Russian Oil Exports From Western Ports To Tumble 18% In July

Photo by Timothy Newman on Unsplash

Is the flood of Russian oil finally tapering?

Following several months of record-busting flows, Eikon data showed on Wednesday that Russia's seaborne oil exports from the ports of Primorsk, Ust-Luga and Novorossiisk will fall to 1.9 million barrels per day (bpd) in July from 2.3 million bpd in June as domestic refineries increase runs, and - perhaps - as Russia finally decides to comply with its self-imposed output cut.

On a daily basis oil loadings from Russia’s western sea outlets are set to decline 18% in July compared to June, Reuters calculations showed. Russia's oil exports are curbed by higher oil processing by domestic refineries along with frozen oil production under OPEC+ agreement and additional cuts pledged by Russia.

Lower loadings expected in July have already supported Urals oil differentials in ports of India - the main buyer of the grade.

Urals and Kazakhstan's transit oil (KEBCO) loadings from Baltic ports of Primorsk and Ust-Luga were set at 5.6 million tonnes, down from 6.5 million tonnes planned for June.

Urals, KEBCO and Siberian Light oil loadings from Black Sea’s Novorossiisk were planned at 2.4 million tonnes in July, down from 2.9 million tonnes in June.

Russian refineries cut runs during spring months allowing state exports to reach a 4-year record in May. After works ended in June exports started to slide.

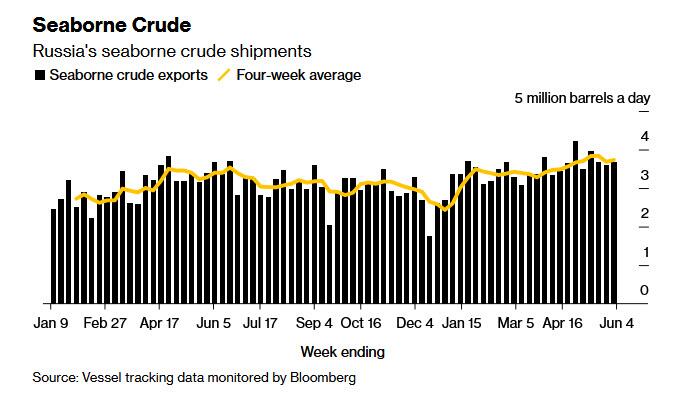

The sharp drop in exports comes after Russian crude oil flows to international markets have largely continued to grow unabated, with no substantive sign of the output cuts that the Kremlin insists the country is making. Four-week total average seaborne shipments, which smooth out some of the volatility in weekly numbers, edged higher in the period to June 4, rising to 3.73 million barrels a day from a revised 3.68 million in the period to May 28, according to Bloomberg.

At the start of the month, flows to international markets were more than 1.4 million barrels a day higher than they were at the end of last year — more than can be accounted for by the diversion of pipeline flows or lower refinery runs. Shipments have also risen since February, the baseline month for the pledged production cut.

Following the recent OPEC+ decision to cut output, Moscow’s OPEC partners have sought clarity and transparency from Russia on the country’s crude production. They noted that Moscow has made a commitment to accept reassessment of February’s production level by OPEC’s secondary sources. The assessment by those seven companies currently stands at 9.83 million barrels a day.

However, there has been precious little evidence that the 500,000 barrels a day of Russian export cuts have been made. Moscow has cited the diversion of crude previously piped to Germany and Poland through the Druzhba pipeline as a reason for robust shipments; but that switch happened in January and February, before the output cut was due to come into effect. Flows of Russian crude through the pipeline, now limited to deliveries to Hungary, Slovakia and the Czech Republic, have been stable at about 240,000 barrels a day since February.

And while Russian refineries cut their crude processing in the first part of May, runs recovered in the final week of the month, rising by about 180,000 barrels a day from the previous seven days. Despite the dip in refinery runs there is no sign of a corresponding drop in overseas shipments of refined products.

Meanwhile, Russia’s revenues from oil are still being hit hard, despite robust overseas flows. May’s budget proceeds from oil taxes plunged 31% from a year ago to 426 billion rubles ($5.2 billion), according to Bloomberg calculations, largely the result of a sharply lower oil price.

Ironically, to boost oil-related revenues, Russia may have no choice but to sharply reduce its output if only to spook speculators and spark a short squeeze which lasts longer than the one in April. Then again, the moment Russia resumes exporting at full blast, the price will drop again until such time as Beijing finally admits that it needs to launch a massive fiscal stimulus which reboots the country's economy. And with youth unemployment already at a record 20%, and potentially jeopardizing the one thing that Beijing cares about the most - social stability - that day isn't too far away.

More By This Author:

Fed's Favorite Inflation Signal Remains 'Stuck' As Wage-Growth Re-Accelerates In May

Where Central Banks Have Issued Digital Currencies

US Pending Home Sales Plunge More Than Expected In May