OPEC Lowers 2025 Oil Demand Forecast On Trade Tensions

Image Source: Pixabay

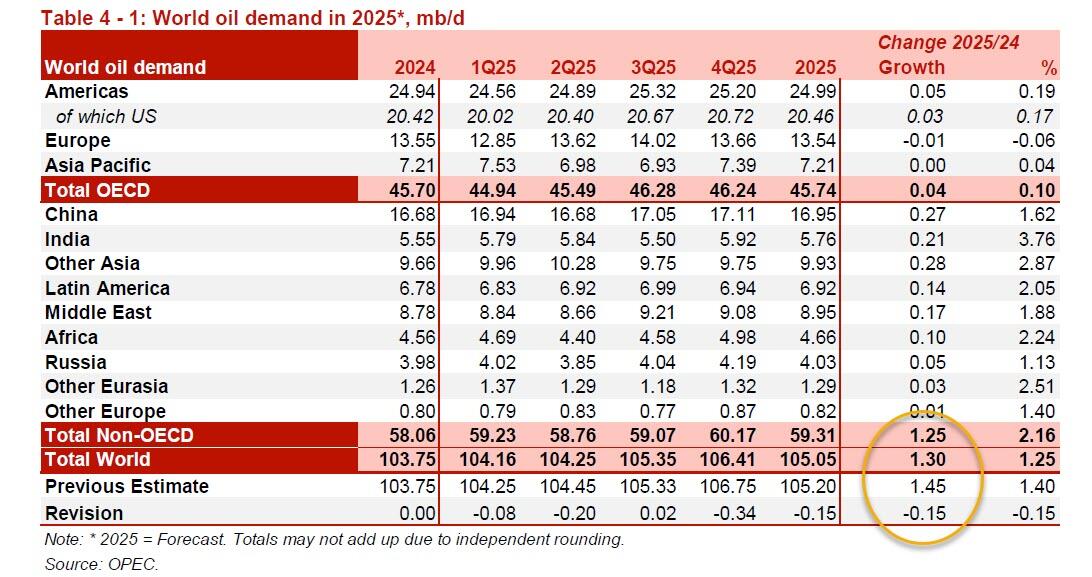

OPEC has revised its global oil demand growth forecast for 2025, citing escalating trade tensions and weaker-than-expected economic indicators, according to Reuters and OilPrice.com. The cartel now anticipates a demand increase of 1.3 million barrels per day (bpd) for 2025, down 150,000 bpd from its previous projection. Similarly, the 2026 forecast has been adjusted downward to 1.28 million bpd.

OPEC's latest report highlights that Trump’s tariff war has dampened economic activity, leading to a more cautious outlook on oil consumption. The organization also revised its global economic growth forecast, now projecting a 3% expansion for 2025, down from the earlier estimate of 3.1%.

Last week, eight OPEC+ countries announced they would phase-out voluntary oil output cuts by ramping up output by 411,000 barrels per day in May--equivalent to three monthly increments. In other words, the Saudis are signaling they might be willing to give up their long-time role as OPEC’s swing producer in an attempt to take a tougher stance against countries that continue to violate the output pact, most notably Kazakhstan, the UAE and Iraq.

The revised forecasts have also impacted oil prices, with Brent crude trading near $66 per barrel, influenced by both the demand outlook and recent tariff exemptions. Analysts suggest that continued trade disputes could further affect market dynamics and investor confidence?

On Monday, April 14, at 11:44 a.m., Brent crude was still trading under $65 per barrel, with the only good news being that it was trading flat instead of down, up a slight 0.05%. The U.S. crude benchmark, West Texas Intermediate (WTI), was trading down 0.24% at $61.35.

For traders, all eyes now will be awaiting the monthly oil market report from the International Energy Agency (IEA), which is set to be released on Tuesday.

More By This Author:

Are China Road Traffic Indicators Set To Collapse As Tariff War Cancels Factory OrdersMorgan Stanley Shares Cling To Gains After Equity Trading Unit Beats

Stellar 30Y Auction: 2nd Highest Direct Award, 3rd Biggest Stop-Through On Record

Disclosure: Copyright ©2009-2025 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies ...

more