Petro River Oil Corp. (PTRC) – Going Back In Time With Modern Technology

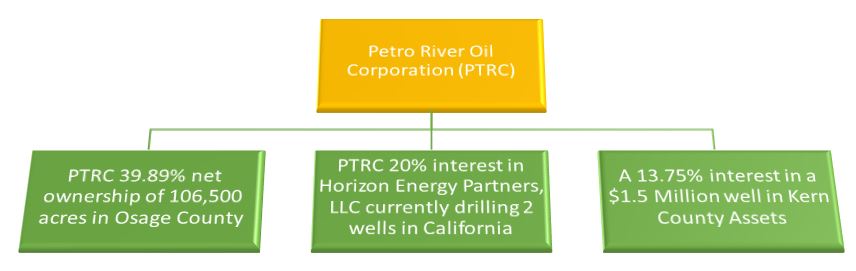

Petro River Oil Corporation (PTRC) provides shareholders with three main forms of values. The first is its core conventional operations in Osage County, Oklahoma where the company is using 3D seismic to identify and drill out production. The second is a 20% stake in a private oil & gas prospector: Horizon Energy Partners, LLC (“Horizon”). The third stems from its relationship with Horizon which enables Petro River to directly participate in large-scale discoveries through direct working interest.

History of Petro River Oil Corporation

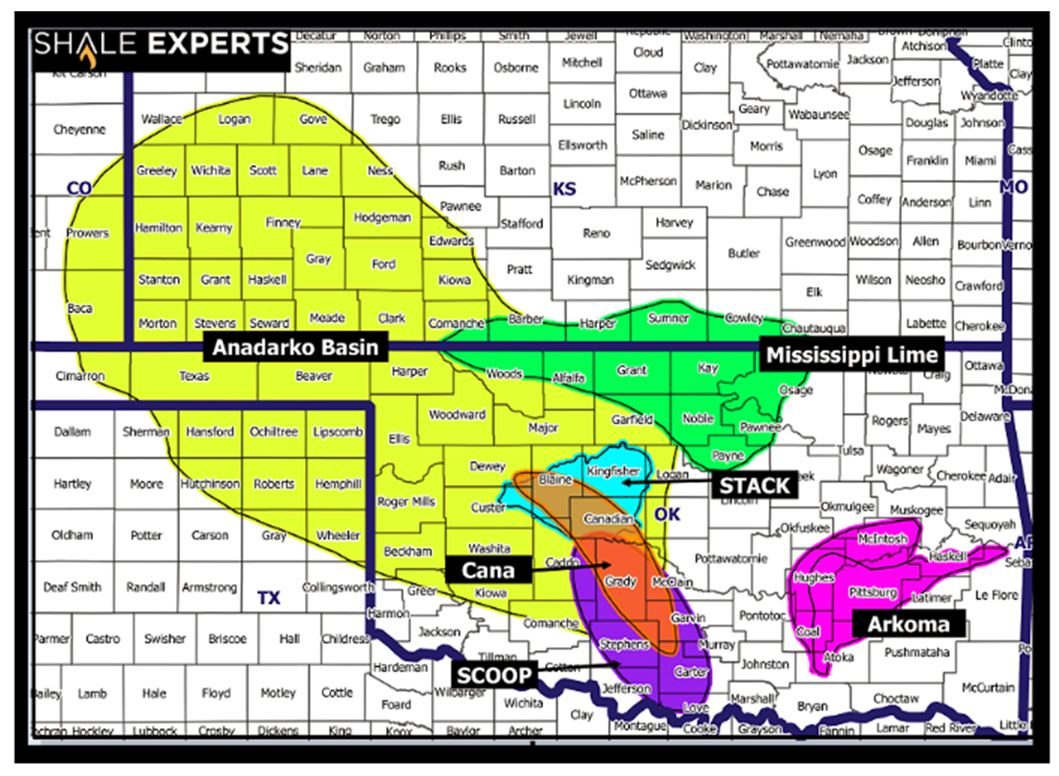

Petro River started as a private company in 2012 targeting the Mississippi Lime formation in Kansas with 85,000 net acres mostly in Cowley County, Kansas. The private company was seeking a joint venture partner with a Chinese company or group of investors to produce from the Mississippi Lime. In March 2013, Petro River merged with Gravis Oil, a Scot Cohen and Iroquois Opportunity Fund entity, where existing private Petro River shareholders owned 95% of the new public entity (PTRC).

(Click on image to enlarge)

Additionally, Petro River owned heavy oil assets in Missouri and Kentucky from the merger with Gravis Oil. Meanwhile, Petro River formed a wholly owned subsidiary, Petro Spring LLC, which was focused on acquiring and developing technologies with a focus on enhanced oil recovery (EOR).

Unfortunately, Petro River was not successful and the company re-adjusted their management, board, and direction. In December 2015, Petro River would now become an Osage County, Oklahoma focused explorer, announcing a 1 for 200 reverse stock split, and acquiring another Scot Cohen entity, Horizon I Investments LLC (“Horizon Investments”), in an all-stock deal. Petro River would exchange 11.5 million shares (73% of Petro River) to Horizon Investments for a 20% stake in Horizon Energy Partners LLC and $5 million in cash. shares (73% of Petro River) to Horizon Investments for a 20% stake in Horizon Energy Partners LLC and $5 million in cash.

Meet the Team

At the end of the day, Petro River Oil Corporation (“Petro River”) is a Scot Cohen led investment. Scot Cohen’s foray into upstream oil & gas investing began in 2008 with his role as Co-Founder and Managing Partner of Iroquois Opportunity Fund. The fund made several public and private investments in oil & gas exploration & production companies and technologies. The demise of the Iroquois Opportunity Fund was due to the collapse in oil prices in late 2014; something Cohen was reminded of before the reorganization Petro River Oil Corporation in 2015. Sustainability has become the new mantra for Mr. Cohen and he is looking to merge modern technology and conventional extraction methods to build a sustainable oil producer in Petro River.

Scot Cohen and his investors group have put around $40 million into Petro River and insiders, management, and Scot Cohen’s investors own around 60% of Petro River. Scot Cohen’s investors have a breakeven cost base per share of around $4.00; therefore, new investors are in a unique position where the founders of the company have much more to lose than the investors. In this case, investors can bet that Mr. Cohen is going to do as much as he can to make Petro River a success.

Core Project

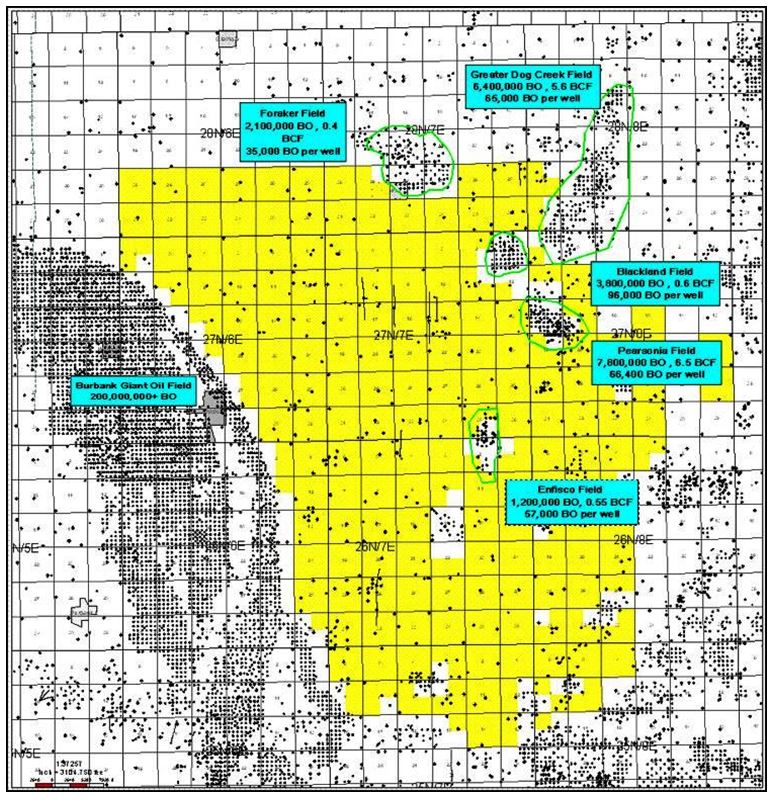

Petro River Oil Corporation’s main oil & gas project is its partnerships in Osage County, Oklahoma with 106,500 acres. In Osage County, the company has used its 3D seismic technology to shoot 36 square miles at a cost of $5 million including $100,000 of reprocessing costs. The company has identified an enclosure of 4,800 acres of which the company plans to prove up 1,610 acres within that enclosure. Petro River plans to drill 4 wells to prove its 3D seismic and identify oil reserves near the Pearsonia Field and Blackland Field. The prospective resource potential on the 1,610 acres enclosure is up to 2.5 million barrels of oil.

In April 2017, Petro River drilled 2 wells at a depth of 2,800 feet targeting the Chat and Channel formation to confirm identification from their 3D seismic campaign. Petro River discovered 20 feet in the oil productive Chat formation with South Blackland 2-11. The company’s other well, South Blackland 1-11, identified the Channel formation, but was not successful in spudding the well.

Petro River Oil Corporation plans to drill a Channel 1-3 well further north where 3D seismic identified a promising Channel formation. If this well proves there is an economic Channel target, this proves up its 3D modelling capabilities and reduces drilling risk.

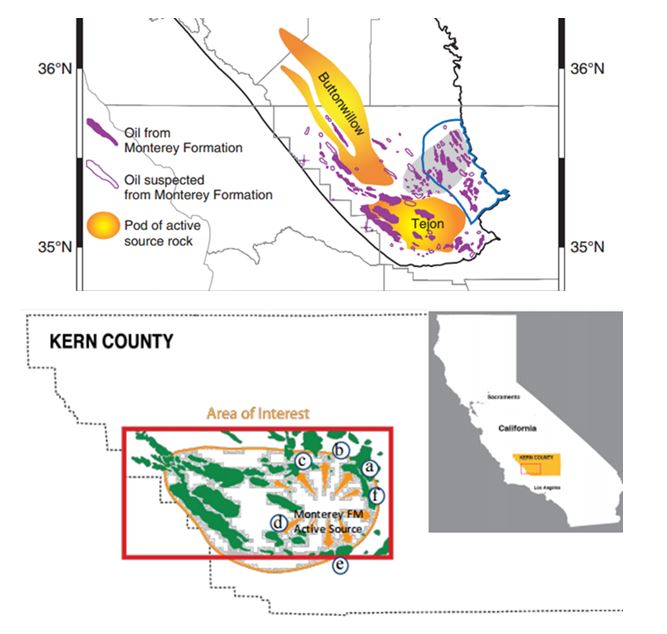

Another project Petro River is focused on is in Kern County, California. The company acquired 30 square miles of 3D seismic and upon reprocessing in January 2017, the company has identified a multi-zone opportunity. The company currently plans to target the Chanac & Cattani and Jewett & Vedder sandstones in its 13.75% owned Kern County test well.

The company anticipates that the well could confirm around 2.7 million barrels of oil and 2.75 billion cubic feet of associated gas in the upper plate and 10.7 million barrels of oil and 26.14 billion cubic feet of gas in the lower plate. The company expects the test well to be drilled in June/July 2017 at a depth of 9,000 feet and cost of $1.5 million.

Financing

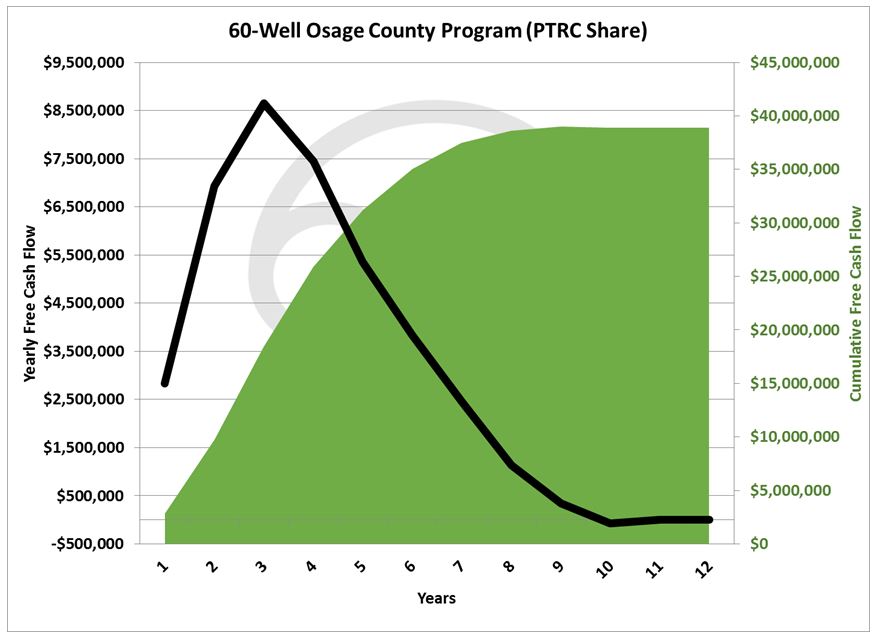

Capital is going to be key to the progress of Petro River in Osage County. If Petro River plans to drill a 60 well program in Osage County after the potential success of confirming a resource in the 1,610 enclosure from its 3D program, the drilling program will require capital of $5.5 million. Petro River’s portion of capital will be approximately $2.19 million, which it plans to fund by issuing debt.The initial wells that are expected to pay back their investment in less than 7-8 months.

Petro River Corporation plans to drill 10 total Channel wells and 50 total Chat wells. Upon the first year of Petro River’s 60 well program, it is expected that the company’s wells will become net cash flow positive, non-dilutive to shareholders, and able to sustain Petro River’s future drilling plans and working interest commitments based on a $50 oil price (WTI).

In Kern County, Petro River’s partners may decide to ramp up production upon success of wells drilled. Petro River may need to tap equity markets in the future and a Nasdaq listing is essential for the company to safely finance both Osage County, Oklahoma and Kern County, California going forward.

Valuation

The valuation of Petro River Oil Corporation is built upon assumptions made by management based on previous drilling results of the same targets in Osage County, Oklahoma and Kern County, California. In the valuation, we assume a price of oil of $50 per barrel (WTI) with a monthly increase of 0.2% in price. Well costs in Osage County are expected to be $250,000 to drill, complete, and tie into midstream facilities and an additional $100,000 in sunk costs are associated with each well. Well abandonment costs are expected to be $50,000.

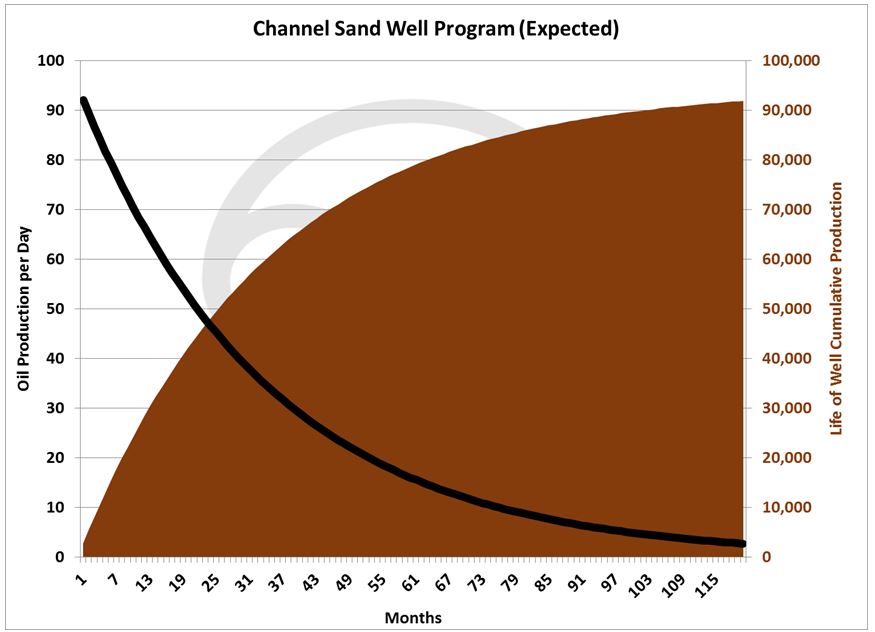

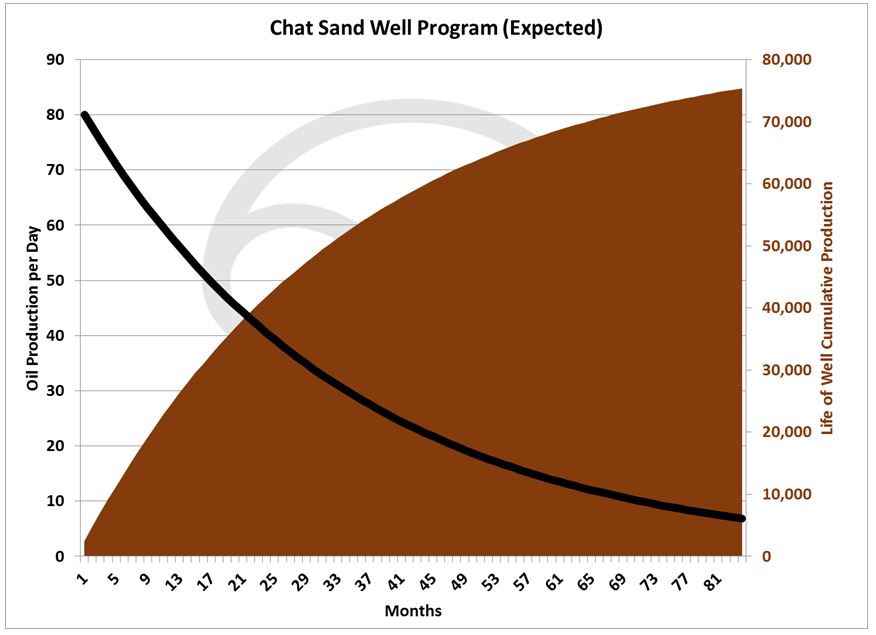

In Osage County, expected 1-year production per Channel well is expected to fall within 80 b/d with an EUR of over 90,000 barrels of oil. Based on the recent Chat discover of 2-11, Chat wells are expected to produce just under 70 b/d with an EUR of 75,000 barrels of oil.

These wells have breakeven costs of $24-$27 per barrel based on the above assumptions. Ongoing operating costs are under $10 per barrel and in this model, we assume a long-run average of $6 per barrel associated with general & administrative costs per well. Based on these assumptions a projection of cash flow is as follows:

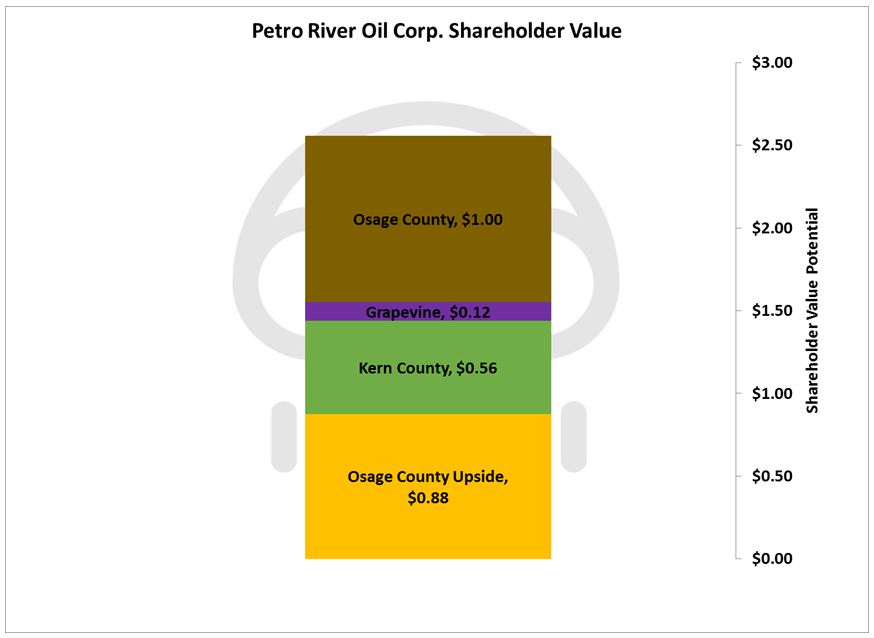

Provided funding of $5.5 million, its 60 well program adds around $1 per share of value to shareholders. Upside potential includes further testing of Channel and Chat formation in the remaining 4,800 enclosure and a new 55 square mile 3D program discounted at 50%, the potential success of drilling in Kern County, California and subsequent drilling program of which Petro River holds 13.75% working interest and Horizon owns an additional 30% interest, and potential success in Horizon’s 50%-owned Grapevine well and potential further drilling program.

Investors Pay Attention: Catalyst or Catastrophe?

The current share price of Petro River Oil Corp. (PTRC) is around $1.25 per share and, provided Petro River can execute on their ambitions, the 12-month intrinsic value of Petro River could be around $2.56. The intrinsic value does not consider the liquidity risk of PTRC stock and management risk of execution.

However, it is stressed to current and prospective shareholders that the expected upside in the current share price, and the current share price for that matter, is dependent on execution. This means that the company is still in a binary trading situation: the company’s equity could go to zero if unable to execute. Investors should weigh the downside risk of Petro River being unable or failing on executing on their ambitions based on historic outcomes and current performance of the Petro River’s management team.

Investors looking at Petro River need to pay close attention to upcoming results. Here are 7 results investors need to focus on:

- Initial IP rates reported at the South Blackland 2-11 Chat well. If the IP rates come up short of management projections, investors should re-evaluate the value to shareholders from the expected 60 well program and any potential upside in Osage County.

- If the Channel 1-3 well is unsuccessful in targeting the Channel formation identified using 3D seismic, this puts Petro River’s entire shareholder value plan into question. If unsuccessful, this significantly increases drilling risk in association with the company’s 60 well drill program and any potential upside in Osage County.

- If the Channel 1-3 well is successful, but production rates come up under management guidance, shareholder value from the 60 well program and potential upside in Osage county will need to be re-evaluated.

- There is additional risk specific to Osage County, where it has been rather difficult to receive approval on drilling permits. Petro River has taken steps to reduce the risk of getting drilling permits approved by partnering with a local operator, Performance Energy, who holds 25% interest in the 106,500 acres. New regulations on permit approvals are expected in 2017. If these new regulations impede the 60 well program Petro River has planned in Osage County or if the new regulations are postponed further, investors should re-assess the capacity for Petro River to deliver on a 60 well program.

- If Horizon Energy Partners, LLC is unable to achieve success in the low risk drilling environment in California it will reflect poorly on Petro River’s decision to acquire a 20% stake in Horizon. Horizon has come up short with exploration efforts in the high-risk Larne Basin onshore Northern Ireland; however, its California operations carry much lower risk. If Horizon and its working interest partners are unsuccessful with its California operations, Petro River’s shareholders may only reap the value of Osage County operations going forward.

- The last thing investors need to pay attention to is Petro River’s ability to continually get financing. Petro River is participating in 2 projects in Oklahoma and California of which it will have to provide significant capital to pursue. Investors need to pay attention to the terms of debt that Petro River will need to drill its 60 well program in Osage County.

- A Nasdaq listing will be very important if Horizon and its partners plan to expand in Kern County, California, Petro River will need to raise equity in public markets on top of additional debt.

Disclosure: This article is part of a new “UnderCovered” series of exclusive articles featuring companies with limited coverage. Authors are compensated by TalkMarkets for their time, and ...

more

Very impressive.

$PTRC keeps going up and up! $2.25 as of today.

Very impressive.

Good read, thanks.

I really liked this line: "New investors are in a unique position where the founders of the company have much more to lose than the investors." That's reassuring. $PTRC

This could be a very profitable investment, but it all hinges on management. Mr. @[Scot Cohen](user:44126), I'd like to hear more about your qualifications and the rest of the management team.

This sounds very promising.

It does sound intriguing but also sounds a little risky.

I purchased $PTRC after reading @[Phil Flynn](user:33688)'s article on the company here: www.talkmarkets.com/.../a-third-dimension-in-oil-production

That was at 85 cents per share. I've been very happy with the increase since then.

Yes, but the greater the risk, the greater the rewards. This upside on this could be huge. I think that far outweighs the risks. Just don't put all your eggs in one basket and you'll be fine. You need to keep a diversified portfolio. $PTRC