Palladium Price Surge Ahead? Russia-Ukraine Crisis Stokes Supply Risks

On The Nature Of Palladium

Palladium prices could be set to extend their rise if tensions between Russia and the US over Ukraine continue to stoke supply disruption fears. The Eastern European giant is the largest producer and exporter of the precious metal. Its popularity in the past 30 years has been supported by its use in catalytic converters to filter toxic emissions into less poisonous fumes.

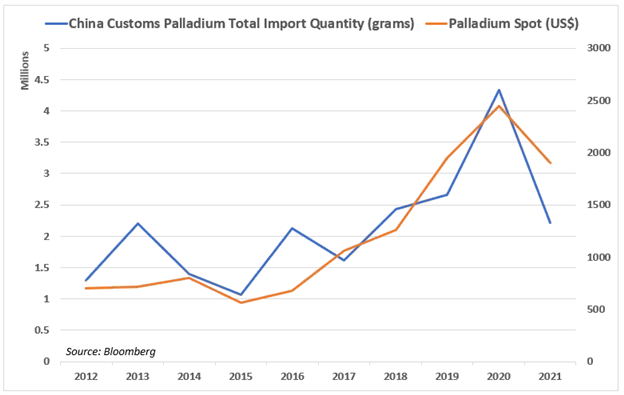

Not entirely by coincidence, rising car sales in China as a result of its growing middle class has fueled demand for palladium. While platinum has also risen as a result of its use in diesel engine catalytic converters, the greater demand for gasoline-powered automobiles (which use palladium) has pushed the precious metal comparatively higher.

Adding to the rise from rebounding Chinese growth - as part of a broader global trend of resurgent demand - is the complicated palladium supply chain. The precious metal is often a by-product of the extraction of another metal - typically nickel. Consequently, a process of separation and purification needs to take place before it is ready to be distributed.

This supply lag has underpinned prices for decades now, playing a key role in stoking volatility. The disruption from COVID-19 and resurgent growth combined with rising geopolitical tension with Russia has led to steep backwardation. That is when prices for spot palladium are higher than those in the futures markets, speaking to robust near-term demand.

Combining structural factors and exogenous forces, the bullish case for palladium appears to be strong. Tension with Russia over the long term may be relatively inconsequential to the trajectory of the precious metal. In the short term however, traders may be positioning themselves to respond to the geopolitical landscape.

Russia-Ukraine: What's Happening Next?

Conflicting reports have emerged about what is happening at the Ukrainian border. Moscow’s claims of troop withdrawal buoyed sentimentinitially, but hopes for de-escalation were quickly dashed amid reports and comments from officials indicating a different reality on the ground. US Secretary of State Antony Blinken offered a rather morose assessment:

“Unfortunately, there’s a difference between what Russia says and what it does, and what we’re seeing is no meaningful pullback…On the contrary, we continue to see forces, especially forces that would be in the vanguard of any renewed aggression against Ukraine, continuing to be at the border, to mass at the border”.

Discussions aimed at de-escalation are set to continue, though certain demands from Russia continue to put a wedge in Russo-Western negotiations. A major one is the North Atlantic Treaty Organization’s (NATO) so-called “open door” policy. This provision allows for any European state to join the organization if it is able to “contribute to the security of the North Atlantic area”.

Moscow has repeatedly voiced concern about the prospect of its Slavic neighbor becoming part of a military alliance it views as hostile to Russian interests. The amassing of Russians troops on the Ukrainian border and provocations of an invasion could be used as leverage in the ongoing negotiations.

As noted in my report about the outlook for oil, this is not the only situation where the US is finding itself trying to meet steep demands. The Biden administration made it very clear that if the Russians cross the border and invade Ukraine, Washington will impose “the mother of all sanctions” against them.

This includes sanctioning major companies, individuals, and restricting/limiting access to a range of key products, and this could include palladium. Approximately 25-30% of all of the world’s palladium is extracted in Siberia by Norilsk Nickel. Sanctioning a major Russian company – complete with the global ripple effects that such an action would imply – is not out of the question.

In April 2018, Washington imposed sanctions on aluminum-producing giant Rusal, which accounts for approximately 6% of all global production of the common metal. It subsequently surged at the expense of the company stock, although those dynamics quickly reversed in January 2019.

For more updates on how politics impact markets, follow me on Twitter @ZabelinDimitri

It is therefore not inconceivable to imagine the US imposing tough sanctions which may even hurt itself economically. While South Africa – the second largest producer of palladium – is a viable alternative, the supply disruption would nevertheless reverberate globally. An escalation of tensions may therefore continue to push the precious metal higher.

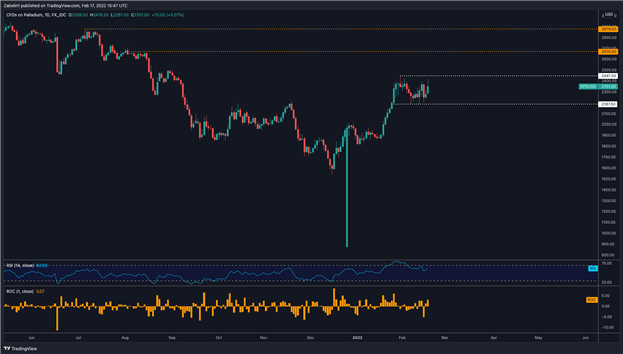

Palladium Price Outlook

Palladium prices have recently retreated from a five-month high at $2,447.50/oz in early February and have been trading sideways since. The manifestation of what appears to be indecision can be considered a cooling period that followed a buying spree. The upper and lower boundaries of the band are $2,447.50 and $2,187.50, respectively.

Palladium Prices - Daily Chart

Chart created using TradingView

If the prior uptrend resumes, the ceiling at the August swing high of $2,670 may be a critical point of resistance. The precious metal attempted to break this roof for several days before finally capitulating and resuming the prior downtrend. If resistance is breached, that could inspire additional bulls to break out of the pen and push palladium prices higher.

Disclosure: See the full disclosure for DailyFX here.