Pre-July US S&D/Wheat Updates - US Seedings Were Dramatic, But Stock Changes Maybe Modest

Market Analysis

The market’s focus will be switching to the USDA’s July 11 ending stocks for the 3 major crops after June’s stunning US acreage report unexpectedly showed higher corn and lower soybean acres. Given this year’s late development of the corn and soybean crops because of 2019’s record planting delays, the market will also remain quite sensitive to the Midwest’s weather. Regular rains will be needed to keep crops in good shape given 2019’s limited root structure from last spring’s excessive moisture. However, the bulk of the US corn crop’s pollination period won’t occur until late July and early August.

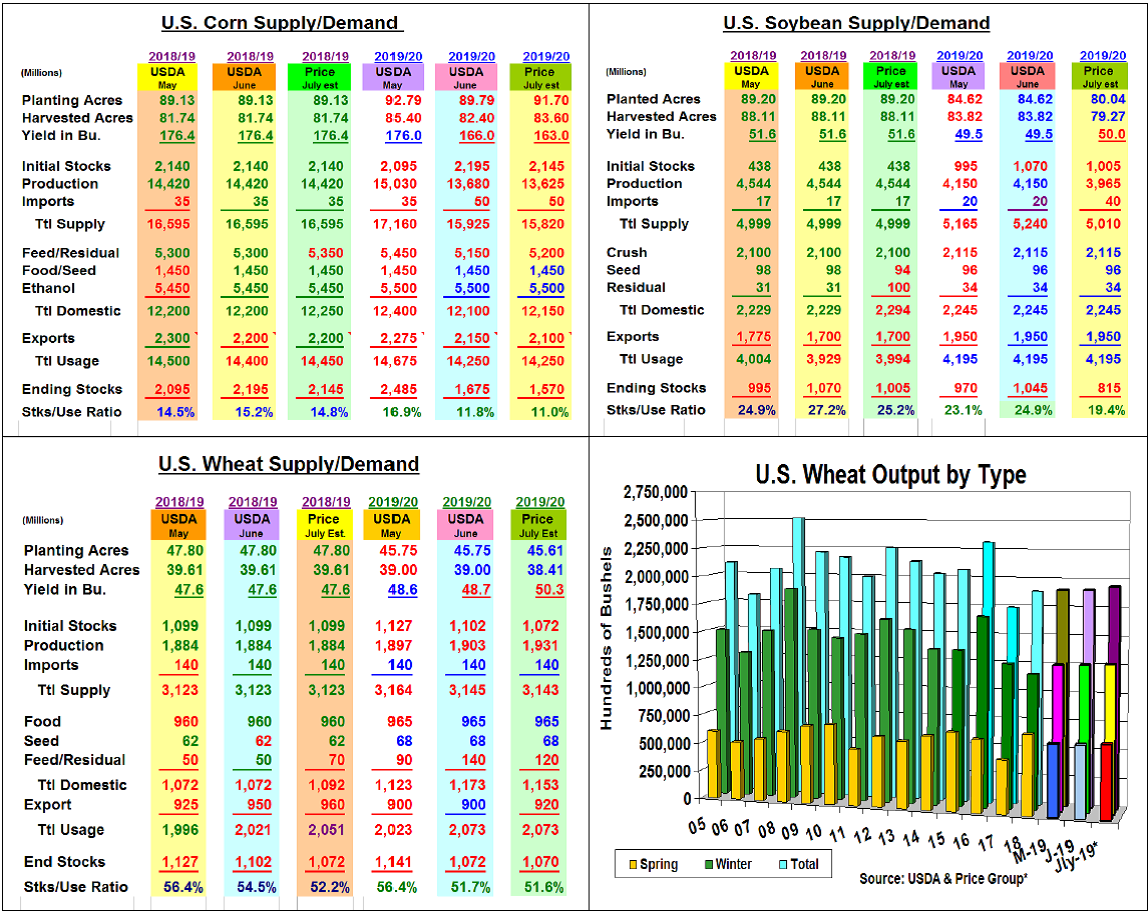

With two USDA officials alluding to the practice of utilizing the latest available data, our crop estimates will use June 28 acreage levels. However, 2019’s crop rating are 2nd lowest in the last 15 years, only 2012 is worse, could justify a further drop in 2019’s corn yield by 3 bu. This will project a 13.625 billion bu. crop, similar to June’s level. Using a 50 million bu. smaller old-crop stocks (better feed demand), 2019/20’s ending stocks may be similar to last month. In beans, the USDA’s 80 million seedings could prompt a half bu. higher US yield because of the smaller marginal plantings. This approach will add a few bushels to the US bean supply while the World Board keeps its demand levels unchanged. This could tighten bean stocks into the 800 million area, but 2019’s stocks/use level will remains high at 19.4%. Overall, the USDA, like the trade, may be waiting for the August resurvey of 2019’s crops before making big judgments.

June’s wheat acreage update showed lower US harvested acres. Stronger graze out in the S. Plains and lower spring wheat seedings in the Dakotas cut this harvested area. However, above normal rain in the Plains will likely boost 2019’s overall yield to 50.3 bu. Overall, wheat’s smaller old-crop stocks could be countered by higher 2019 supplies resulting in no July stock change.

(Click on image to enlarge)

What’s Ahead:

Sunshine and rainfall without any extremes will be needed to rebound 2019’s US corn crop. Soybeans have more time and ability to adapt during their growing conditions to a point. Also, the limited outlook for a resolution in our current trade conflict with China suggests producers should bring 2019 bean sales to 50% on November rallies into the $9.20-$9.30 range. Hold new-crop corn sales for now.

Disclaimer: The information contained in this report reflects the opinion of the author and should not be interpreted in any way to represent the thoughts of The PRICE Futures Group, any of its ...

more