Positive Divergences Abound In Precious Metals

Image Source: Pixabay

Positive divergences within a downtrend are important because they can precede a bottom and trend reversal. Our most recent editorial noted some positive divergences in the gold market.

One should never make much of one trading day, but the ongoing positive divergences in the precious metals sector and last Friday’s action raise the odds of a trend change.

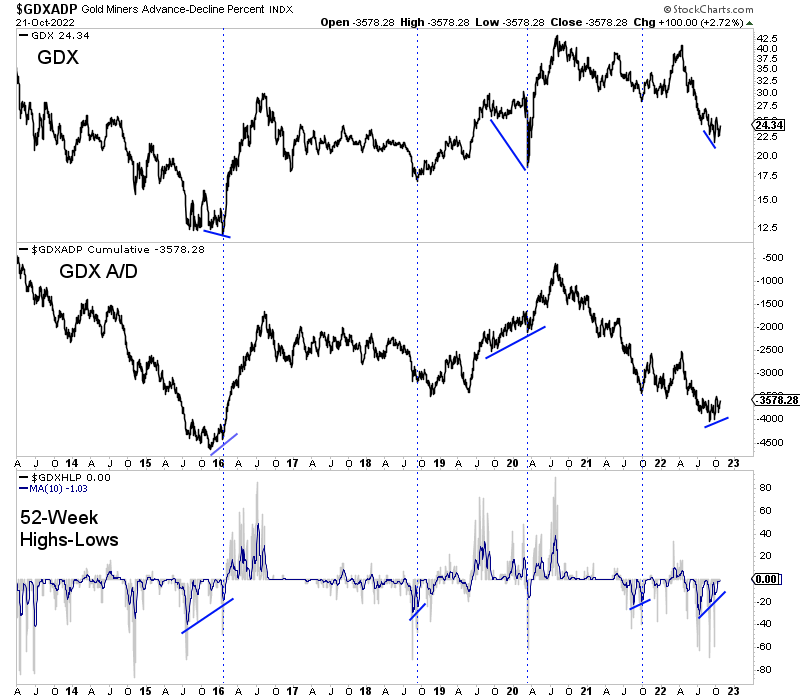

Below you will see the positive divergence in the GDX advance-decline line, the third one in the last seven years, and the positive divergence in fewer new 52-week lows as GDX made its most recent low.

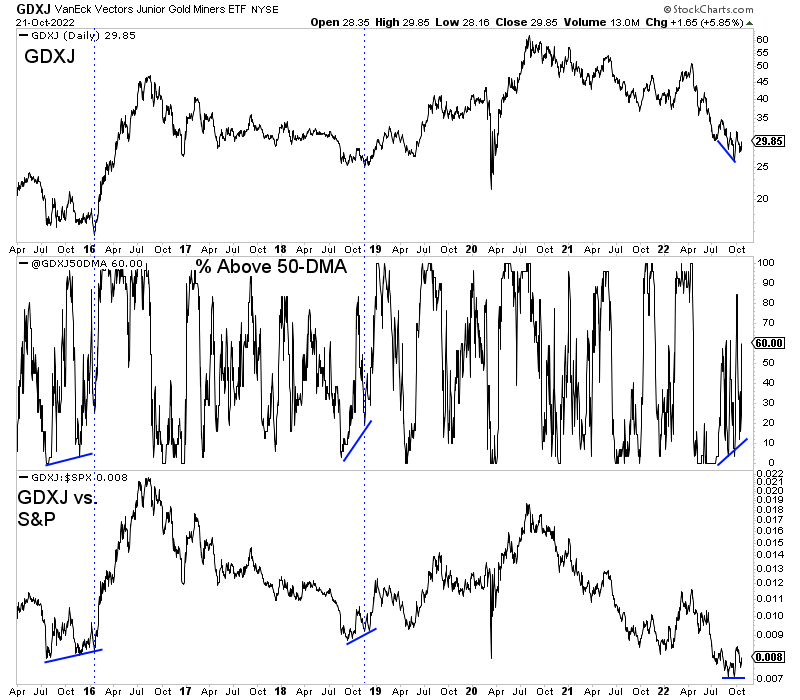

Here are two more positive divergences in the miners; for this, we chart GDXJ. The percentage of GDXJ stocks trading above the 50-day moving average trended higher as GDXJ made a lower low, and the GDXJ to S&P 500 ratio hit the bottom before GDXJ.

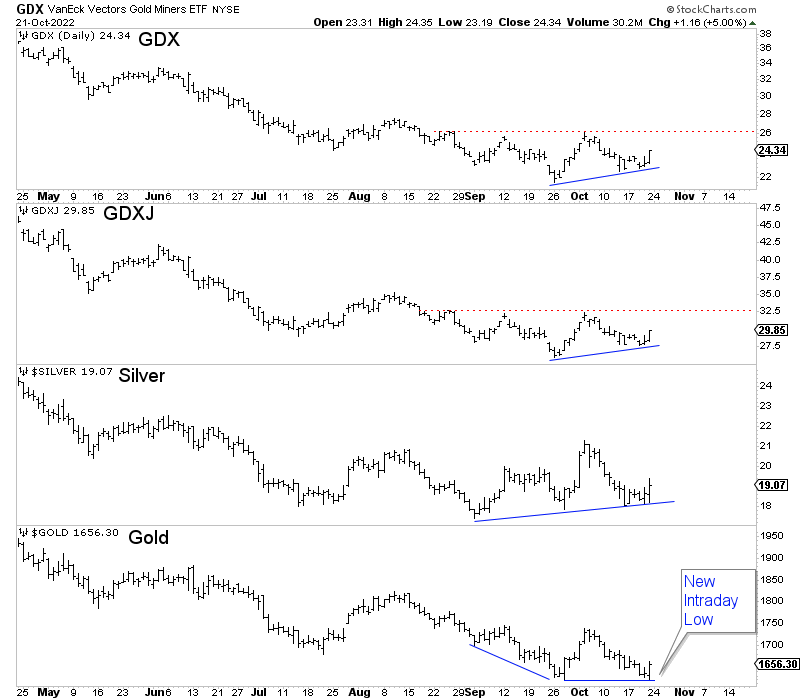

There are several more divergences to note. First, note how silver made its low at the beginning of September and failed to make a lower low even as gold broke below $1675.

Second, before gold reversed on Friday, it traded $1 lower than its low at the end of September. Silver, GDX, and GDXJ were not even close to making a lower low on Friday.

On Friday morning, WSJ reporter Nick Timiraos wrote that the Fed essentially would not over-tighten. This was followed by two regional Fed presidents easing off their previously hawkish rhetoric. The Fed knows recession indicators are flashing bright red even as the full impact of their tightening has yet to land.

Precious metals could be trying to grind out a bottom just as the Fed begins the process of moving toward a pause. Markets anticipate and discount the future. The Fed will likely finish hiking before next quarter, and 2023 is likely to be a time of Fed easing. These are all very bullish for precious metals.

More By This Author:

Another Sign Of Secular Bear Market In Stock MarketGold Update And Big Picture Look At Markets

When Will Gold Decouple From Stock Market?

I continue to focus on finding high-quality juniors with 5x, 7x, and 10x potential over the next few years. To learn the stocks we own and intend to buy, with at least 5x upside potential in the ...

more