Record Inflows To Bitcoin; Record Outflows From Gold

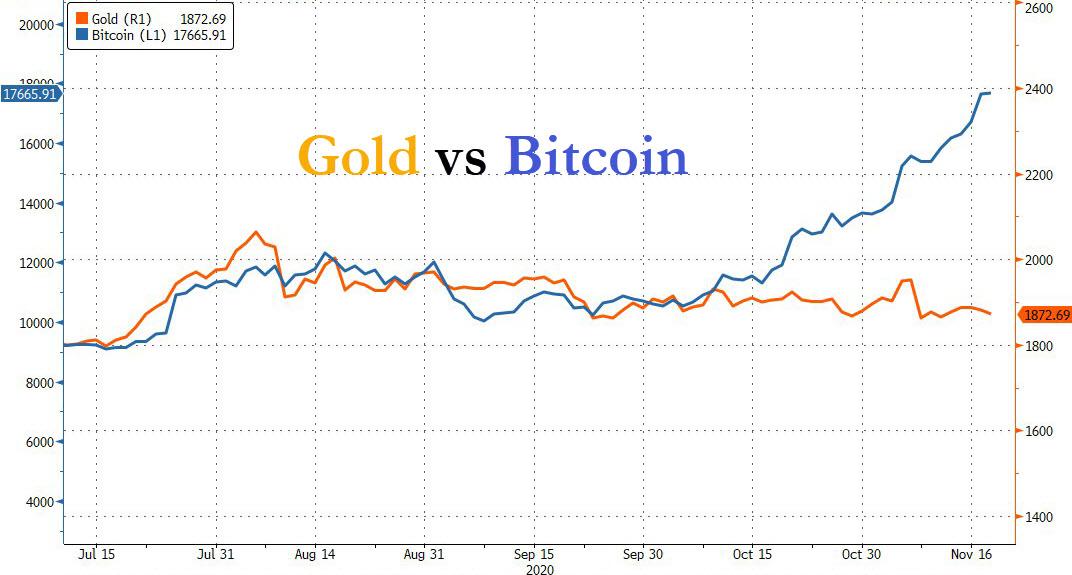

On Wednesday, when looking at the growing decoupling between gold which has traded flat since August, and bitcoin which is about to take out its all time highs around $20,000, we pointed out an observation from Deutsche which said that gold was up both during periods when deflation was the dominant concern and also when inflation re-emerged as the primary concern.

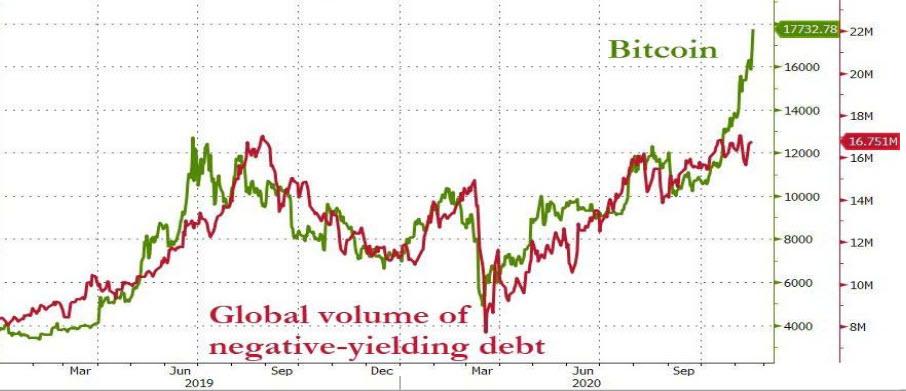

This prompted Deutsche Bank's Jim Reid to conclude that "There also seems to be an increasing demand to use Bitcoin where Gold used to be used to hedge Dollar risk, inflation and other things."

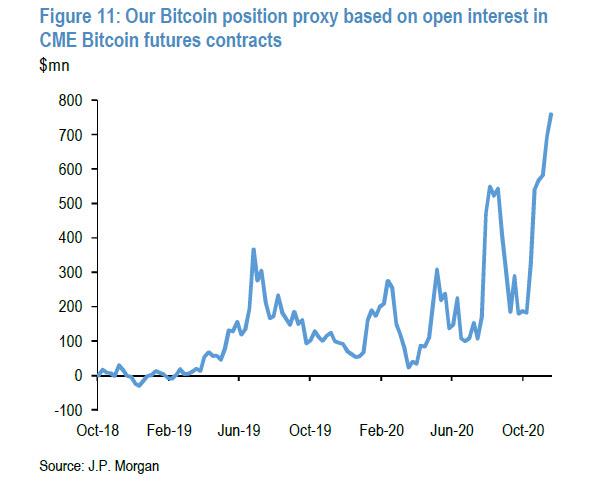

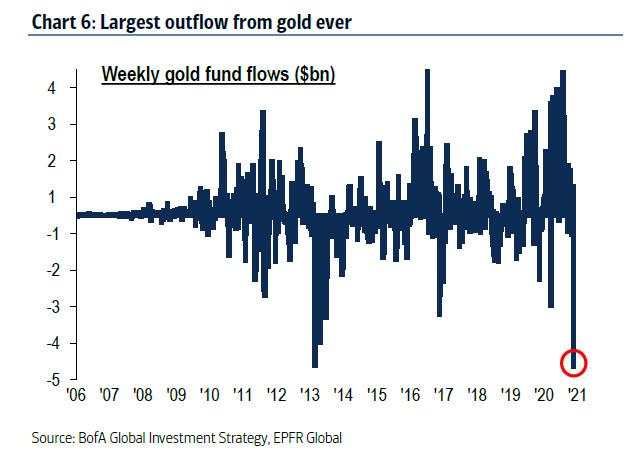

The latest weekly fund flow data confirms this, because even as bitcoin continues to rise amid a surge in institutional buying, with volumes in futures contracts exploding to an all time high, this was "offset" by what Bank of America calculated was the largest weekly gold fund outflow on record.

And while offsetting flows between bitcoin (in) and gold (out) would make sense in the context of repositioning (as younger investors buy bitcoin and older investors sell gold), the "cross the stream" moment will kick in when both storm higher.

That's the "Hedging Goldilocks" scenario laid out by BofA's Michael Hartnett, who notes that the biggest threat to the "uber-Goldilocks" base case for 2021, which as a reminder is the following...

a year of vaccine not virus, a year of reopening not lockdown, a year of recovery not recession; 2021 forecast by consensus to be the "uber-Goldilocks"...consensus predicting 5.2% global GDP growth, 3.8% US GDP growth, 1.9% U.S. inflation, 1.2% US Treasury yields

This is via higher inflation and bond yields (e.g. GT10 >2%) in 2021 as:

- supply bottlenecks in goods, services, labor fail to keep up with an unexpected surge in demand,

- excess debt (global debt now $277tn or 365% GDP) causes US dollar debasement,

- Fed desperation to prevent disorderly rise in bond yields sparks self-defeating/disorderly asset price inflation;

It is here that both bitcoin and gold will be early indicators, because as Hartnett concludes, "Bitcoin >20,000, Gold >2000, DXY <90 would all be harbingers of higher volatility & yields." His advice: "hedge inflation risk via volatility, commodities, CRE, and EM."

Disclosure: Copyright ©2009-2020 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies ...

more