OPEC+ Delays Production Hike (Again)

Image Source: Unsplash

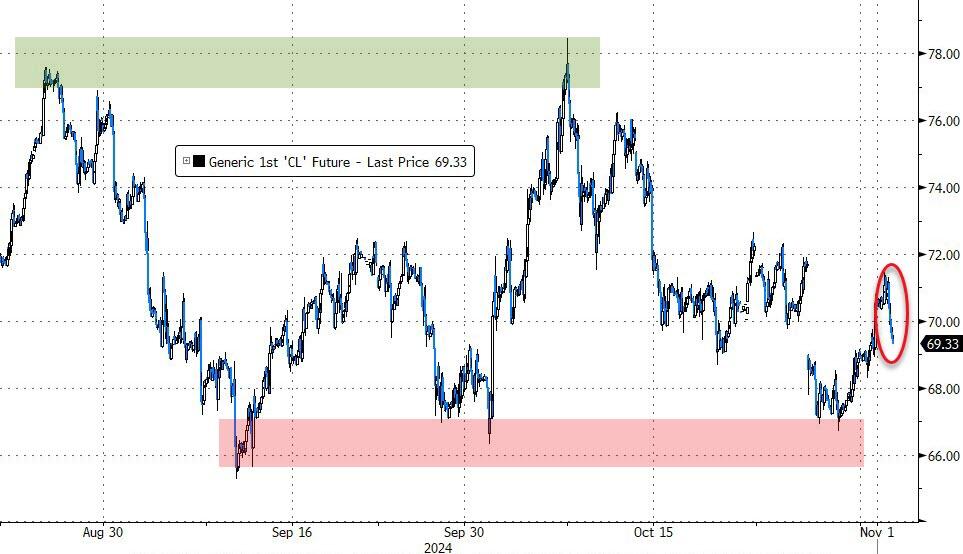

OPEC+ agreed to push back its December production increase by one month, the second delay to its plans to revive supply as faltering demand in China and swelling supplies from the Americas pressure prices.

but... but "Reuters sources" inside the Biden oil selling department said OPEC would flood the market any second https://t.co/ICGWItFYL0

— zerohedge (@zerohedge) November 3, 2024

No reason was given for the delay.

"Market conditions won out," said Harry Tchilinguirian, head of oil research at Onyx Commodities Ltd.

"OPEC+ showed it couldn’t ignore the current macroeconomic economic realities centered on China and Europe, which point to weaker oil demand growth."

OPEC Plus had first announced in June that it would gradually increase production by an estimated 2.2 million barrels a day, or around 2 percent of global supplies, in October.

That had been a major source of concern for the markets.

Then, in September, the group announced a delay until at least December.

And this is how Reuters and its "sources" manipulate the oil market pic.twitter.com/YsRe1Ft2Xy

— zerohedge (@zerohedge) September 4, 2024

The OPEC+ move is “modestly positive,” said Giovanni Staunovo, an analyst at UBS Group AG in Zurich. The market will focus instead on Iran’s response to Israel’s attacks and the outcome of US elections, he said. However, JP Morgan analysts wrote that "with geopolitical concerns temporarily set aside, attention is once again shifting back to market fundamentals."

We suspect the election will matter... a lot.

“Given all the geopolitical tension in the Middle East and, perhaps more importantly, the upcoming US presidential elections, it makes perfect sense for OPEC+ to postpone the unwinding of the voluntary cuts for an extra month,” said Jorge Leon, senior vice president at consultant Rystad Energy AS.

These eight OPEC+ countries reiterated their collective commitment to achieve full conformity with the Declaration of Cooperation, including the additional voluntary production adjustments.

“For me, the impact is more important on sentiment than the numbers,” said Amrita Sen, director of research at consultant Energy Aspects Ltd.

“The market has been incorrectly viewing OPEC+ as wanting to flood the market to regain market share,” but instead, their “primary focus remains keeping oil inventories under control.”

Prices are headed into the $60s next year, and potentially lower if OPEC+ opens the taps, according to Citigroup and JPMorgan analysts.

That poses a financial threat for Riyadh, which needs levels closer to $100 a barrel to cover the ambitious economic plans of Crown Prince Mohammed bin Salman, according to the IMF.

The market outlook the group faces ultimately hinges on the outcome of US presidential elections on Nov. 5, Currie added. “The real geopolitical risk has yet to come, which is the shockwave from the US election,” he said. “Not only will it jar fragile flash points around the world, but it will also reveal the all-important path that Chinese stimulus takes in response.”

More By This Author:

US Big Banks Suffer Biggest Deposit Outflow Since April... Until The Fed 'Adjusted' ThemNvidia To Replace Intel In The Dow Jones Industrial Average; Stock Jumps

Jobs Shock: October Payrolls Huge Miss As Private Jobs Drop For First Time Since 2020

Disclosure: Copyright ©2009-2024 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more