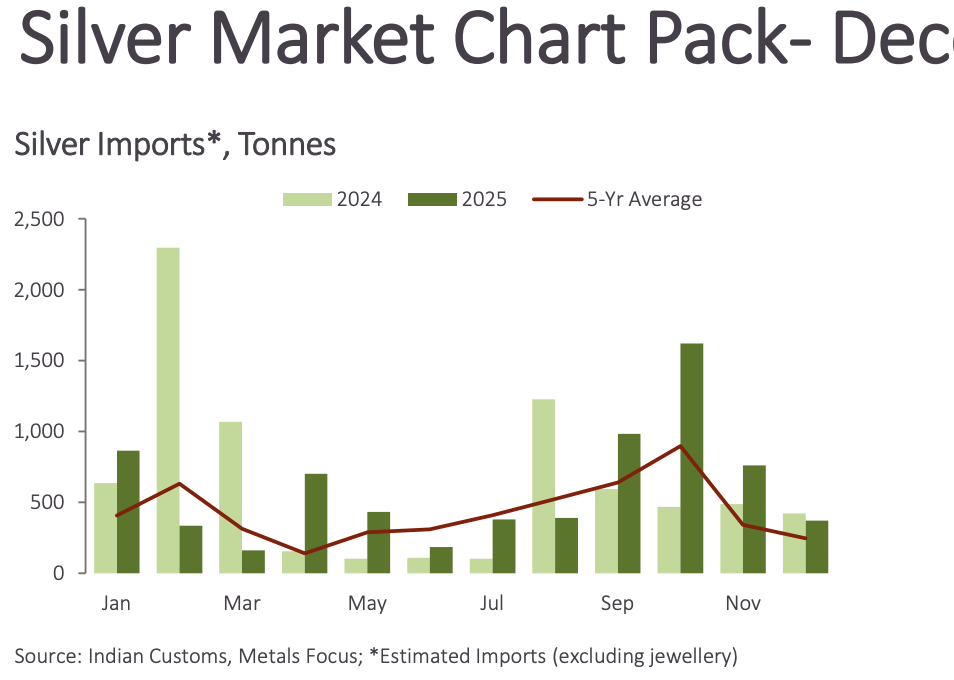

Then consider that these conditions in India are occurring even after two months of tepid silver import levels.

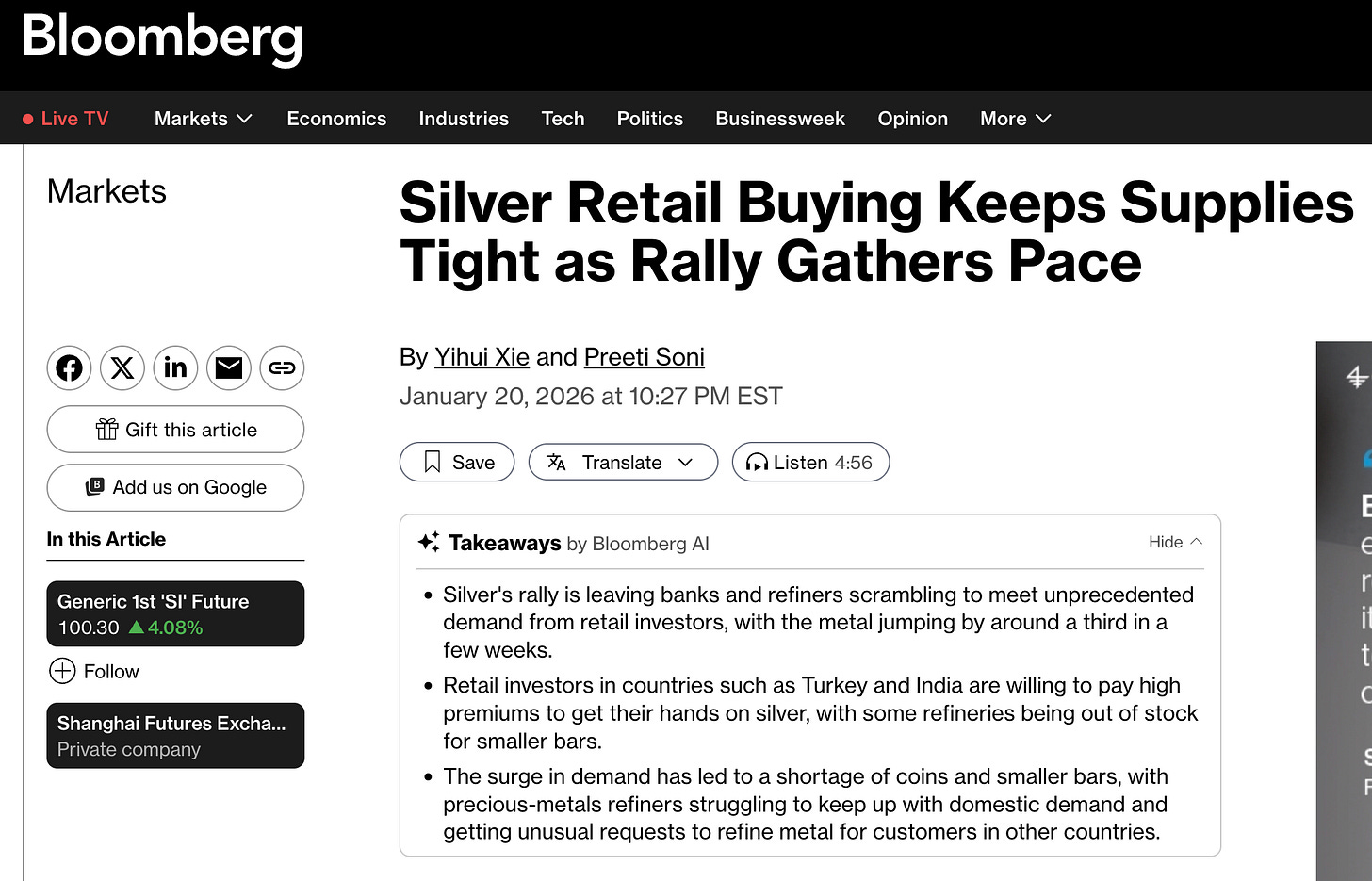

Bloomberg had an article earlier this week on the global silver dislocations, and below are some interesting excerpts that fit in line with what I just mentioned.

(Click on image to enlarge)

“It’s the highest demand I’ve ever seen,” said Firat Sekerci, the general manager of Public Gold DMCC, a bullion dealer based in Dubai. “Most refineries in Turkey have been out of stock for the smaller bars — 10 ounces, 100 ounces — for the past 10 days.”

That’s prompting global banks to prioritize shipments to the country and region, resulting in less metal reaching India and leaving demand there unmet, according to two dealers familiar with the matter, who asked not to be named as they are not permitted to speak publicly.

A short squeeze last October showed how local supply constraints can quickly go global, especially for a less-liquid metal like silver.

The UAE has been a large silver exporter to India in recent years due to a favorable tax treatment policy, and the article talks about how less metal is reaching India from Dubai. So in an already fragile market, with the price over $100 in New York, how exactly would the market react if a region goes back into a shortage, or another more overt supply crisis, like what India and London experienced just a few months ago?

Investor demand for silver is now even higher in India than it was in October, with smaller bars and coins in vogue, according to Samit Guha, the CEO and Managing Director of MMTC-PAMP India Pvt., the country’s largest precious metals refiner.

The company’s silver dore imports have more than doubled between October and December from last year, but it’s struggling to keep up with domestic demand and is also getting unusual requests to refine metal for customers in South Korea, the United Arab Emirates, Vietnam, and Malaysia, he said. “Whatever we manufacture, we sell. We could supply 25% more coins and bars and the market would absorb it.”

That’s not good news for the silver supply chain if Indian investment demand is even higher than when the market went into a shortage, while refiners are getting unusual requests from South Korea, the UAE, Vietnam, and Malaysia.

The squeeze in October has also depleted inventories in some locations, leaving the market without much of a buffer. Stockpiles linked to the Shanghai Futures Exchange made a partial recovery in early December, but have now fallen again to where they were after the crunch in October.

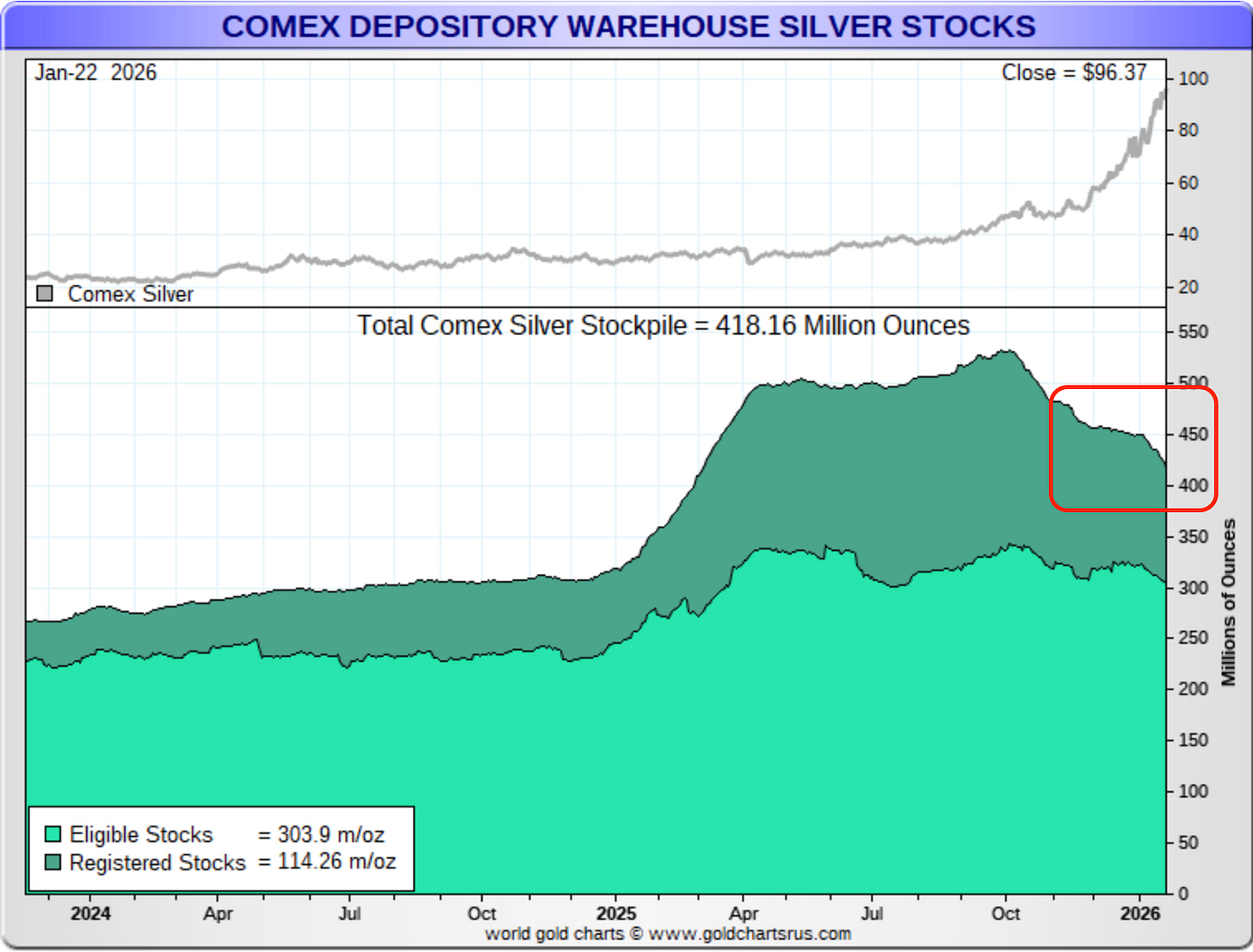

We’ve talked plenty about how China started experiencing supply issues after they sent silver to London to help address London’s crisis, and we can also see that silver continues to leave the Comex as well.

(Click on image to enlarge)

Here’s a comment from former JPMorgan precious metals managing director Robert Gottlieb’s LinkedIn commentary yesterday:

Silver continues to flow out of CME warehouses, as another ~4 million ounces reportedly left yesterday, with roughly 422 million ounces remaining. In total, about 110 million ounces have reversed course over the last few months.

All of this should help loosen short-term OTC forward rates and free up metal for global physical demand, particularly India and ETFs.

But here’s what caught my eye:

While short-dated forwards have loosened with the physical flow out of the U.S., long-dated OTC London silver forwards have actually become more backwardated.

Just last week, 1–5 year OTC lending rates were roughly -1.5% to -2.5%. Over the past two days, they’ve moved to around -3.5% to -4%. That is an aggressive move and it matters because silver has no lender of last resort. In gold, banks can source liquidity via central bank lending. Silver doesn’t have that backstop.These long-dated levels are extremely tight and may be signaling that some producers are starting to explore hedging 2–5 years out at these elevated prices while banks, understandably, are far more cautious about warehousing long-term risk than they were when silver was $29.

After what we saw last October, with short-term rates printing extreme levels like -25% and limited ability for banks to intermediate out the curve, it makes sense that the back end remains tighter than the front end, especially with metal continuing to migrate from the CME to overseas.

That would also support the view that there is growing legitimate concern about the silver supply on more than just a short-term basis.

Then, add in that after a couple years of historic selling on the retail level, we’re starting to see a surge in buying, that large online gold and silver dealer MoneyMetals.com describes as ‘exceeding COVID-era levels, even as long-time holders take profits after silver tripled over the last 12 months.’

More By This Author:

Bloomberg: 'Investor Demand For Silver Is Now Even Higher In India Than In October'Silver's Now Up Almost 100% In Just The Past 2 Months, & That's After It Broke The $50 Level

As Silver Breaks $94, Here's Why It Might Still Be Early