Risk Premium Pushes Aluminium Higher

Three major developments in the aluminium market have seen prices top the LME complex, not least rising geopolitical risks in Europe.

Three main developments send aluminium price higher

Aluminium is toping the LME base metals complex with the 3M contract gaining around 10% year-to-date as of Friday. And those extended gains come despite a strong dollar this week after a hawkish tilt from the Fed Chair, Jerome Powell at his news conference following the FOMC meeting. Some sizeable inventory outflows have taken the overall on-warrant stocks to 811kt as of Friday (Jan 28), the lowest since 2007. The stock drawdown has been supportive of prices. We think there are three main developments behind the recent aluminium market strength.

- First of all, European power prices have still kept those disrupted capacities in western Europe out of the market. Since our last update, there have been more than 610kt capacity losses. The longer these capacities stay shut, the more supply losses we'll get in 2022. Without meaningful demand destructions, the European market balance points to a deeper deficit. While some may be hoping power prices could get better after the heating season, tensions around Ukraine have made things worse so that European buyers are even scrambling for coal for fear of Russian gas supplies being cut off. Another risk is that if the currently elevated power prices become entrenched, producers in the region could have more difficulties securing their power contracts. Subsequently, margin erosions could jeopardise future supply.

- The ongoing Russia-Ukraine tensions bring another question: What if sanctions were to be implemented which block Russian aluminium from the market? Recent tightness in the European market has boosted aluminium ingot and billet premium. Like buyers stockpiling coal just in case, some consumers in the aluminium market may opt to secure more aluminium in case of further disruptions, adding to the tightness. Russia is the world’s single largest producer outside of China. The country's main producer, Rusal, ships almost half its products into the European market, including primary foundry alloys, ingots, and other semi-finished products. With some producers from western Europe cutting their operations due to the elevated power prices, Russia is the only country in the region that could contribute to additional supply growth in 2022. This is because Russia has just ramped up the Taishet smelter that is set to bring an additional 429kt of aluminium to the market this year, according to the nameplate capacity. No one knows how the Ukrainian situation will unfold, but the market is pricing in some risk premium on a potential escalation of the geopolitical risk which may further rattle the already stretched aluminium market.

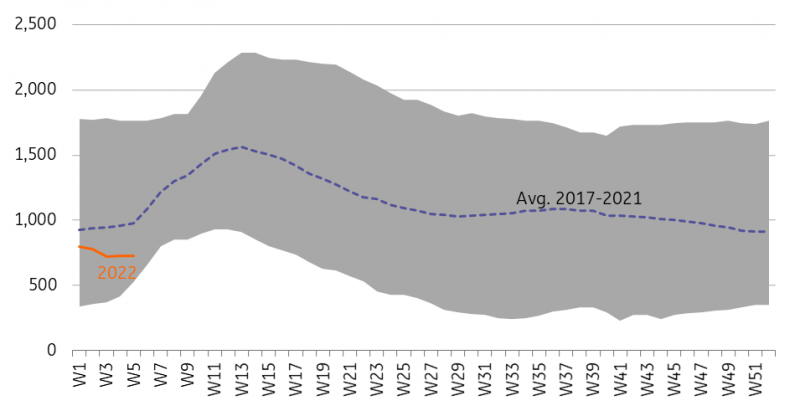

- The China onshore market is heading into the holidays without stock building which is unusual, as you can see in the chart below. Historically, there could be some stock building before the Chinese New Year. This is now sitting at 726kt, compared to 714kt the week before the last new year and far below the 980kt average level from the previous five years. This may suggest a constructive picture of the local market as a result of the collapsed operation rates at smelters during the later part of 2021 (see Fig 2) and firm demand. As Beijing has now shifted towards more pro-growth as they recently announced a slew of both monetary and fiscal measures aimed to boost the economy, we estimate that the Chinese market could see a strong sequential demand recovery post the Winter Olympics. This, compounded with lower inventories, could lead to a stronger price in Shanghai, potentially opening the import arbitrate, which could further accelerate the tightness in the ex-China market.

Fig 1. No stock building before the Chinese New Year

Image Source: ShFE, ING

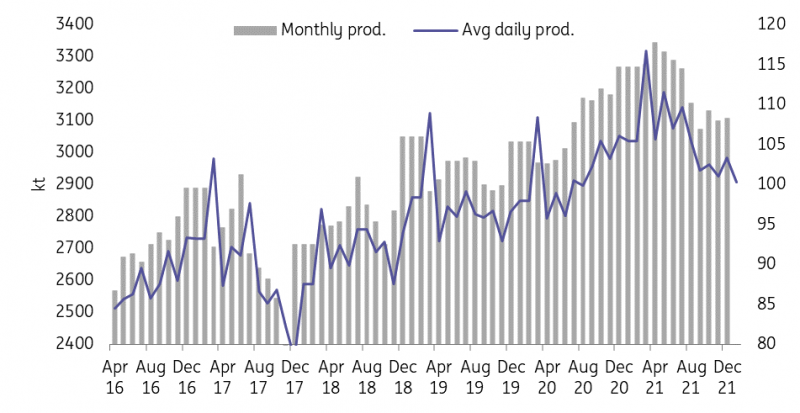

Fig 2. Average daily production falls in 2H21

Image Source: NBS, ING

Still positive, but not without risks in the medium term

Overall, we don't think there's a rising tide lifting all boats for the metals' sector in 2022. Still, aluminium stands out as our top pick among metals with the most upside potential this year, as we examine in our outlook last December. However, the recent escalation in geopolitical dangers has posted more upside risks to our previous forecast for 1Q22. While we remain overall positive towards aluminium, there are some potential downside risks too. These include but are not limited to:

- The risk premium could dissipate if there were some kind of resolution on the Ukraine front.

- Increasing headwinds on the macro front if we get more aggressive interest rate rises and super-charged balance sheet reductions from the Fed.

- More importantly, the scale and timing of restarts/ramp-ups from China could swing the short-term market balance. Overall, this remains a big uncertainty because the bulk of disrupted capacities last year was due to the 'dual-control' mandate. The outlook on the scale and timing of restarts/ramp-ups from China is very much dependent on decarbonisation-related policies and how regional governments carry out related works.

Our base case is that we don't expect all the disrupted capacities to come back this year, and the bulk of restarts/ramp-ups may only return during the latter part of 2022. While we keep monitoring the developments, some rhetorical changes from top Chinese officials over the nation's twin carbon goal are worth paying attention to as these could swing market expectations.

On Monday (Jan 25), Chinese President Xi remarked on the nation's twin-carbon goals. While he continued to stress the importance of the goals, he also admitted that 'it is not something that can be achieved easily. It is the first time he made it clear that 'emissions' reductions do not mean cutting production' when carrying out relevant works. This echoes the calls from other Chinese authorities on avoiding 'campaign-style' or 'one-size-fits-all' carbon reductions that had jeopardised economic stability. We think that this may suggest some fine-tuning is on the way to achieving the 'twin-carbon' goals, and there may be less disruption to production when regional governments carry out their decarbonisation-related works this year. If this is the case, we could see larger restarts in aluminium later this year.

Disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information ...

more