Oil Slips After Choppy Trading Week

Image Source: Unsplash

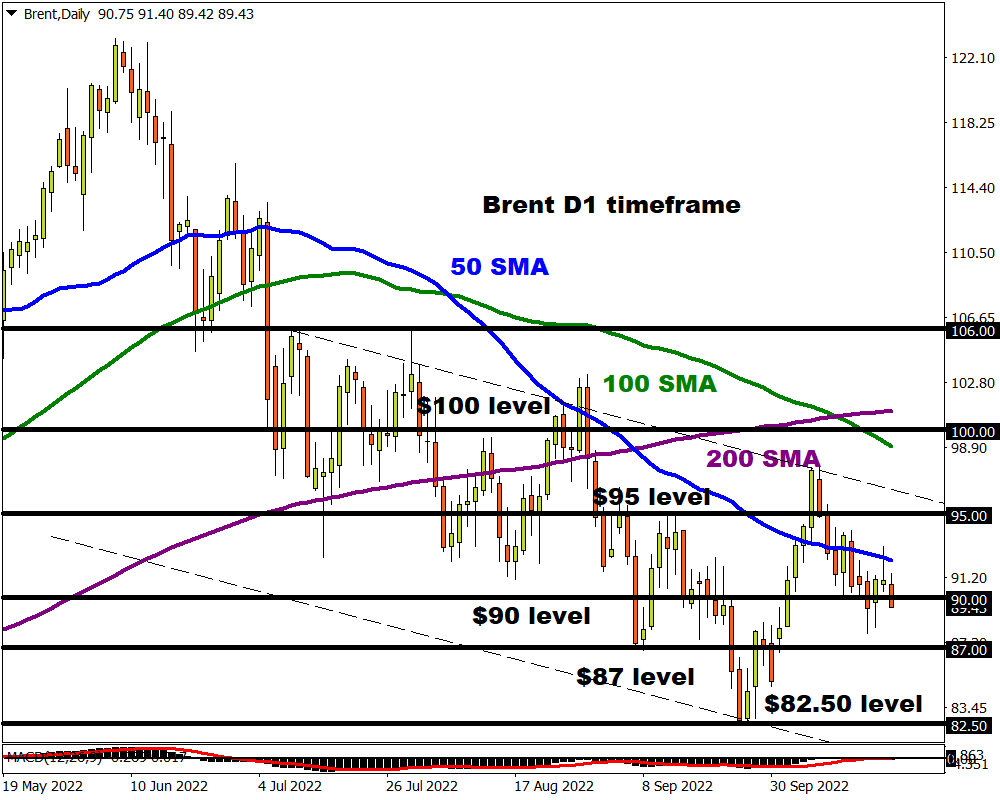

Oil prices swung between losses and gains this week as concerns over a global economic slowdown clashed with caution over tightening supply. Prices have kicked off Friday on a negative note, trading below $90 as of writing.

The global commodity remains a fierce battleground for bulls and bears due to the conflicting themes with a fresh theme needed to tip the balance of power. As investors continue to tussle with slowdown fears, rapid changes in risk sentiment, a stronger dollar, and other themes impacting supply/demand dynamics – this could result in more choppy price action. It does not end here. Markets could be in store for a period of uncertainty as OPEC+ cuts output and developments revolving around European Union sanctions on Russia. Developments in China will most likely influence the commodity’s outlook, especially after the world's second-largest economy recently signaled that it would stick with its Covid Zero policy. All in all, we are expecting more choppiness and volatility from oil prices as the year slowly comes to an end.

Looking at the technical picture, Brent remains under pressure on the daily charts. Prices are trading below the 50-, 100- and 200-day Simple Moving Average. A sustained weakness below $90.00 could open a path toward $87.00 and $82.50. Should prices push back above $90.00, the next key level of interest can be found at $95.00.

More By This Author:

Euro Bulls Gain Foothold Above 1.13 HandleBuyers Attempt To Secure Foothold Near 1.13

BTC Also Battered By Deterioration Of Global Epidemiological Environment

Disclaimer: Forecasts which are made in the review constitute the personal view of the author. Commentaries made do not constitute trade recommendations or guidance for working on financial ...

more