Overdue Gold & Silver Selloff Arrives

Image Source: Pixabay

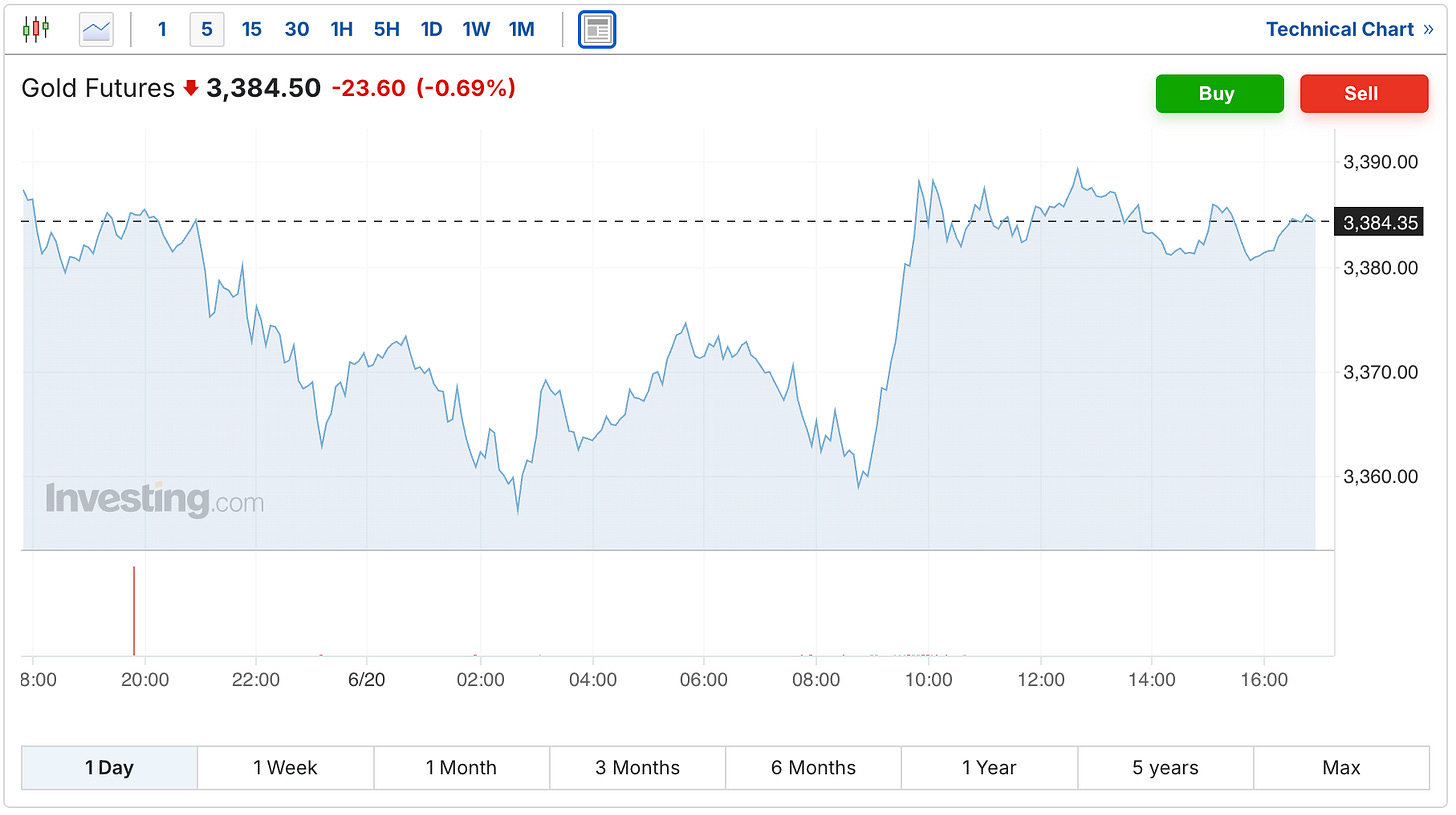

The gold and silver selloff, which started to a degree earlier this week, arrived in more full force over the last 24 hours.

The gold futures had a rally on Friday morning to recoup much of the losses from Thursday night, and are currently down $24 to $3,384.

(Click on image to enlarge)

The silver futures also recovered after last night’s selloff, yet are still down 95 cents on the day to $35.96.

(Click on image to enlarge)

I mentioned on Wednesday that between the current positioning by the banks, as well as how we had just witnessed one of the more rapid and forceful silver rallies in recent years, that we were in that territory where the chances of a sell-off were elevated.

CNBC was chalking it up to the Fed’s decision on Wednesday to cut rates less quickly than previously forecasted. Although I would maintain my belief that this selloff has a lot more to do with the positioning, and the current phase of the cycle, rather than the market still digesting 2-day-old news from the Fed.

So while it may not have been fun to watch the prices come down this week, if there's ever been a sell-off that was likely due just to the positioning, rather than being a substantive indication that a larger bull market has ended, this would be it.

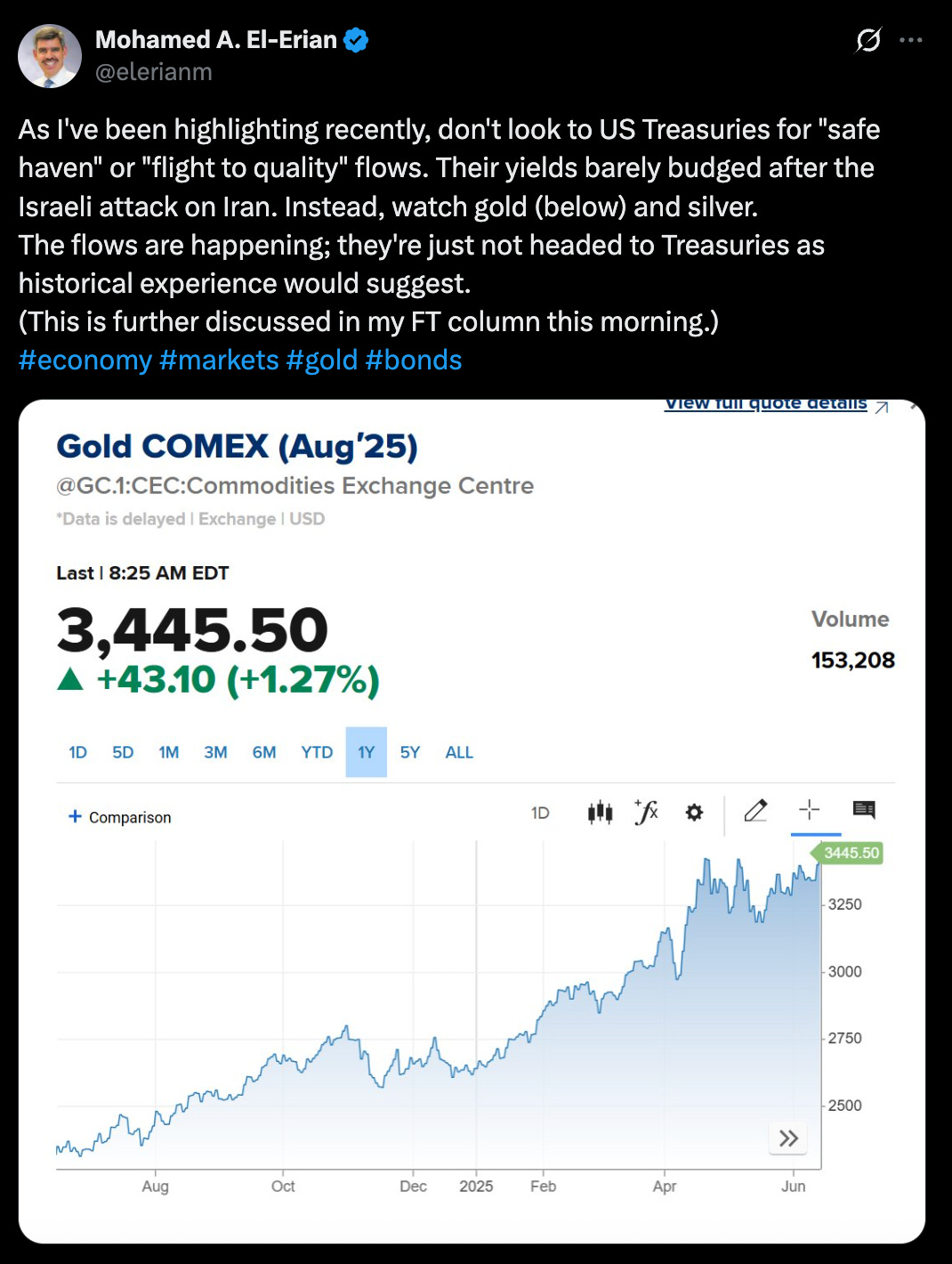

Lastly, as this is all happening, it's worth taking notice that now even the most well-known bond investors are talking about how gold and silver are rapidly wresting the safe haven crown away from the US Treasury market.

Mohamed A. El-Erian (formerly of Pimco with bond king Bill Gross) is the latest mainstream investor to join the crowd, and here’s what he had to say last week:

If this is what the bigger bond investors in the US are saying, and we've already heard plenty about how the BRICS are de-dollarizing because of how they feel about the situation, what does that ultimately say about the demand for US Treasuries?

I’ll leave you with that to ponder for the weekend, while also hoping that you’re safe and healthy, as it sure feels like there’s a lot of tension in the world right now.

But if you're reading this message, I’ll trust you are well, and look forward to checking back in on Monday.

More By This Author:

Copper Market Faces Same Supply Problems As SilverIndustrial Silver Demand Could Soon Consume Entire Mine Supply

Precious Metals Decline On Latest Controversial Federal Reserve 'Dot Plot'