A GLANCE AT THE NEWSSTANDS

A GLANCE AT THE NEWSSTANDS

Magazine covers must be one of the best contrarian indicators out there...

The text at the bottom of the cover says, "Never mind superstar fund manager Cathie Wood’s recent slump. She wants to sell you a future so fantastic you’ll beg her to take your money."

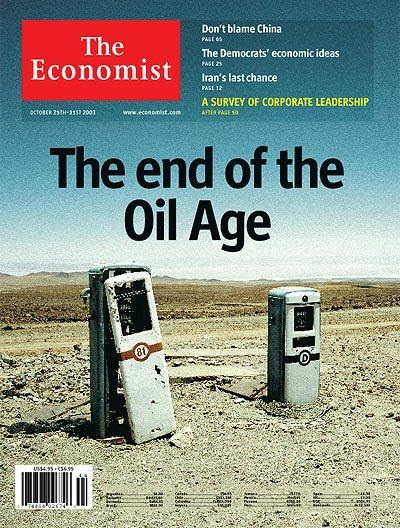

As the saying goes, history never repeats, but it often rhymes. Recall 2003 when we saw this.

To jog your memory, oil had dropped to between $20 and $30 a barrel and nobody in the industry was making any money. Fast forward to 2008, and oil had rocketed to $141 a barrel.

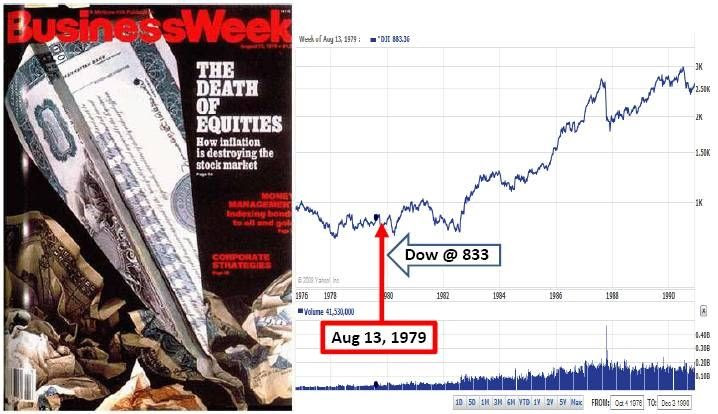

Or the famous “death of equities” cover, just before stocks more than tripled in the following years.

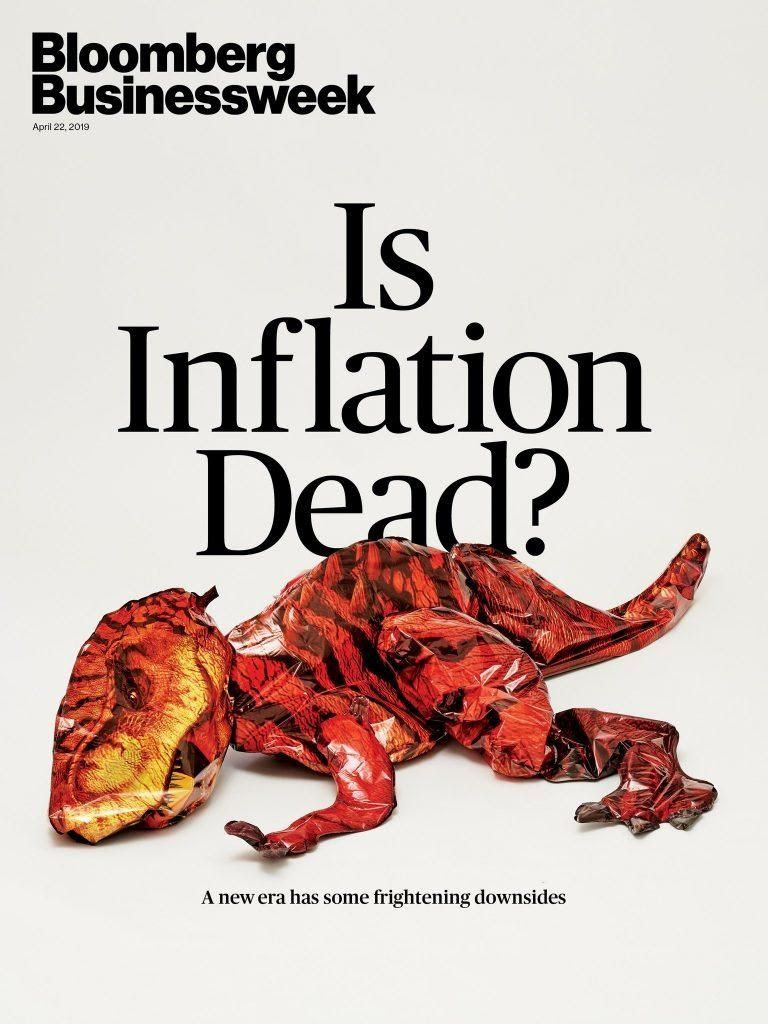

And more recently, in April of 2019 we had a pretty decent indicator that something was afoot. Why? Because nobody was positioned for inflation.

Which brings us to the next topic of the week...

"DON’T YOU WORRY, IT’S ALL TRANSITORY"

"DON’T YOU WORRY, IT’S ALL TRANSITORY"

If you were with us when the above "is inflation dead?" cover came out, you’ll recall we began highlighting the fact that supply shortages were building. Even more importantly, we warned that inflation can come not only from demand-led-growth but also from supply constraints.

Fast forward to today...

Now, popular opinion and "experts" would have us believe this is only a "temporary" thing (or as they would say, "transitory").

But the reality is, you can’t shut down the world, create the greatest levels of uncertainty, unemployment, and economic hardship in our lifetimes and think that all that was produced in terms of goods and services prior will magically continue to be produced. It’s called supply destruction.

Couple that with fiscal policy ($6 trillion is the Biden administration's new number, though we’re sure it’s probably going to change yet again soon).

The probability that this is "transitory" is, in our humble opinion, bollocks.

COMMODITIES ARE RIPPING

COMMODITIES ARE RIPPING

Meanwhile, the Bloomberg Commodity Index just soared to the highest level since 2015.

Though the market is starting to wake up to the realities, we’re still just in the first inning in what is setting up to be a commodity supercycle that will surprise even the biggest resource bulls.

Here, take a look at this long-term chart from Crescat Capital:

And here’s another thing to ponder...

What happens when the reality of rising commodity prices hits this narrative-driven social media hysterical world we live in?

That narrative will be all about inflation, and it won't take much for it to gain traction. For starters, it will be grounded in reality, and secondly, it will be painful. Expect the narrative along the lines of "central banks will never tame inflation again so commodities are cheap at any valuation" to take hold.

As crazy as the valuation of "growth" stocks has become, we can easily see the same for "inflation hedges" over the coming years.

SIGN OF THE TIMES

SIGN OF THE TIMES

The following tweet perfectly captures the zeitgeist of today’s markets. By the way, shares of AMC, a struggling movie theatre chain, are up 2,454% just this year (not a typo!).

Ah, what a time to be alive! Folks are going to look back on this era and marvel at how the combination of TikTok, stimulus cheques, and Robinhood accounts created some of the most asymmetric setups ever seen in financial markets.

Disclaimer: This is not intended to render investment advice. None of the principles of Capex Administrative Ltd or Chris MacIntosh are licensed as financial professionals, brokers, bankers or even ...

more

Disclaimer: This is not intended to render investment advice. None of the principles of Capex Administrative Ltd or Chris MacIntosh are licensed as financial professionals, brokers, bankers or even candlestick makers in any jurisdiction, anywhere on this big ball of dirt.We do NOT know your individual situation, and you should always consult with your attorneys, accountants, financial planners, and those that are sanctioned to provide you with advice. DO YOUR OWN DUE DILIGENCE.

But seriously, all investments carry risk. Some of what I discuss arguably carries great risk. Investments which can lead to you losing 100% of your capital and maybe more if you are stupid and use margin.If you invest more than you can afford to lose, or borrow money from Joey down at the tavern, Master Card or Visa to make your investments, then you need to go and read a different website.

But really seriously…

Capex Administrative LTD – parent company of CapitalistExploits.at is not a a registered investment advisor or broker/dealer. Readers are advised that the material contained herein should be used solely for informational purposes. Neither CapitalistExploits.at, Capex Administrative LTD purport to tell or suggest which investment securities members or readers should buy or sell for themselves. Readers, subscribers, site users and anyone reading material published by the above mentioned entities should always conduct their own research and due diligence and obtain professional advice before making any investment decision. Capex Administrative LTD, it’s principles and employees cannot and will not be liable for any loss or damage caused by a reader’s reliance on information obtained in any of our posts, newsletters, special reports, email correspondence, memberships or on this website. Like us, our readers are solely responsible for their own investment decisions.

The information contained herein does not constitute a representation by Capex Administrative LTD or CapitalistExploits.at or a solicitation for the purchase or sale of securities. Our opinions and analyses are based on sources believed to be reliable and are written in good faith, but no representation or warranty, expressed or implied, is made as to their accuracy or completeness. All information contained in our newsletters or on our website should be independently verified with the companies and individuals mentioned. The editor and publisher are not responsible for errors or omissions.

Capex Administrative LTD may receive compensation from time to time from the companies or individuals that may be mentioned in our newsletters, special reports or on our web site. If compensation is received we will indicate that compensation in the post or the content, or on this website within this “disclaimer.” You should assume a conflict of interest when compensation is received and proceed accordingly.

Any opinions expressed are subject to change without notice. Owners, employees and writers may hold positions in the securities that are discussed in our newsletters, reports or on our website.Owners, employees and writers reserve the right to buy and sell securities mentioned on this website without providing notice of such purchases and sales. You should assume that if a company is discussed on this website, in a special report or in a newsletter or alert, that the principals of Capex Administrative LTD have purchased shares, or will make an investment in the future in said company.

If you have a question as to what we own and when, we are happy to fully-disclose any and all interests to our readers.

less

A GLANCE AT THE NEWSSTANDS

"DON’T YOU WORRY, IT’S ALL TRANSITORY"

COMMODITIES ARE RIPPING

SIGN OF THE TIMES

Certainly the one item that is in over-supply is gullibility. Instant mass communication devoid of any fact checking. and hysterical emotion driven actions.

Combining those conditions with a federal reserve bank that evidently has a serious agenda aimed to benefit only one population segment, and that short term, and it has become an exciting ride. Amazing predictions, like those listed, that do not happen, and yet the sources are seldom adequately de-bunked.

Presently the large monster is climate change, and the agenda is removing personal freedoms. But the actual cause is an increased solar heat output. The sun is getting just a bit warmer, as suns very distant have been doing all along. Thus we need to learn to adapt and live with it.

And as for this inflation being "transitory", life itself is "transitory", but that does not mean short. Many of those who are clueless are still skilled orators, the fed are no exception.