S. America’s 2022 Output Has Shrunk & US Export Demand Tighten Stocks

Market Analysis

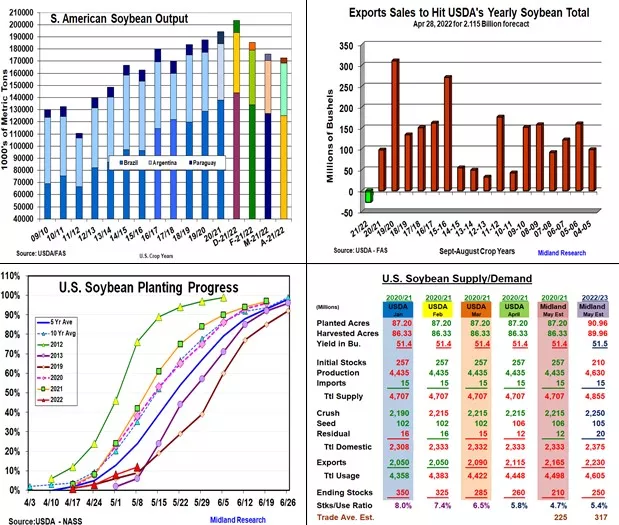

Similar to corn, numerous world events have occurred this spring to impact soybeans and world oilseed supplies and their prices making the USDA’s US & World 2021/22 and their 1st 2022/23 supply/demand outlooks important on May 12. The Black Sea conflict has cut Ukraine’s old-crop sunflower exports & new-crop prospects. S America’s soybean output was hurt by La Nina’s cold Pacific Ocean temperatures cutting Brazil’s southern crop by drought and Mato Grasso’s output by excessive moisture. Cold & wet US weather has also curtailed this year’s N Plains & Midwest seedings keeping 2022’s pace near the lowest level of the decade. Investor liquidation ahead of the USDA numbers & this week’s swing to hot temperatures in the

Central US prompting talk of a big planting jump weaken prices. Despite expectations of another record South American soybean output back in December 2022’s output has declined 15% from its early forecast when La Nina trimed both Brazil’s and Paraguay’s crop outputs sharply. This year’s 31 mmt decline has prompted buyers to increase their US purchases recently. Last week’s US exports advanced this year’s sales 27 million bu above the USDA’s current 2.115 billion bu 2021/22 forecast. With 4 months left in the current crop year, a 50 million bu increase in soybeans’ old-crop foreign demand seems likely this month.

This spring’s inclement weather has limited last week’s increase in soybean seedings to 4%. This pace is still above both 2013’s and 2019’s planting levels at 12%. However, the upcoming week’s progress now seems likely to remain 10-12% below the US May 15th 5-yr 40% average. More talk is now surfacing about producers considering utilizing the USDA’s prevent plant program, particularly in the northern growing areas. Currently, 750,000 more acres are projected in these states of the Mid- west’s 2.5 million larger seedings this year.

The USDA normally uses its Ag Outlook demand and yield levels along with its spring planting level for its initial new-crop balance sheet each May. However, a 50 million lower carryover from higher exports and a modest rise in foreign demand suggests this month’s initial US 2022/23 soybean stocks will remain reasonably tight at 250 million bu keeping plantings important.

What’s Ahead:

The US remaining plant season and Ukraine’s sunflower exports and output will continue to be market factors going forward. With the world’s vegoil output becoming a major feedstock for expanding renewable diesel to produce a cleaner atmosphere, oilseeds will continue to have significant value. Hold old-crop soybean sales at 90% and new-crop marketings at 25-30%.

Disclaimer: The information contained in this report reflects the opinion of the author and should not be interpreted in any way to represent the thoughts of any futures brokerage firm or its ...

more