Opportunities In A Wrecked Shipping Industry: LNG Carriers

This article is Part 2 in a 3 Part series about the investment opportunities in shipping.

<< Read More: Opportunities In A Wrecked Shipping Industry: Overview: Part 1

In the first part of this three-part series on shipping, I described how shipping stocks, trading at the cheapest valuations in over 20 years, offer investors a unique opportunity to profit off the recovery in the industry. Since then, trade tensions have escalated, with the U.S and China on the brink of a full-blown trade war. This has understandably caused investors to be skeptical about investing in shipping, which relies heavily on free-flowing global trade. However, some areas of the shipping industry still present huge opportunities despite the protectionist rhetoric. One such area is LNG (Liquefied Natural Gas) carriers.

Natural gas has increasingly become vital to the worlds energy market. Since 2000 the number of countries importing LNG has quadrupled. As a cheap clean-burning fuel, it has supplanted coal as the go-to-cheap energy source. Natural gas is already the most used energy source in the United States and all signs point to its increased use abroad. Liquefied natural gas carriers or LNGC’s are the vessels responsible for transporting natural gas (in its liquefied form) from producing countries such as the U.S or Qatar to energy-starved nations in Europe and Asia. LNGC’s represent a very small portion of the worlds commercial fleet but as demand for natural gas explodes and production in the U.S increases, it sets up LNG shipping to be extremely profitable for investors.

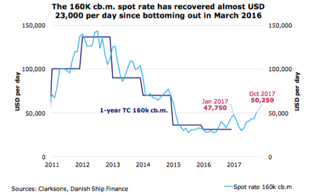

Much like the rest of the shipping industry the market for LNG carriers suffered greatly during the financial crisis in 2008 and the oil crash in 2014-15. These crises significantly depressed the market for natural gas and by extension natural gas trading and shipping. In 2012, the spot price for LNG carriers was an eye watering $143,750 per day, by March 2016 the spot price had fallen to a mere $27,500. Now as the energy and natural gas markets recover LNG carriers are set to make a comeback, by October 2017 spot prices had increased almost 83% from their 2016 lows to $50,250. With stocks in this sector starting to bottom out investors can benefit greatly off the recovery.

To understand the opportunity in LNG shipping it is necessary to understand what is driving the recovery in the market. The answer, simply put, is strong Asian demand for natural gas coupled with steadily increasing U.S production, which has led to a dramatic increase in LNG trading. LNG trading volumes were up 10% in 2017, as Asian countries and China, in particular, begin to replace their polluting and inefficient coal power plants with newer natural gas powered ones. At the same time, an unprecedented energy boom is taking place in the United States where shale drillers continue to ramp up production of oil and natural gas, rapidly turning the U.S into an energy exporter. The United States LNG export capacity has jumped to 18 million tons annually in 2017 from just 2 million in 2015. This dynamic of rapidly growing natural gas demand and production might be keeping a lid on natural gas prices but it is a boom for LNG trading, as U.S based surpluses of natural gas are sold to Asian countries which have seen their own gas fields depleted.

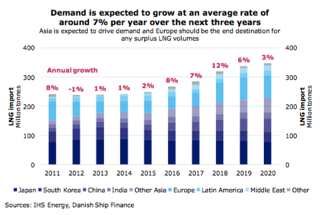

Asia is the end destination for almost 3/4ths of seaborne LNG volume and the region is expected to account for 50% of all demand growth in the LNG market over the next three years. Growing industrialization and populations have created a growing need for cheap clean energy. Developing countries like Indonesia, Thailand, and Philippines all plan to use more natural gas in their energy grids. Chinese LNG imports alone are expected to increase 13% a year, over the next three years as the country continues to battle pollution. This has led to China signing a 15-year deal with Cheniere Energy (LNG) to buy 1 million tons of liquefied natural gas a year and LNG carriers will be needed to carry all of it.

Proof of greater U.S LNG exports to Asia comes from data collected by the Panama Canal Authority, which manages the vital waterway connecting the Pacific to the Atlantic. The Panama Canal received 60 LNG tankers in the last quarter of 2017 compared to just 43 in the same period in 2016. The Canal Authority expects this number to increase an additional 50% as Asian demand and U.S production of LNG expands. Greater U.S LNG exports to Asia mean LNG carriers have to travel longer distances, this increases fleet utilization (as ships must be chartered out for longer periods of time), which in turn increases charter rates. Higher charter rates lead to improved profits and increased returns for investors.

Asia is also not the only region desperate for U.S natural gas exports.Demand from Europe is on the rise as well. European demand for LNG is expected to increase 17% a year until 2020. This demand growth is being fueled by falling domestic production, and a projected decline in pipeline supply from North Africa. Also, Western European countries, historically dependent on Russian gas supplies, may choose to buy American LNG as tensions with Moscow rise. This growth in American LNG exports is extremely beneficial to the LNG shipping business.

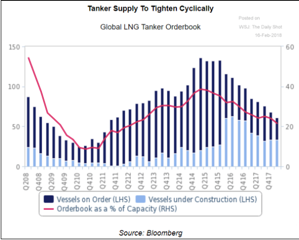

The demand picture for LNG tankers is solid but it is also necessary to look at the amount of LNGC’s in and entering the market. If the supply of ships outpaces demand growth, the market will suffer. Delayed deliveries of new ships in 2017 greatly helped the LNG shipping recovery, only 20 ships out of expected 36 were delivered.This limited fleet growth to 5%, which was considerably below demand growth. A continued recovery will depend on a supply of ships remaining low. In the first 9 months of 2017, 13 new orders for LNGC’s were placed bringing the total order book for LNG carriers to 123 vessels. This is well below the November 2015 peak of 164 and with increased demand for LNG import,s the supply and demand balance for LNG shipping should continue to improve. However, the market balance will remain delicate for some time leading to periods of volatility.

The market for LNGC’s is steadily improving; investors who want to get involved have the option to invest in multiple different companies. Unfortunately, many LNG shipping companies are in poor financial health following several years of tough market conditions. With that being said, there are a few companies that have seen their stock prices and financial conditions improve along with the LNG shipping market. Some of these companies include GasLog Partners LP (GLOP), Golar LNG (GLNG), and Teekay LNG Partners LP (TGP). All three have seen their stock prices stabilize after several years of declines and all three are either profitable or expected to return to profit in 2018. As such they offer investors a good avenue to gain exposure to these LNG trading and shipping sector.

Still, even though LNG shipping presents investors with an enormous possibility there are some risks. Chief amongst them is the rise of renewable energy sources threatening demand for natural gas imports as well as the possibility of an oversupply of LNG tankers. These are the greatest risks to the LNG shipping sector but may not be as prominent over the next few years. Renewable energy sources are still too expensive to be adopted on a large scale by smaller developing countries, which will still need access to large supplies of cheap energy, in other words, natural gas. As for the supply of ships, new vessels will continue to hit the market over the next three years but there are not enough LNGC’s under construction to overwhelm the market like in the past. This means LNG carriers, a somewhat niche business within the shipping industry, represent an enormous opportunity to take advantage of the growing demand for LNG imports. Investors who get involved now could see significant profits over the next several years as the market grows.

Disclaimer: This material has been distributed for informational purposes only and is the opinion of the author, it should not be considered as investment advice.

This is well done. I hadn't thought of these investing opportunities.