Pairs In Focus - Gold, Silver, Nasdaq 100, Bitcoin, USD/CAD, EUR/USD, USD/CHF, USD/JPY

Image Source: Unsplash

Gold

Gold markets have rallied again during the previous week, as we have broken above the $4500 level. I think this is a situation where anytime you get the opportunity for a short-term pullback to take advantage of, you simply must do so. This is a very bullish market, and the $4400 level should be a bit of a floor. If we can break down below the $4400 level, then the $4375 level would be the next support level. I believe that gold will be $5000 an ounce sometime in the spring of 2026.

Silver

Silver continues to be explosive, closing the week above the $76 level. At this point, parabolic doesn’t even begin to describe what is going on. Short-term pullbacks, I think, open up the possibility of binding value, but at this point, we are getting overbought by just about any metric you can use. That being said, I also say the same thing about the silver market each week, going back at least a month.

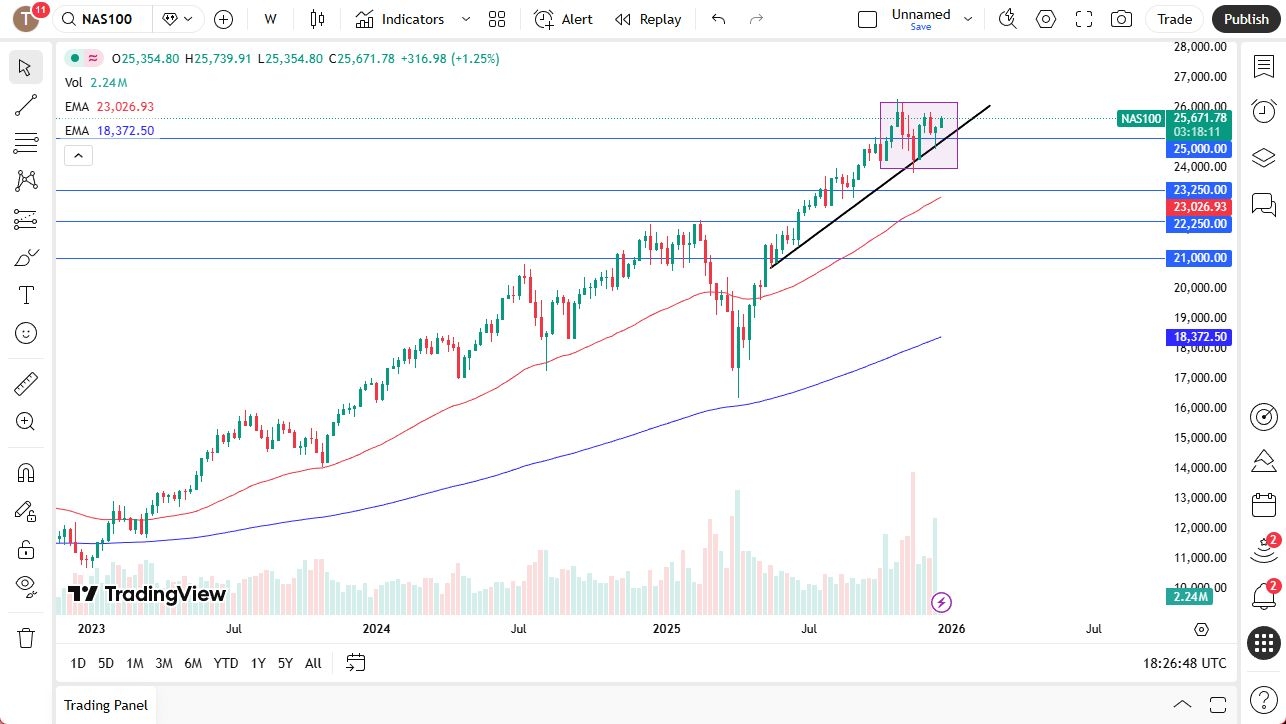

Nasdaq 100

The Nasdaq 100 rallied a bit during the week, as it looks like we are trying to get to the 26,000 level. Keep in mind that there are a lot of questions about the volume over the next couple of weeks, so while we could get the occasional pullback, we will likely find plenty of buyers underneath willing to take advantage of it. I do think that the Nasdaq 100 takes off in 2026, but that doesn’t necessarily mean that it is going to be immediate, nor an easy move in this holiday season.

Bitcoin

The Bitcoin market initially tried to rally during the week, but continues to see plenty of overhang when it comes to the idea of selling pressure. I don’t necessarily think that this is a market that’s going to fall apart in the short term, but I also don’t necessarily believe that this is a market that’s going to take off right away. I think we need to spend some time going sideways in order for people to feel somewhat comfortable. If we were to break down below the $80,000 level, then we could see some really ugly price action. To the upside, we are probably looking at more of a grind higher than anything else.

USD/CAD

The US dollar has fallen significantly against the Canadian dollar during the week, as we have finally broken below the 1.3750 level. We are approaching the 200 Week EMA, but I think that the downside is somewhat limited regardless of the moving averages, as the 1.36 level has been a major floor in the market, and I believe that it is probably only a matter of time before support comes back into the picture. Over the next week or so, volume will be an issue, so I don’t necessarily think that we are going to see a massive move in one direction or the other. If we can wipe out the candlestick from this past week and go above it, that would obviously be a very bullish sign.

EUR/USD

The Euro rallied this past week against the US dollar, but it continues to see a lot of resistance near the 1.18 level. The 1.18 level is an area that has been very difficult to get above, and it is probably going to be a significant barrier that extends all the way to the 1.1875 level. If we can break above all of that, then the Euro more likely than not will go looking to the 1.20 level next. If not, then I think we are going to settle into consolidation, which does make a certain amount of sense considering the time of year we are in and the lack of volume.

USD/CHF

The US dollar fell significantly during the week but seems to be finding a significant amount of support near the crucial 0.79 level. Keep in mind that this pair is going to be a little bit different, as opposed to other currency markets, as the Swiss National Bank has explicitly stated that it is watching the exchange rate of the Swiss franc, and therefore, I think it continues to have a bit of a “floor in the market” in this area. Sideways action makes more sense than not over the next week or even a month.

USD/JPY

The US dollar fell during the week against the Japanese yen, but is starting to show signs of stability on Friday. At this point, it looks like a market that remains somewhat sideways, with the ¥158 level above offering a bit of a barrier. The ¥155 level below offers a significant amount of support. I think we stay within this range.

More By This Author:

BTC/USD Forecast: Build A Consolidation PatternGBP/JPY Forecast: Bullish Trend Holds

USD/CAD Forecast: Drifts Lower As Holiday Trading Fuels Range-Bound Action

Disclaimer: DailyForex will not be held liable for any loss or damage resulting from reliance on the information contained within this website including market news, analysis, trading signals ...

more