Shale Is Not Coming To The Rescue

Image Source: Pixabay

The market is waking up to a harsh realization: Frackers operating in the US shale patches won't be the saviors this time as West Texas Intermediate (WTI) approaches $100 a barrel. A combination of investor payouts, inflation, and interest rates decelerated the rate of drilling, and, contrasting with previous years, many of these operators will be slow to bring on new rigs.

Before the 2024 election, President Biden faces an ominous outlook on crude supply as the administration drained 240 million barrels of oil in pursuit of short-term popularity gains. All those oil price declines are now gone, as the Strategic Petroleum Reserve is down to half where it was at its peak. Meanwhile, Saudi Arabia and Russia have sent Brent prices near $100 on increasing production cuts.

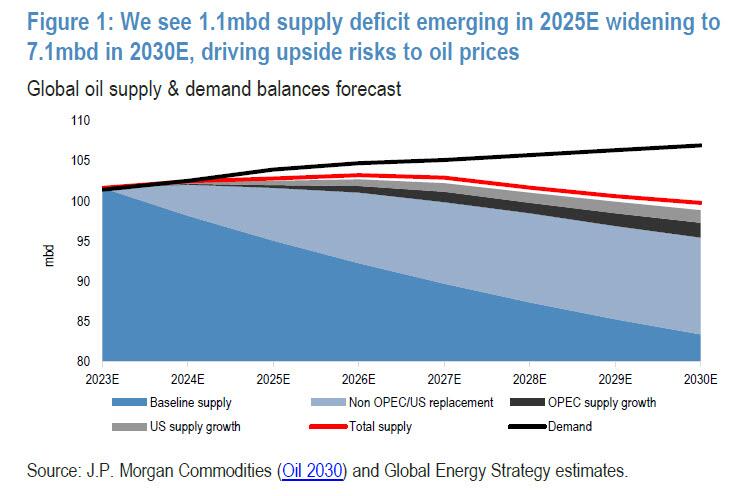

This very bullish market structure for WTI comes as JPMorgan discussed last month that it predicted the return of the oil "supercycle": crude is about to rise much higher due to what JPM sees as a staggering 7mmb/d deficit by 2030...

In prior years, frackers could crank up new production at almost a moment's notice, but not anymore. The Wall Street Journal explained:

"Some oil executives said most of the shale industry plans to stand pat even as global oil prices increase further. Most shale companies have vowed to hand over their winnings from high energy prices to investors via share buybacks and dividends. They also face pressure from inflation and high-interest rates."

Jack Williams, a senior vice president at Exxon Mobil, said:

"If you think about capital efficiency, and you want to make sure you're thinking long-term about your business, moving [drilling rigs] up and down a lot is not a good idea."

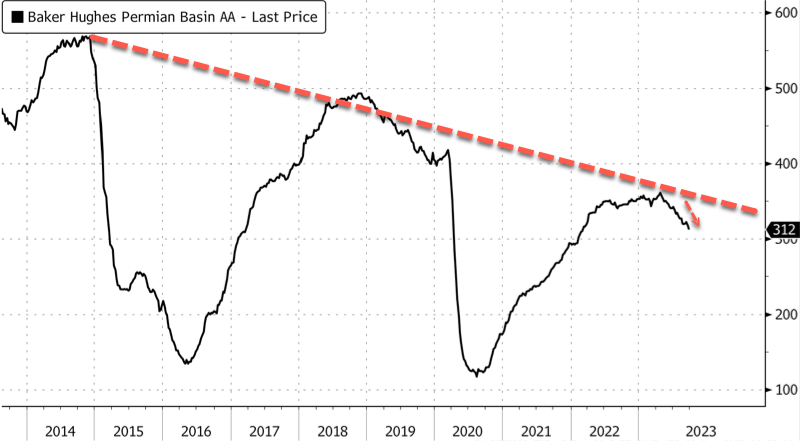

New rigs across the Permian Basin of New Mexico and West Texas peaked in April this year at 361 and have fallen ever since to 312 -- even with crude prices rising $13 a barrel over that same period.

(Click on image to enlarge)

Exxon is one of the largest shale drillers. It has reduced drilling rigs by two so far this year to 17, well under its 65 level in the Permian and other fields before the pandemic downturn in 2020, according to energy analytics firm Enverus.

Even with Exxon raking in a record $55.7 billion annual profit last year, the company has kept drilling subdued while trying to squeeze more oil from fewer wells while boosting shareholder payouts. Data from FactSet shows about $16.1 billion on dividends and share repurchases were spent in the first half of the year, compared with $10.8 billion on capital investments.

WSJ pointed out smaller drillers are also being forced to slow down operations:

"Higher costs of equipment, labor and steel in the oil patch has also reined in their activity, executives and analysts said, as has an outflow of investment from the sector."

Kirk Edwards, an executive at a small Texas oil producer, described the Organization of the Petroleum Exporting Countries and its allies could at any moment flood the market with "two million more barrels a day on the market, which will drive the price [of a barrel of oil] from 90 to 60 dollars." He said that makes him nervous about increasing production as prices rise.

A new survey conducted by energy research firm Daniel Energy Partners said 55 US oil companies would keep operations unchanged if WTI continued to trade around $80 a barrel. Even at $90, respondents said they wouldn't budge.

Without new production, Continental Chief Executive Officer Doug Lawler said during a recent interview with Bloomberg TV that "you're going to see $120 to $150" a barrel of oil.

"That's going to send a shock through the system," Lawler said. Without policies encouraging new drilling, "you're going to see more pressure on price."

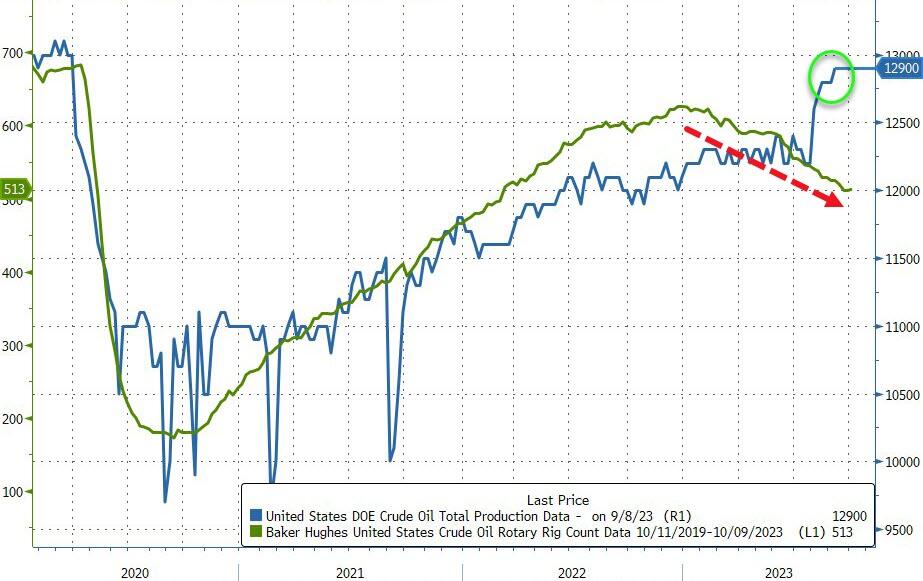

Rystad Energy said US crude production tracked around a record 13 million barrels a day in September but still no recovery from pre-pandemic days when 13 million barrels a day was recorded in November 2019.

US crude production rose to post-COVID highs (despite the ongoing decline in rig count)...

(Click on image to enlarge)

The big takeaway is that the supply response by shale needs to be faster to come to Biden's rescue.

All of which leaves President Biden with a major problem. Inflation is resurgent (on the back of soaring gasoline prices) and looks set to go higher...

(Click on image to enlarge)

Supplies are collapsing, and prices are set to rise above $100.

More By This Author:

Bonds, Bullion, & Black Gold Battered As Hawkish FedSpeak & Inflation Fears Lift The DollarA September To Forget: Here Are The Best And Worst Performing Assets In September, Q3 And 2023

Atlantic Overfishing: Europe's Worst Offenders

Disclosure: Copyright ©2009-2023 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies ...

more