Resistance On Crude Oil Can Be Supportive For USD/CAD

Today we will talk about Crude oil + USD/CAD and their negative correlation, as Canada is the third-largest oil reserve.

CRUDE OIL,4H

As you can see, Crude oil turned sharply down from the highs in March, while USD/CAD recovered strongly from the lows, which we see as a first leg A.

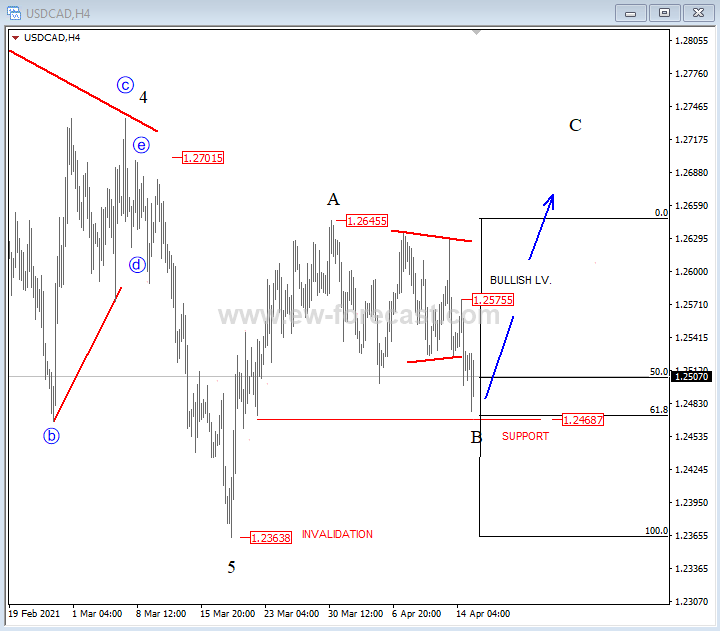

Well, recent slow price action and corrective wave structure we see as a wave B correction, which means that we have to be aware of wave C that can push Crude oil back to lows, while USD/CAD may face a bigger recovery back to highs. So, watch out for limited current movement and be aware of reversals that can occur anytime soon.

USD/CAD,4H

Disclosure: Please be informed that information we provide is NOT a trading recommendation or investment advice. All of our work is for educational purposes only.

It seems that the interactions of logic and emotions produces an oscillation waveform that might possibly be predictable. But how repeatable? Certainly it is a bit believable that there is some predictable relationship between the past and the future. Clearly the trick towards knowing when to sell would be the ability to see when the second derivative of the curve changes sign. So at that point the hard part would be guessing the math function of the curve, so that the second derivative could be calculated. ( I am using calculus terminology, not stock market terminology here.)

Thanks for the share. And I like your new photo Gregor! Looking good!