Pairs In Focus - Nasdaq 100, USD/JPY, USD/CAD, Bitcoin, EUR/USD, AUD/USD, Crude Oil, Silver

Silver targets $26 after soaring, while WTI Crude Oil eyes $95 amid global concerns. AUD/USD steadies, EUR/USD fluctuates, and Bitcoin faces pullback. USD/CAD and USD/JPY rally, NASDAQ 100 sees volatile week.

.

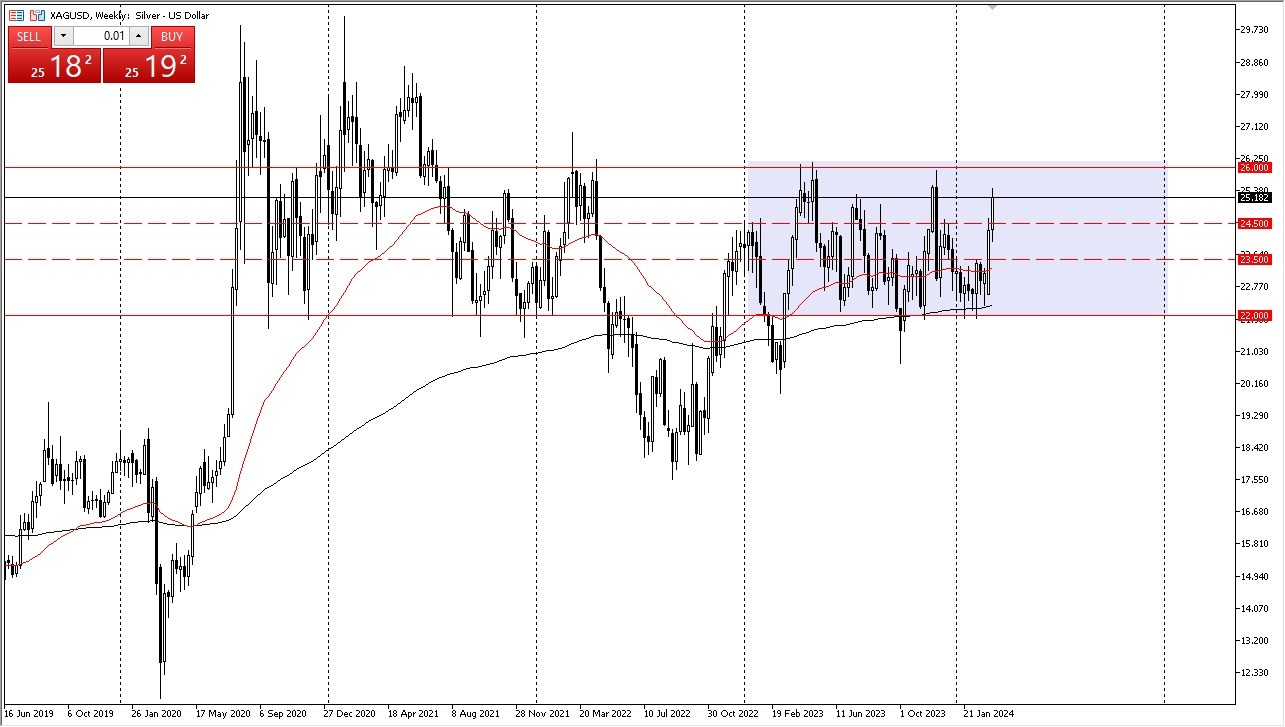

Silver

Silver has shot straight up in the air during the previous week, as we now are threatening to break above the $25.50 level, perhaps running to the $26 level. I think that’s the actual target, the $26 level, but whether or not we can break above there is a completely different situation altogether. If we were to break above the $26 level, it could send a lot of FOMO trading into this market. More likely than not, we get a short-term pullback that is heavily supported near the $24.50 level.

WTI Crude Oil (US Oil)

The US Oil market has had a very strong week, breaking above the $80 level. At this point in time, it looks like oil is ready to continue going higher and that does make a certain amount of sense considering that cyclical trade does dictate that oil typically rises this time of year. Furthermore, supply has been somewhat tight, and of course we have a lot of geopolitical concerns out there that could continue to send this market higher anyway. I am a buyer of dips, and I do believe eventually we go looking as high as $95 this summer.

More By This Author:

AUD/USD Forecast: Aussie Continues To Grind AwayUSD/CAD Forecast: Dollar's Rebound Quest Begins

EUR/USD Forecast: The Euro is Still Exhibiting Lack of Momentum