Oil Spikes After Saudis Unexpectedly Cut Output Unilaterally By 1 Million B/d

Just hours after Saudi Arabia, which is seemingly running out of money faster than most had expected, announced broad government spending cuts including suspending the cost of living allowance amid broad austerity measures for about $26.6 billion and a tripling of the value-added tax as part of measures aimed to shore up state finances, which have been battered by low oil prices and the coronavirus, Bloomberg reported that Saudi Arabia will unilaterally cut its crude oil output by 1MMb/d in June, as it aims to pump just under 7.5 million barrels a day in June (it is unclear if the cut will extend beyond the month), compared with an official target under the most recent OPEC+ agreement of 8.5 million barrels a day. Aramco has also been instructed to cut May production if possible.

If Riyadh follows through, Saudi production would drop the lowest since mid-2002, a reflection of the continuing plunge in global oil demand.

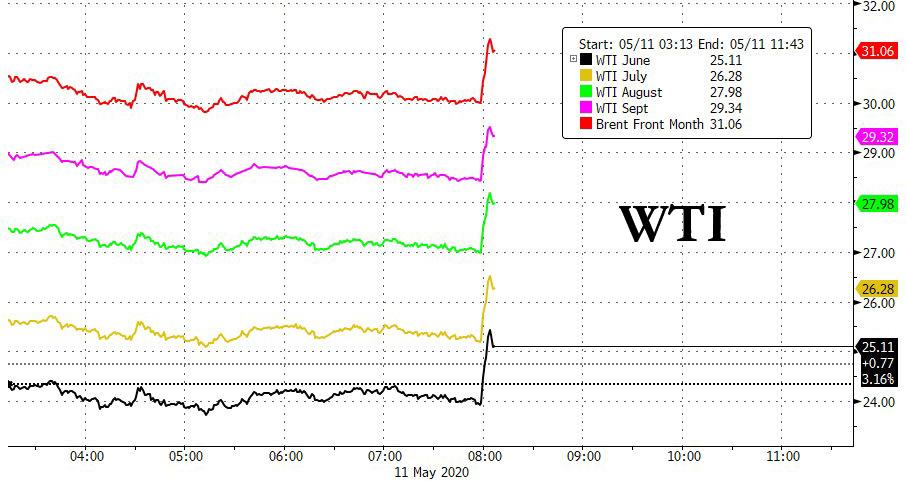

In kneejerk reaction, WTI crude erased earlier losses, jumping as much as 3.4% to $25.58 a barrel...

... while Brent also erased earlier gains to reach an intraday high of $31.47 a barrel

While the cut was immediately seen as bullish, for Saudi Arabia to engage in such an unprecedented unilateral emergency cut, it would suggest that demand is well below optimistic V-shaped rebound expectations.

Why is Saudi Arabia pursuing this unprecedented step? According to an official at the Saudi Ministry of Energy, "the Kingdom aims through this additional cut to encourage OPEC+ participants, as well as other producing countries, to comply with the production cuts they have committed to, and to provide additional voluntary cuts, in an effort to support the stability of global oil markets."

Needless to say, if Saudi Arabia hopes that by cutting production - and spiking prices - it will force shale producers to follow in its footsteps, it will be sorely disappointed: as oil prices rebound, the real question is at what price will shale dive right back and restart output as they seek to steal even more market share from Saudi Arabia, whose "flood the world with oil" gambit is backfiring again, just like it did in 2014.

Indeed, as Energy Intel's Amena Bakr notes, "Iraq isn't cutting its share of the Opec plus cuts and Saudi Arabia is now cutting an extra 1 million bpd....deja vu anyone?"

Disclaimer: Copyright ©2009-2020 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more

@[Rick Ristov](user:5151), you'd enjoy this article.