Retaliation Inevitable As Trump Slaps Tariffs On Metals, Again

Image source: Pixabay

President Trump has signed an executive order imposing an additional 25% tariff on steel and aluminum imports into the US, effective March 12, 2025. With four weeks until the tariffs take effect, there is still room for negotiation. But with many countries ramping up their trade defense, further trade escalation seems inevitable.

During his first term as US president, Donald Trump announced tariffs of 10% on aluminum and 25% on steel imports, effective March 2,3 2018, under Section 232, citing national security concerns. Initially, only Mexico and Canada were exempt, but they, along with the EU, were hit with these tariffs two months later. Multiple deals eventually ended tariffs for many countries.

Under former President Joe Biden, tariffs on Chinese steel and aluminum were tightened. On July 10, 2024, Biden imposed a 25% tariff on Mexican steel melted or poured outside North America and a 10% tariff on Mexican aluminum containing metal smelted or cast in China, Belarus, Iran, or Russia.

Now, President Trump has reintroduced steel and aluminum tariffs without exceptions, citing a surge in imports and a decrease in US capacity utilization. He stated that the previous deals, often in the form of quotas, have become redundant and hurt US manufacturers.

How much does the US produce and where do US steel and aluminium imports come from?

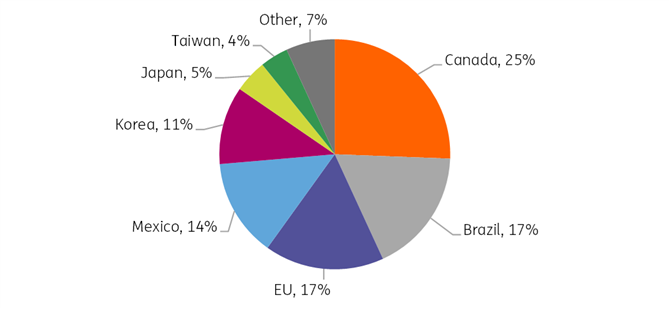

While the US produced some 79.5 million tons of steel in 2024, it still imported about 28.9 million tons, i.e. a quarter. China, the world's largest steel producer, produced 1,005.1 million tons in the same year. Regarding steel imports into the US, around 25% came from Canada, followed by Brazil at 17%, Mexico at 14%, and South Korea at 10%.

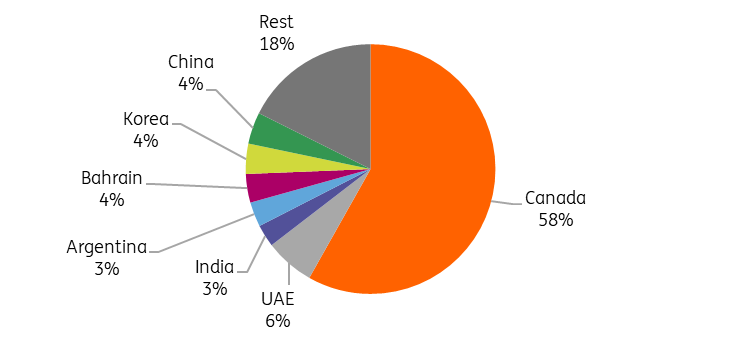

Likewise, the US imports roughly half of its aluminum from abroad, with Canada the biggest supplier, accounting for 58% of imports, followed by 6% from the United Arab Emirates. The US also relies on Mexico and Canada for around 90% of its aluminum scrap imports.

China, on the other hand, only accounts for around 4% of US aluminum imports. Tariffs and trade actions in recent years have reduced China’s desirability as a trading partner for aluminum products. A 25% rise in US tariffs on Chinese aluminum might have little impact on China’s aluminum industry. Many Chinese aluminum semi-finished product producers have already reduced exports after China canceled an export rebate in December, retaining more material for domestic use. You can read about the potential impact of tariffs on aluminium here.

aluminum supply to US

Source: US International Trade Administration, ING Research

Steel supply to US

Source: US Census Bureau, ING Research

Aiming for jobs and production, but facing declining trends

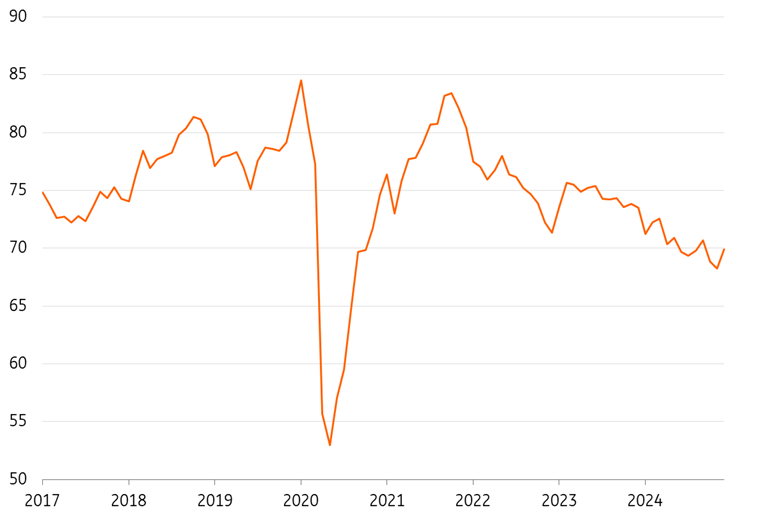

Trump said the new duties are meant to crack down on the efforts of countries like Russia and China to circumvent existing duties, bolster domestic production, and bring more jobs back to the US. However, previous tariffs did not lead to increased domestic production of the two metals. Although US capacity utilization for iron and steel briefly rebounded to 80% during Trump's first term, it has been declining since late 2021 and is currently at 69.9%.

Capacity utilization would therefore need to increase by 10 percentage points to achieve the US administration's target level of 80%.

US capacity utilization – iron & steel (%)

Source: LSEG Datastream, ING

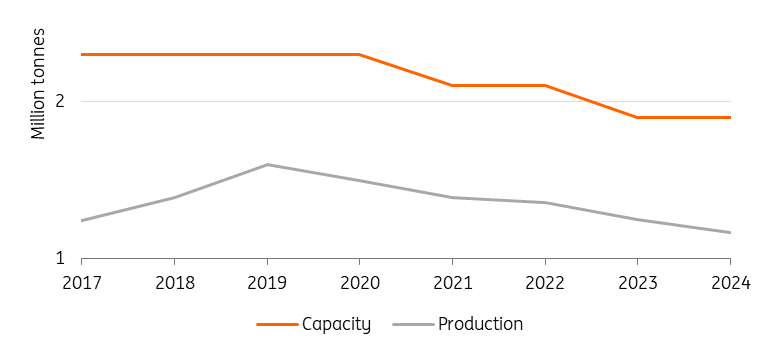

In 2024, the output of the US steel industry was 1% lower than it had been in 2017 before the introduction of the first round of tariffs by Trump, while the aluminum industry produced almost 10% less.

Despite tariffs imposed in 2018, US steel output has continued to fall

US steel production

Source: World Steel Association, ING Research

For aluminum, the US has only four operating smelters. These four smelters together produced about 680,000 tonnes of aluminum last year, down from 741,000 tonnes in 2017, the year before Trump first introduced duties (according to data from Harbor Intelligence). In comparison, China produced around 43 million tonnes of aluminum last year.

Previous tariffs had no effect on increasing domestic production

Source: US Geological Survey, ING Research

Industries in the US like automotive and manufacturing, which heavily rely on imports of aluminum and steel and are deeply integrated with US supply chains, would face increased costs and disruptions if the proposed tariffs went ahead since many parts cross the border multiple times before becoming a final product.

In which countries will the steel industry get hurt most?

Not only would US steel and aluminum importers be affected, but steel manufacturers in Canada and Mexico would also face a significant impact, as more than 90% of their steel exports go to the US. However, the overall economic effect should be manageable for these countries, as steel exports represent only about 2% and 0.8% of their total exports to the US, respectively.

Brazil, on the other hand, would suffer more, as steel exports account for 14.5% of its total exports to the US in terms of trade value. This could lead to some economic repercussions for Brazil's steel industry but could also make a deal between the US and Brazil more likely.

Share of steel exports by selected countries

in %, by value, 2023

Source: UN Comtrade/WITS database, ING calculations

Additionally, we might see changes in trade flows of aluminum. Canadian exports might get redirected to Europe, where they have duty-free access. This shift could be bearish for European premiums, potentially lowering prices in the European market.

A clash with Europe is inevitable

While the US reached an agreement with South Korea, Australia, Argentina, and Brazil shortly after tariffs were announced in 2018, other countries opted for retaliation. In June 2018, the EU responded to the US Section 232 tariffs on steel and aluminum with immediate retaliatory countermeasures in the range of 10-25% on motorcycles, agricultural products, bourbon, clothes, and steel, amongst others. Additional countermeasures were to be imposed after three years if no settlement was reached.

Then, on 31 October 2021, the US and the EU announced a multifaceted agreement to address the tariffs imposed during the Trump administration, replacing tariffs with a tariff rate quota (TRQ) system, allowing a certain volume of EU steel and aluminum to enter the US market duty-free. Any imports above these quotas would be subject to the original tariffs. The EU also agreed to suspend its retaliatory tariffs on various US exports, including American whiskey and motorcycles until 31 March 2025, while the US prolonged the TRQs on EU products until 31 December 2025.

This time around, even before the new tariffs were officially announced, the European Union issued a statement condemning any potential additional tariffs coming from the US. If the EU is hit by additional tariffs from March, it could simply reinstate its retaliatory tariffs on US exports.

And, if history is anything to go by, EU policymakers will not be the only ones opting for retaliation.

aluminum prices are set to rise while industrial metals demand will weaken

The prospect of a global trade war is bearish for industrial metals in terms of slowing global growth and keeping inflation higher for longer.

aluminum is likely to be most impacted by potential tariffs on metals with the US importing significant volumes of its aluminum from abroad. Tariffs would result in higher aluminum prices in the US, representing a significant upside risk to the US Midwest premium this year. The US Midwest premium, the best indicator of tariff risk, is already up more than 30% since Trump won the US presidential election. The premiums are added to the global benchmark prices, which are set on the LME to deliver the metal to the US Midwest. However, the effects on LME prices will be minimal. US tariffs previously had little impact on LME prices. Tariffs also risk demand destruction in the US as the extra costs would most likely be passed on to end consumers.

With growth in the US likely to slow due to the tariffs, and with China already struggling to revive its economy, demand for industrial metals is likely to weaken. Benchmark steel prices were down 38% last year with higher interest rates hurting demand in steel-intensive industries like building and construction.

President Trump has laid the foundations for further trade escalations. This will not be the last tariff move. Retaliation is on, and it’s going to get nasty.

More By This Author:

Reserve Bank Of Australia To Cut Rates Amid Turbulent ConditionsCommodities Feed: Trump Sets 25% Tariffs On Steel And Aluminum

FX Daily: Scandies And CEE Outperform

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any ...

more