Reductions In Risk Caused Disparate Returns For Commodities In April

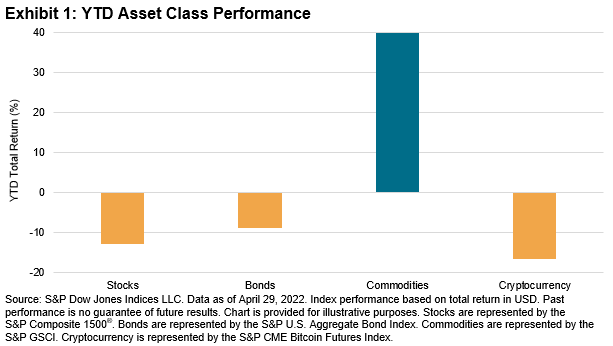

Another higher inflation reading helped the S&P GSCI, the broad commodities benchmark, to post an additional 5.1% gain in April. Many market participants realized the U.S. Fed may be behind the curve and have started allocating capital to commodities in 2022. Agriculture and energy continued to outperform last month, while metals and livestock underperformed. Among the major asset classes, commodities’ outperformance YTD is striking (see Exhibit 1).

The S&P GSCI Energy rose another 9.0% in April, with an impressive 59.2% YTD performance. Natural gas and heating oil led the way for the month, rising 26.9% and 24.7%, respectively, as the major crude oil grades continued to consolidate from the March peak in prices. Demand for U.S. natural gas exports rose dramatically this year with the global push to break dependence on Russian supplies. Natural gas production in the U.S. has slowed and the Energy Information Administration increased its price forecasts for 2022 to reflect this supply/demand imbalance.

Consolidation was evident in the metals markets in April. The S&P GSCI Industrial Metals declined 7.6%. Copper and aluminum fell notably, as COVID-19 restrictions in top consumer China and the growing likelihood of aggressive interest rate hikes fueled concern of weaker global growth.

Gold’s appeal waned in April. While gold is perceived as an inflation hedge, higher short-term U.S. interest rates and bond yields tend to increase the opportunity cost of holding a zero-yield asset such as the yellow metal. The S&P GSCI Precious Metals ended the month down 2.1%.

The S&P GSCI Agriculture gained 5.8% over the month, propelled higher by strong performance across the grains and oilseeds complex. The stand-out performer for the month was corn; the S&P GSCI Corn rallied 9.6%. U.S. corn planting in the last week of April was the slowest pace since 2013; the risk of late corn planting is that the crop is likely to pollinate later, and that can often feature hotter, yield-limiting temperatures. U.S. corn predominantly pollinates in July. The S&P GSCI Soybean Oil rose to record levels in April, ending the month up 23.0%. Access to oils for making food and fuel has been thrown into disarray, as war in Ukraine and weather-driven supply woes reduced availability, and the situation was exacerbated in April following Indonesia’s sweeping ban on palm oil exports.

Livestock markets struggled in April under the weight of higher feed costs and the protracted lockdown across China, a key export market particularly for U.S pork. The S&P GSCI Livestock ended the month 6.9% lower.

Disclaimer: For more information on the risk-adjusted performance of actively managed funds compared with their benchmarks in 2018, read our latest more