Oil Slides Despite Huge Draw Sending Total US Crude Inventories To 2024 Low

Image Source: Pixabay

With oil trading at 2024 lows, despite a report earlier denying last week's Reuters fake news that OPEC+ would hike output in October which sent oil prices tumbling, and despite last night's API report that a whopping 7.4 million in crude oil were drawn in the past week with draws also in all other categories, moments ago the DOE confirmed what we warned recently, namely that as CTAs - and the Kamala/Biden oil trading desk - are aggressively shorting oil into oblivion, oil demand remains resilient and very soon we may hit tank bottoms...

Will be ironic if CTAs short oil all the way down to tank bottoms

— zerohedge (@zerohedge) September 3, 2024

... when it reported another huge draw in the last week. Here is what API reported yesterday, and what the DOE said this morning:

API

- Crude -7.4mm (exp. -1mm)

- Gasoline -0.3mm

- Distillates -0.4mm

- Cushing -0.8mm

DOE

- Crude -6.873k (exp. -0.3mm)

- Gasoline +848k

- Distillates -371k

- Cushing -1.142mm

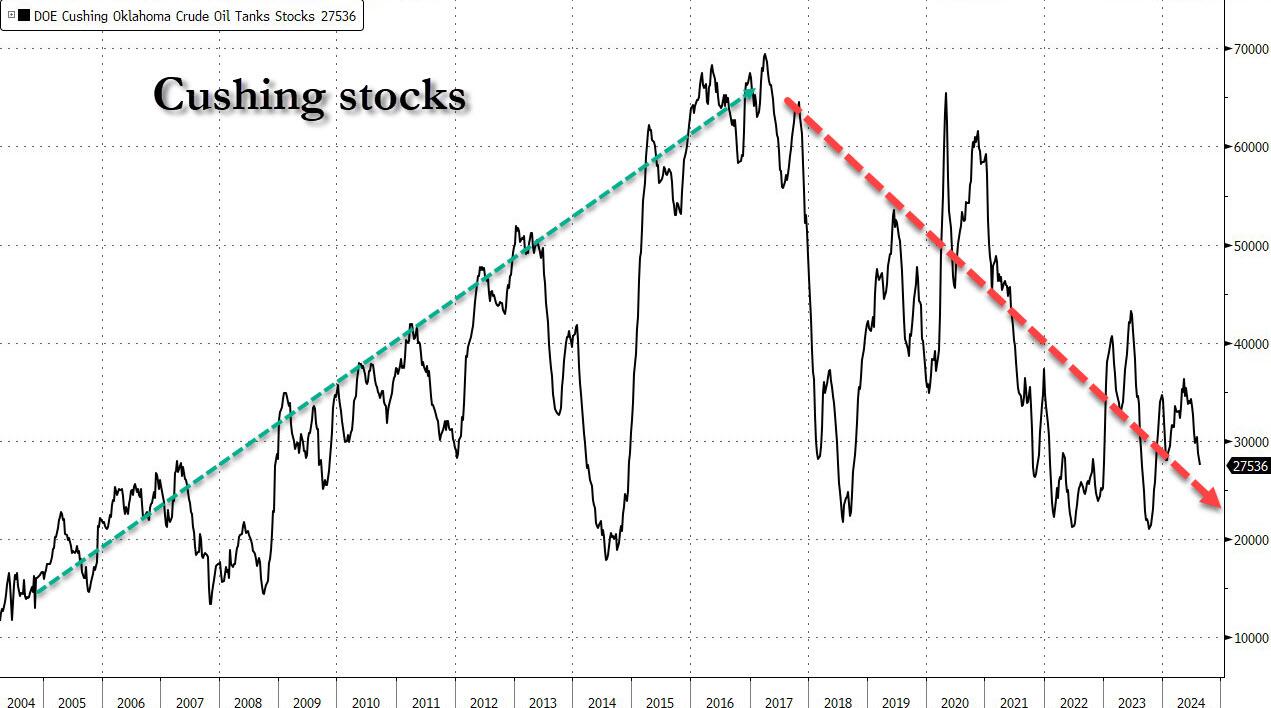

Of note, US Crude stocks declined for the 9th week in the past 10 (my much more than expected) as Gasoline inventories rose fractionally reversing 3 weeks of draws while distillates were flat. But what is perhaps most interesting is the continued drain of Cushing, where a few more weeks of this decline and everyone will be talking about tank bottoms.

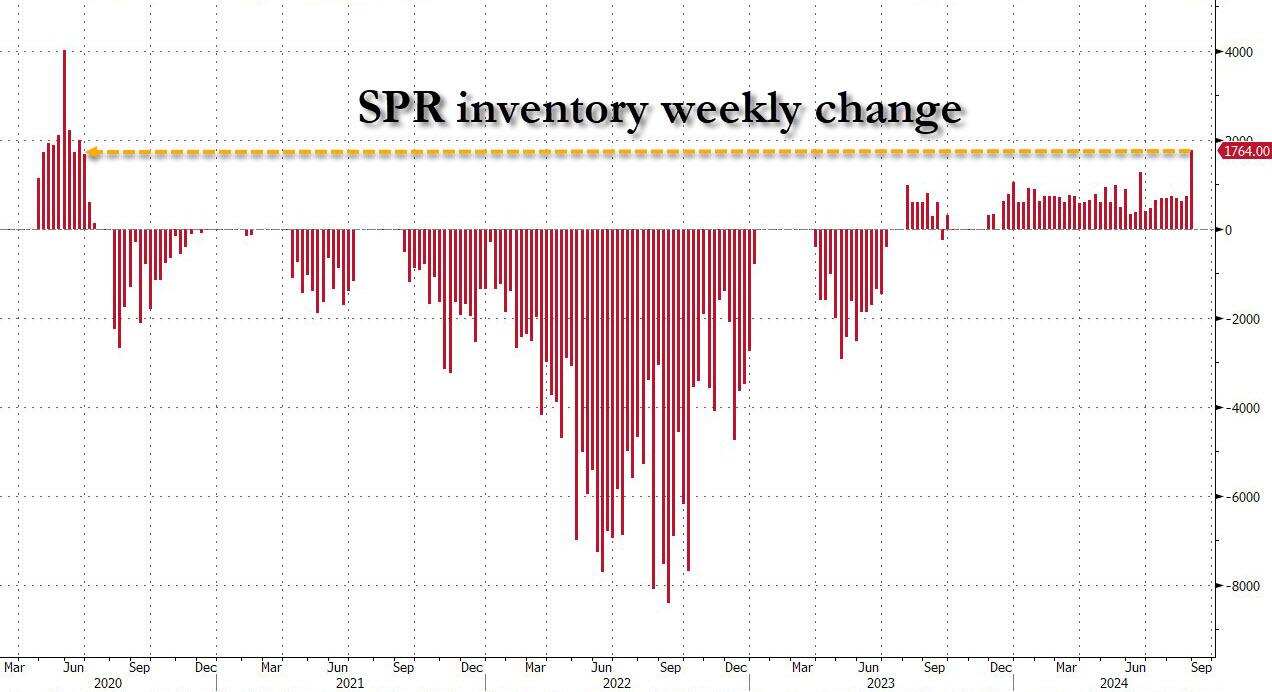

One reason for the large oil draw is that in the past week, the Biden admin added a notable 1.8mm barrels to the SPR, the largest increase since June 2020.

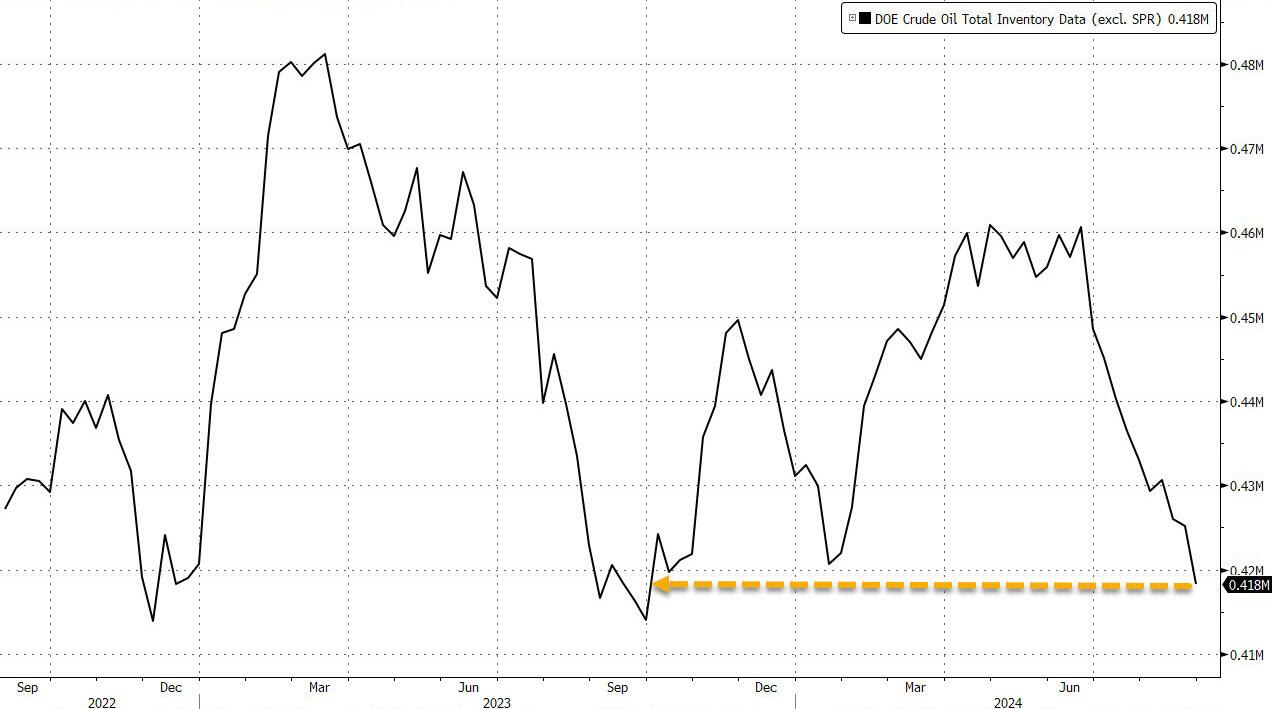

That pushed the total US Crude stockpile down to its lowest since January...

... with Cushing stocks rapidly approaching the 20MM level many consider tank bottoms.

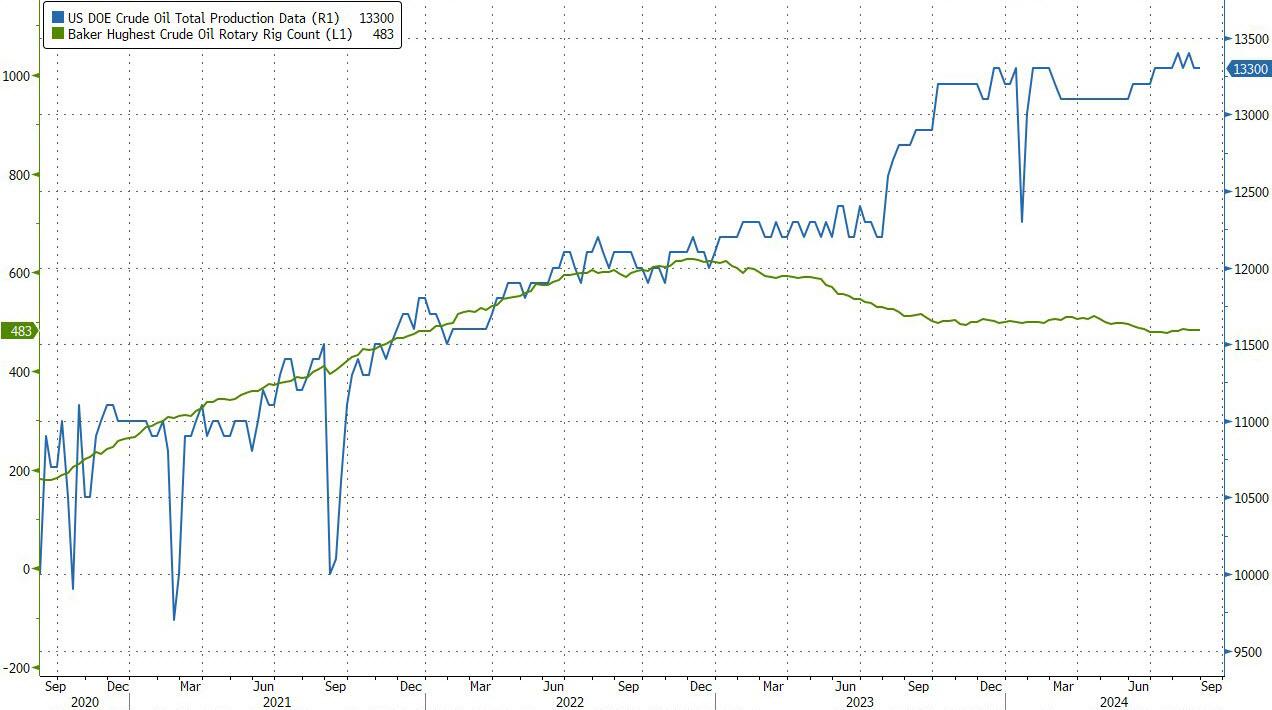

The collapse in US inventories takes place as US crude production remained at an all time record high (and despite a continued decline in oil rigs).

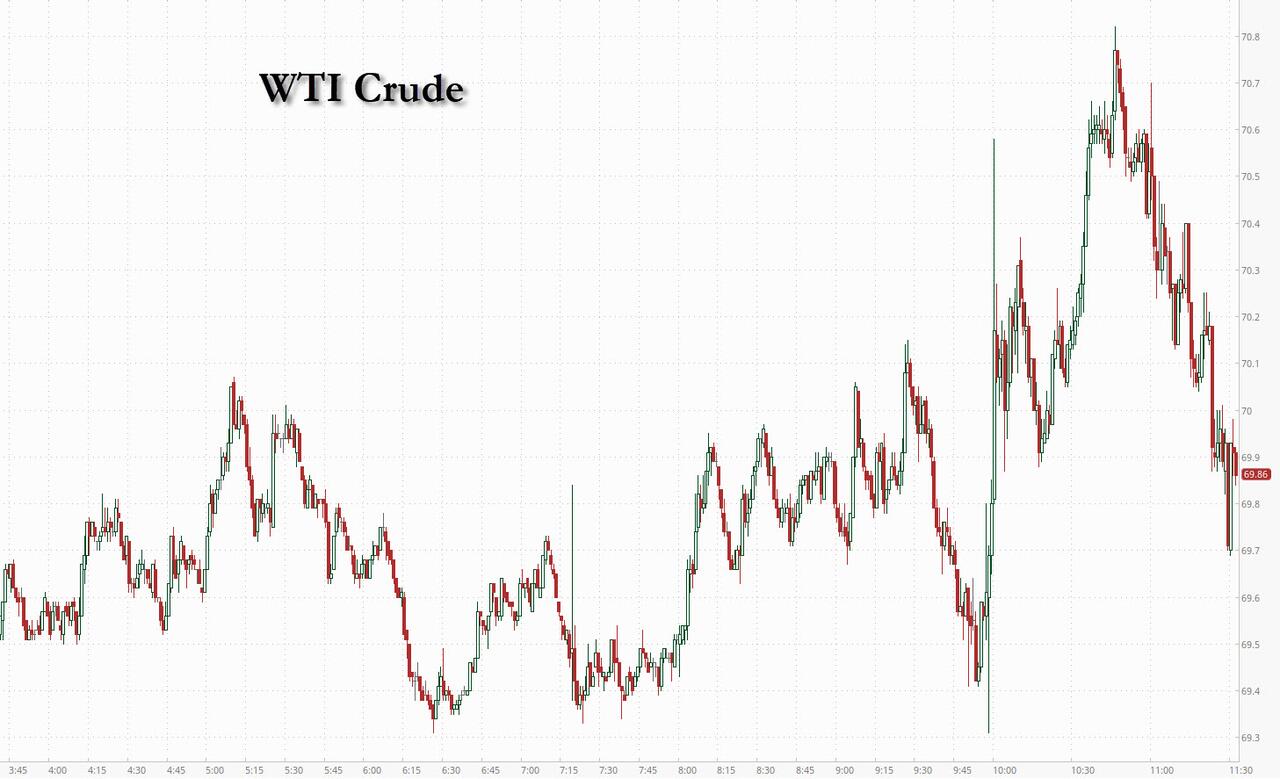

And yet, despite the massive draw, despite the collapsing US inventories, despite the risk of tank bottoms in Cushing, and despite the OPEC+ decision not to hike output, WTI Crude prices extended their earlier losses as the bears are now fully in control of the energy complex.

The flip side is that with demand flat if not rising, there is only so much more inventory draws that can take place before there is an unprecedented paper price vs physical showdown, and a full-blown physical oil crisis that blows up in the shorting CTAs' electronic faces.

More By This Author:

Jobless Claims Data Refuses To Accept 'Hard Landing' Scenario

A Stunning Chart Ahead Of Friday's Job Report

Hard-Landing Panic Leads To First Yield Curve Disinversion In Two Years, As Nvidia Plunge Continues

Disclosure: Copyright ©2009-2024 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more