OPEC Day

Energy

The OPEC ministerial meetings kick off in Vienna later today, and there is still plenty of uncertainty around what OPEC+ will do. Meetings are set to get underway at 15.00 CET, followed by a press conference after the closed session meeting. But as usually is the case, be ready for the meeting to drag on for longer than scheduled. If you want a quick recap on where we currently stand with the OPEC+ deal, and what the options are for the group, have a look at our preview note.

Iraq seems to have quietened down on its calls for deeper cuts and is reportedly supporting the idea that an extension to the deal should do the trick. Despite this, oil moved quite a bit higher yesterday, with ICE Brent settling almost 3.6% higher on the day. The initial step up was driven by Bloomberg reports that trade negotiations between China and the US were progressing better than recent comments had suggested and that phase-one of the trade deal was still on course to be completed before 15 December. The on/off noise we continue to hear on this subject is unlikely to disappear anytime soon and is set to continue dictating broader market sentiment.

Oil got an extra boost later in the day, with the EIA reporting that US commercial crude oil inventories fell by 4.86MMbbls over the last week, significantly more than the 1.5MMbbls drawdown the market was expecting, and larger than the 3.72MMbbls draw the API reported the previous day. The key behind the large draw was a big bounce in refinery utilisation rates, which increased 2.6 percentage points over the week to 91.9%. This takes utilisation rates back to levels last seen in early September. As a result of these increases, crude input into refineries jumped by 464Mbbls/d over the week. In the coming weeks, we would expect run rates to continue to edge higher, which would be in line with the seasonal trend.

While the crude oil numbers from the report were bullish, the same cannot be said for products. Given stronger refinery run rates, larger than expected builds were seen in gasoline and distillate fuel oil. These increased by 3.39 MMbbls and 3.06MMbbls respectively. These increases have put some pressure on product cracks, and given expectations for higher run rates at refineries as we head deeper into December, this could put further pressure on refinery margins, at a time when they are already very weak.

Metals

Unsurprisingly yesterday’s reports on trade progress saw risk appetite returning to markets, with gold taking a back-seat. Meanwhile, the USD index retreated to a one-month low of 97.58, providing further support to base metals. For copper, the more positive sentiment, along with stock outflows of 3,300 tonnes provided a boost to the market, with the LME 3M contract closing 1.2% higher on the day. For zinc, there appeared to be option related activity, which provided further support to the market. Despite the move higher, there is little change to the fundamental outlook for the metal.

Turning to ferrous metals, and the active iron ore contract on the Dalian Commodity Exchange (DCE) increased to a 3-month high of CNY658/t yesterday on expectations of tighter supplies in the near term. Earlier this week, Vale reduced its shipping guidance from Brazil by c.2mt for 1Q20, now estimating that it will ship around 68-73mt in the quarter, compared to their November estimate of 70-75mt. These revisions are due to operational issues at the Brucutu mine and weather-related seasonal disruptions.

The company provided full-year guidance for 2020 as well, with the expectation that output will range between 340-355mt for the year, suggesting a significant recovery in production later in the year. Meanwhile restocking demand for steel has been supportive for spot steel prices in China, which may keep iron ore demand relatively firm in the immediate term.

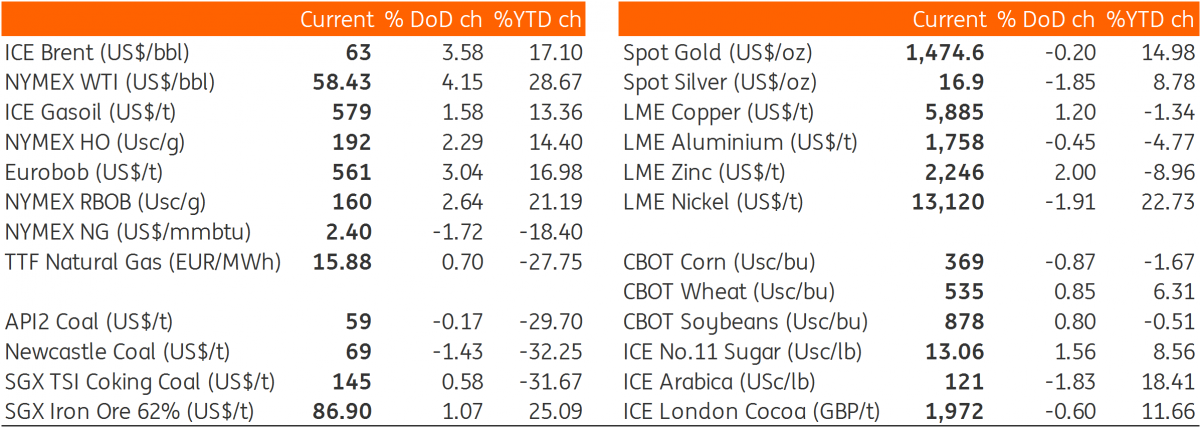

Daily price update

(Click on image to enlarge)

Source: Bloomberg, ING Research

The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. more