Oil Prices May See $65 By Year End, But Not Without Volatility

The price of oil has been a bit of a mystery, with one extreme move after another. Only few saw the precipitous fall. The recent almost doubling of WTI was also only seen by few. This is why market timing isn’t necessarily the best way for an individual to invest. This is especially so for commodities. The price of oil can bounce around like a pinball, and do it for a plethora of reasons.Inventories, rig numbers, the dollar, supply and demand are all important. While oil trades inversely with the dollar, it is not the only thing that can prop up or cause significant declines. New traders generally make one very large mistake, and that placing positions solely based on charts and momentum. The variables most difficult to maneuver are those in the future. Sometimes insignificant changes in the world economy, become significant for oil down the road. Knowing how those changes will effect oil prices can be more of an art than a science, but all are important. Balance is important, and getting too comfortable with a trade can become a disaster. This has been the case for the USO. Those stuck short felt some pain.

(Click on image to enlarge)

(Source: Stockcharts.com)

There are a large number of ways to play the current oil markets. This also includes levered ETFs and ETNs:

The iPath S&P Crude Oil Total Return Index ETN (NYSEARCA:OIL), the ProShares Ultra Bloomberg Crude Oil ETF (NYSEARCA:UCO), the VelocityShares 3x Long Crude Oil ETN (NYSEARCA:UWTI), the ProShares Ultrashort Bloomberg Crude Oil ETF (NYSEARCA:SCO), the U.S. Brent Oil ETF (NYSEARCA:BNO), the PowerShares DB Oil ETF (NYSEARCA:DBO), the VelocityShares 3x Inverse Crude Oil ETN (NYSEARCA:DWTI), the PowerShares DB Crude Oil Double Short ETN (NYSEARCA:DTO), the U.S. 12 Month Oil ETF (NYSEARCA:USL), the U.S. Short Oil ETF (NYSEARCA:DNO), the PowerShares DB Crude Oil Long ETN (NYSEARCA:OLO), the PowerShares DB Crude Oil Short ETN (NYSEARCA:SZO), and the iPath Pure Beta Crude Oil ETN (NYSEARCA:OLEM)

The big question is where oil is headed. Although there is no certainty, we could be at the start of a bigger pullback. We do not think that we will see 52 week lows, only that things could get sketchy in the short term. The run up in oil price was precipitated by natural oil declines and transient disruptions.Outside OPEC, the US and Brazil have seen relatively large declines. Disruptions from wildfires in Canada and attacks in Nigeria have been significant. Production increases have been seen from Iran, Iraq, and Saudi Arabia.We have been filling up world inventories, and the pending glut will take a very long time to work through.I do not want to sound too bearish the oil markets.There are many reasons to be bullish as well. The charts point to the possibility that oil prices have already bottomed. Demand for oil and refined products is very good. Most importantly, the market has already balanced. This may have

occurred in May, well ahead of expectations pointed towards 4Q16 or 1Q17.

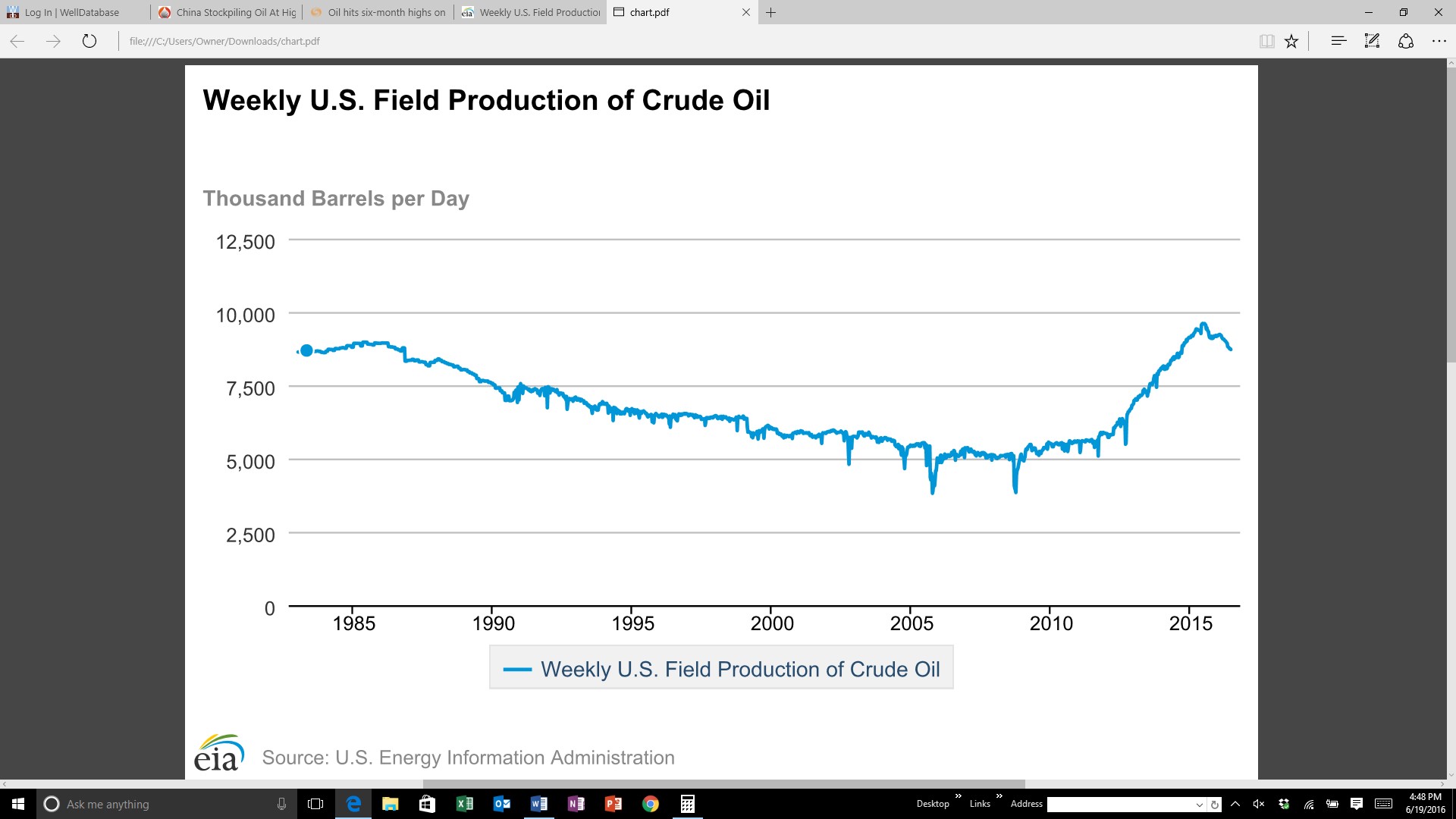

(Click on image to enlarge)

(Source: EIA)

US production had been declining since 1986. Shale production revitalized the industry, until the drop in oil prices. This drop has been sharp, and there are fears this will continue, at least in the short term. Production decreases have been seen throughout the world. Brazilian oil production is also on the decline.

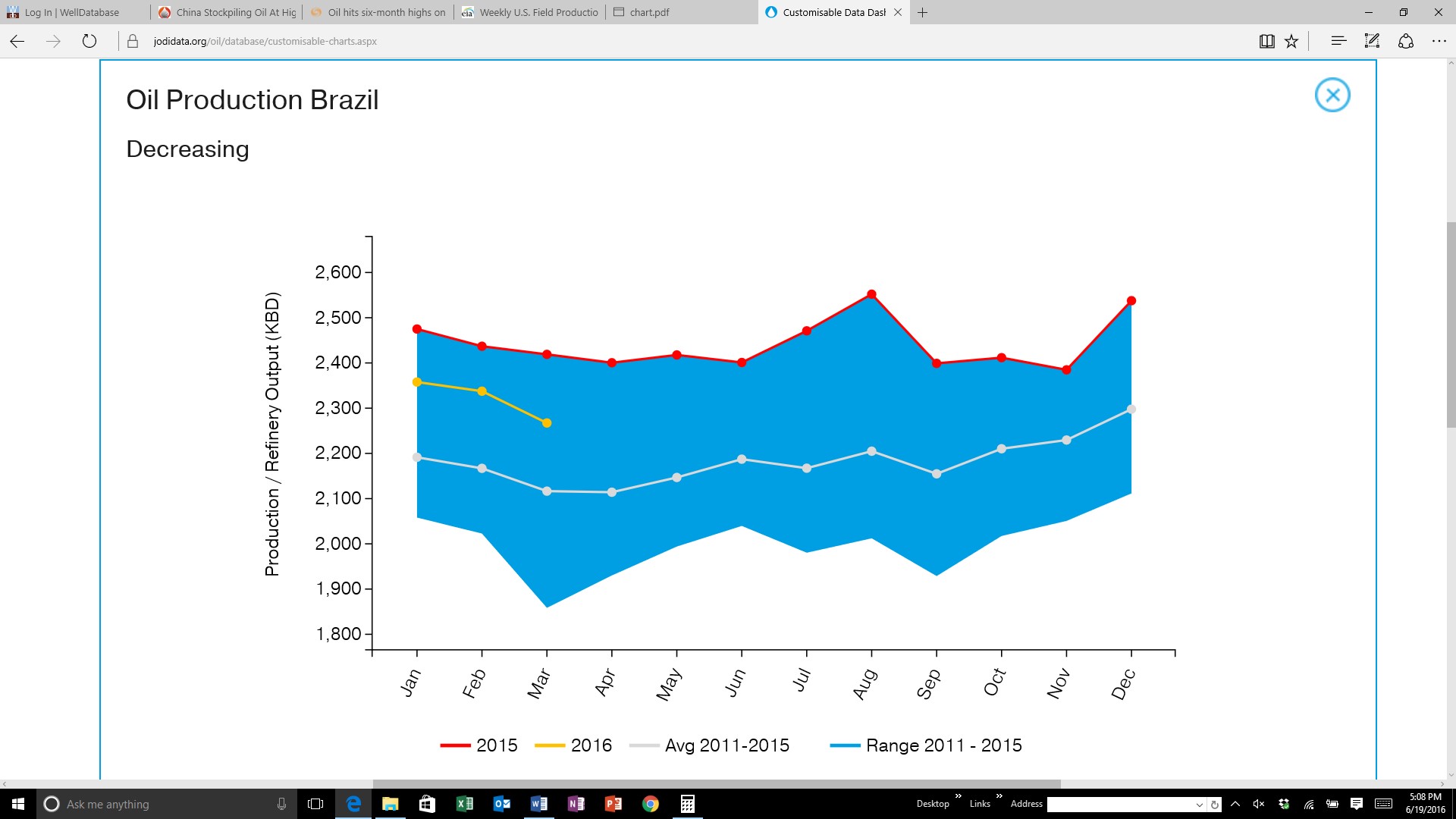

(Click on image to enlarge)

(Source: JODI)

Brazil saw production increase significantly in 2015, with a double top in August and December.2016 has been painful, with production making new lows each month. Oil production in Brazil has seen a relatively big move, with production well above the 2011 low of 1,850 KBD. Venezuelan production has also dropped off. There are worries the entire industry in that country will implode, as the country is making debt payments instead of buying food. Chinese oil production has also dropped this year.

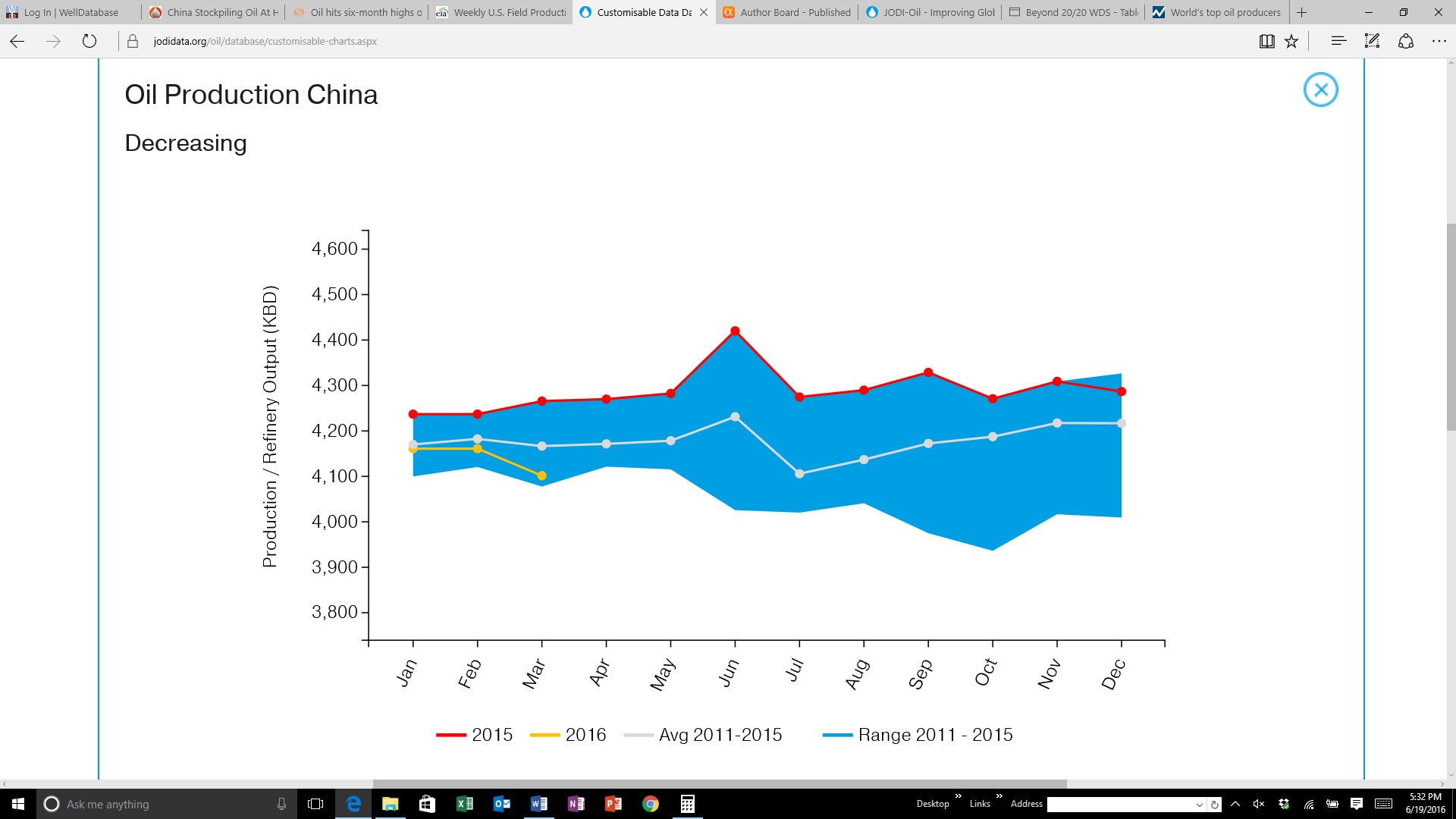

(Click on image to enlarge)

(Source: JODI)

China’s production in March of 2016 is below 4,100 KBD. In June of 2015, it was above 4,400 KBD. There is anticipation that Mexico will begin to hike oil output as it moves to revitalize its industry. Increased traffic in the Gulf and possible shale plays on the coast could be targets.

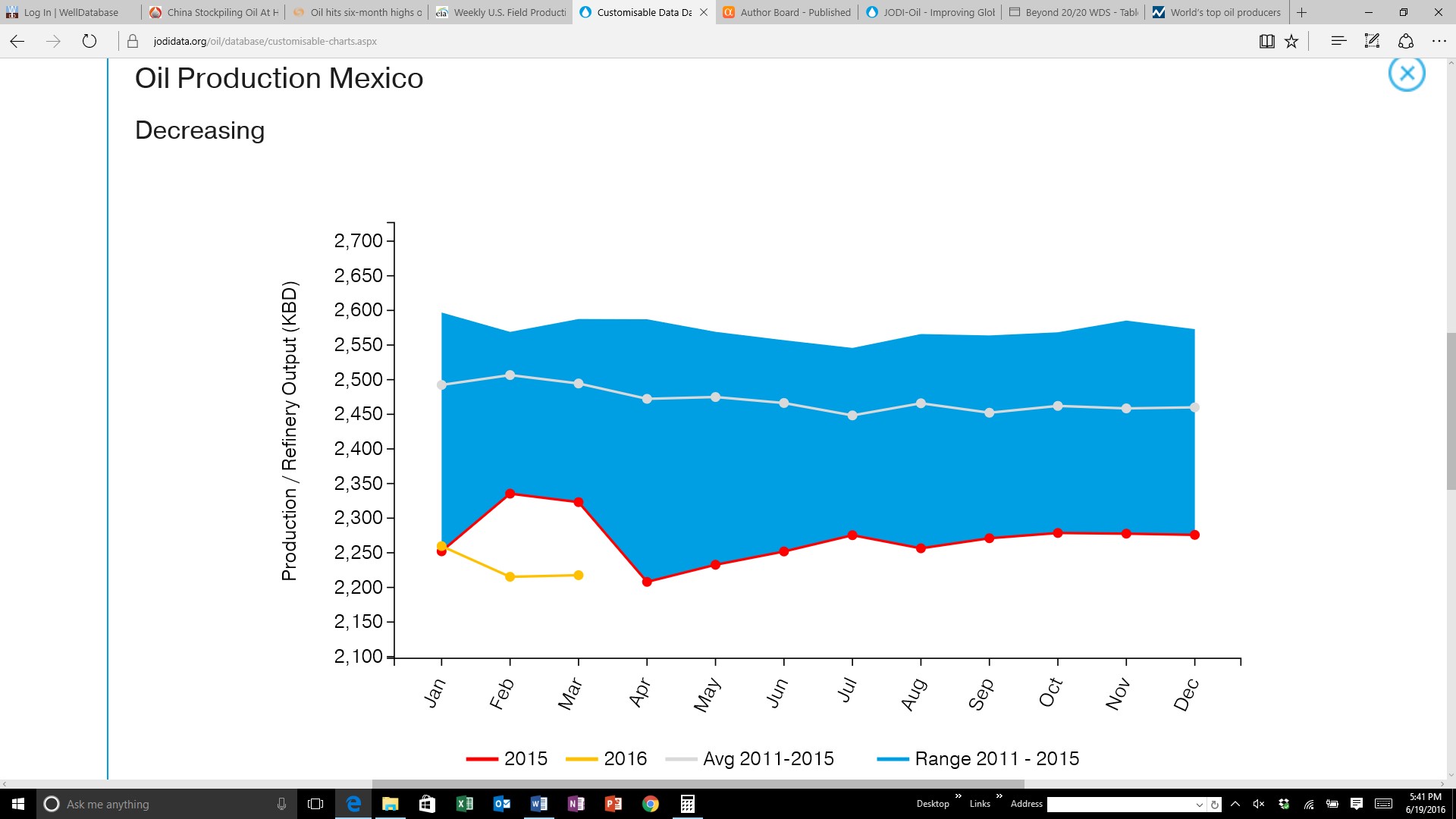

(Click on image to enlarge)

(Source: JODI)

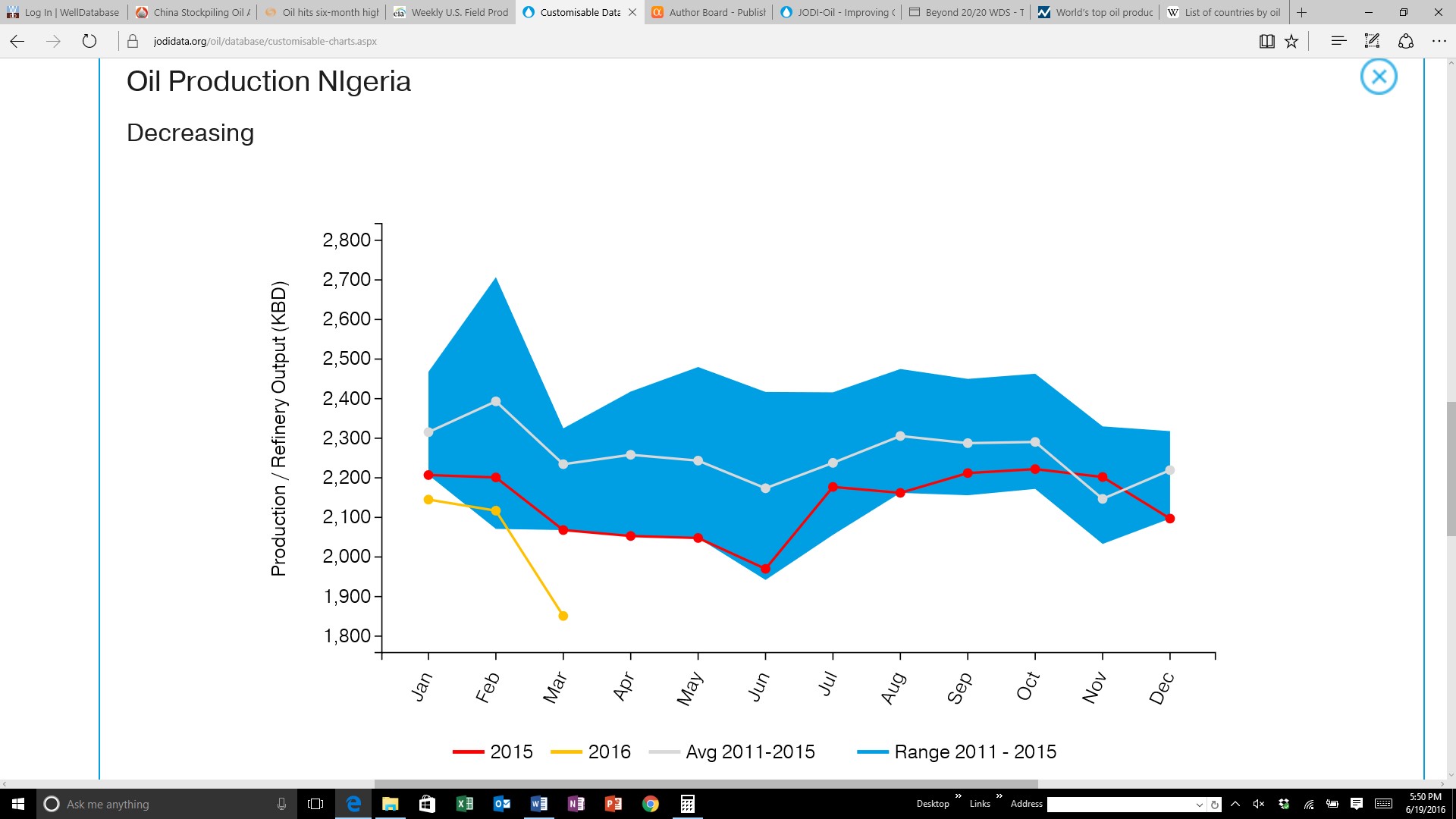

Even with these recent moves, production has dropped in 2016. Mexican production has been dropping for years as natural depletion and lack of investment took its toll. Nigerian production has fallen off of a cliff. This could get worse, as it will be difficult to control the Avengers.

(Click on image to enlarge)

(Source: JODI)

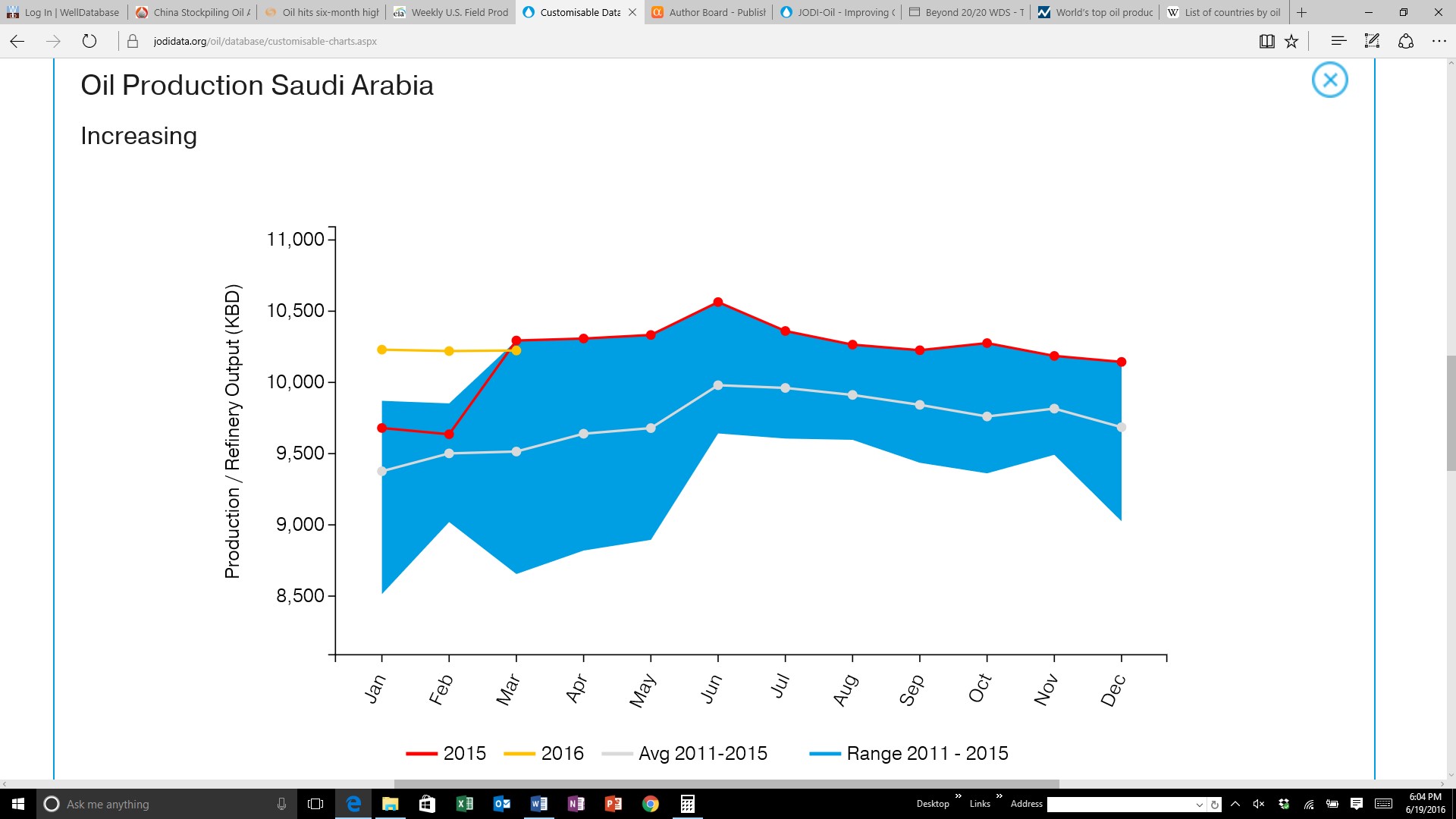

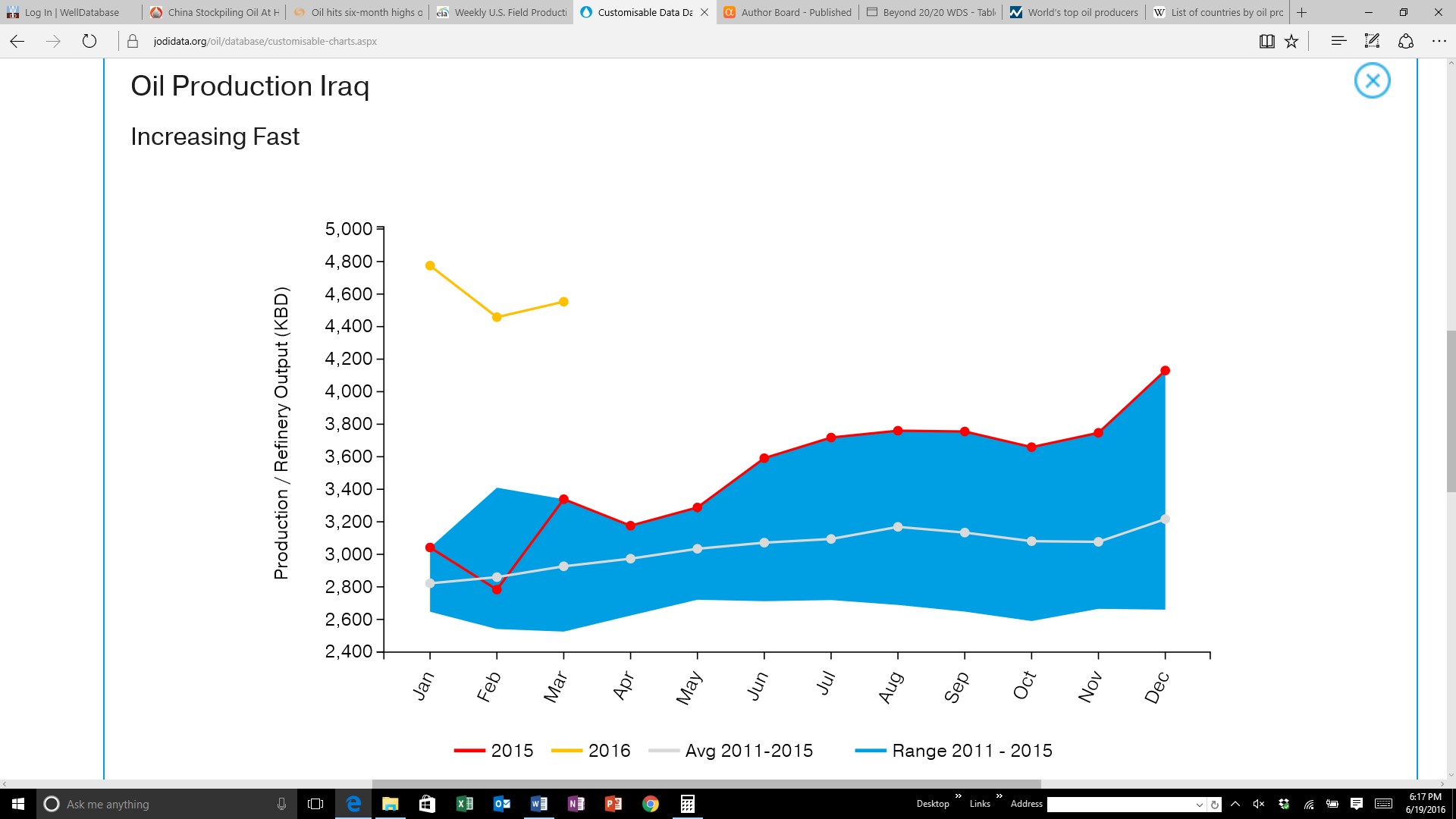

Production increases have been occurring, and could continue. Russia and the Saudis have been vocal about grabbing market share. When sanctions were lifted, the Iranians had already had 50 million barrels of oil in tankers on the Persian Gulf. The Iranians are beginning to fight to get its old customers back. Most of these names are buying crude from the Saudis, which only increases the friction. The Iraqis continue to add production, and have been doing so for a while.

(Click on image to enlarge)

(Source: JODI)

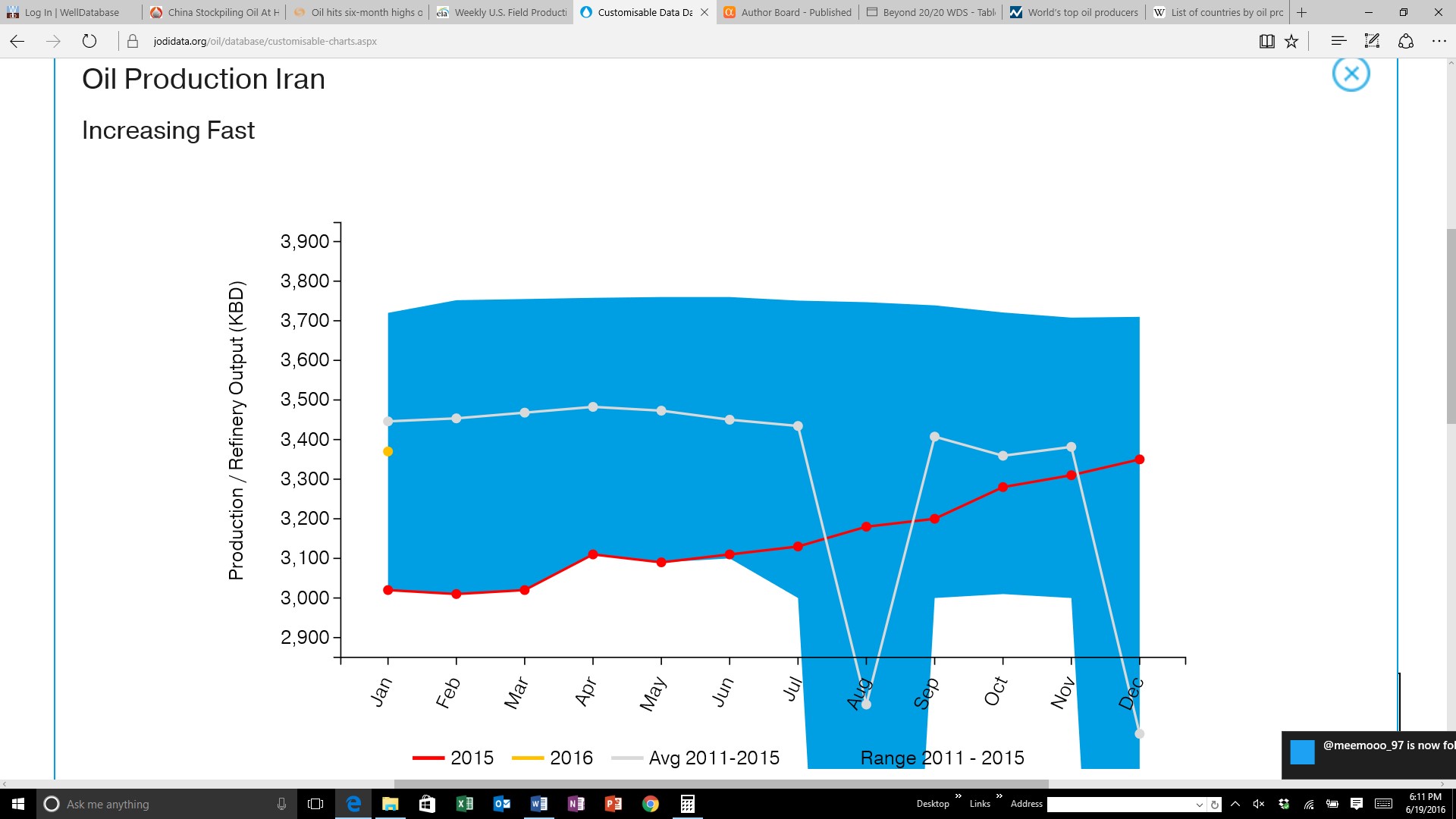

Although the chart does not show a significant move, production is up since January of 2015. Saudi Arabia says it can increase production by 1 million bbls/d right away. It also says another 2 million bbls/d can be added soon after. Time will tell.Iranian production is almost to pre-sanction levels. Most thought this would not occur, but it has and in a quick manner.

(Click on image to enlarge)

(Source: JODI)

Although we don’t have a graph of the move in Iranian production (February and March not assessed), we have seen a large ramp up through 2015.Production is probably above the 2011-2015 average for January through July.Tanker surveys suggest Iran had increased exports by 600,000 bbls/d by April. This number has been argued by many, and there are no concrete numbers to date. Iraq production increases have continued.It is one of the OPEC countries with the ability to continue doing this.Iraq has continued to expand production as it recovered from the Gulf War.

(Click on image to enlarge)

(Source: JODI)

World oil economics have created a change, where low cost producers take customers from those unable to maintain production levels.It will continue, and become more lopsided as we get further into this new normal oil price.

Longer term we think oil prices are headed higher, but there could be a quick move lower in the coming months. The first reason is refinery maintenance season.We are a few months away, but could see this season early this year. Refiners have seen crack spreads tighten recently, and there are worries we are headed into a refined product glut. The oil glut looks to continue for a time, but if we end up with a refined product glut refinery utilization would decrease early and more than expected. Since March of this year, refinery utilization in the US has been around 90%. Over the past few years, refinery utilization has decreased to around 86% in early October.This may end up being the percentage this year, but a refined product glut could push refinery utilization into the low 80s.

(Click on image to enlarge)

(Source: EIA)

We have seen utilization drop below 70% during recessions, but we doubt it would get that bad. The biggest issue with a refined product and oil glut is the unknown. Since we haven’t seen the supply/demand dynamic like this since the 80s, it is difficult to know exactly where oil prices are headed.

The dollar is also an issue. Yellen has done a very good job of pushing the dollar down by doing little except talk.It is possible the dollar will continue at these levels, but there are too many variables that could push its value lower. We think the dollar heads higher even if the Fed raises just once this year. We think the number is twice (keep in mind, we initially thought four) this year, depending on the Brexit vote. Although the US economy is not great, it is a lot better than Europe and Japan. The dollar should head higher even with the attempts of the Fed to push it down.If Brexit occurs (we don’t think it will), the Euro will see significant downside and demand for refined product will decrease.Its effects could ripple through many major economies. Brexit probably isn't the end of the world, but the oil markets will over react. At least that is what the market normally does when it has difficulty figuring out the changes in world economies from something as large as this.

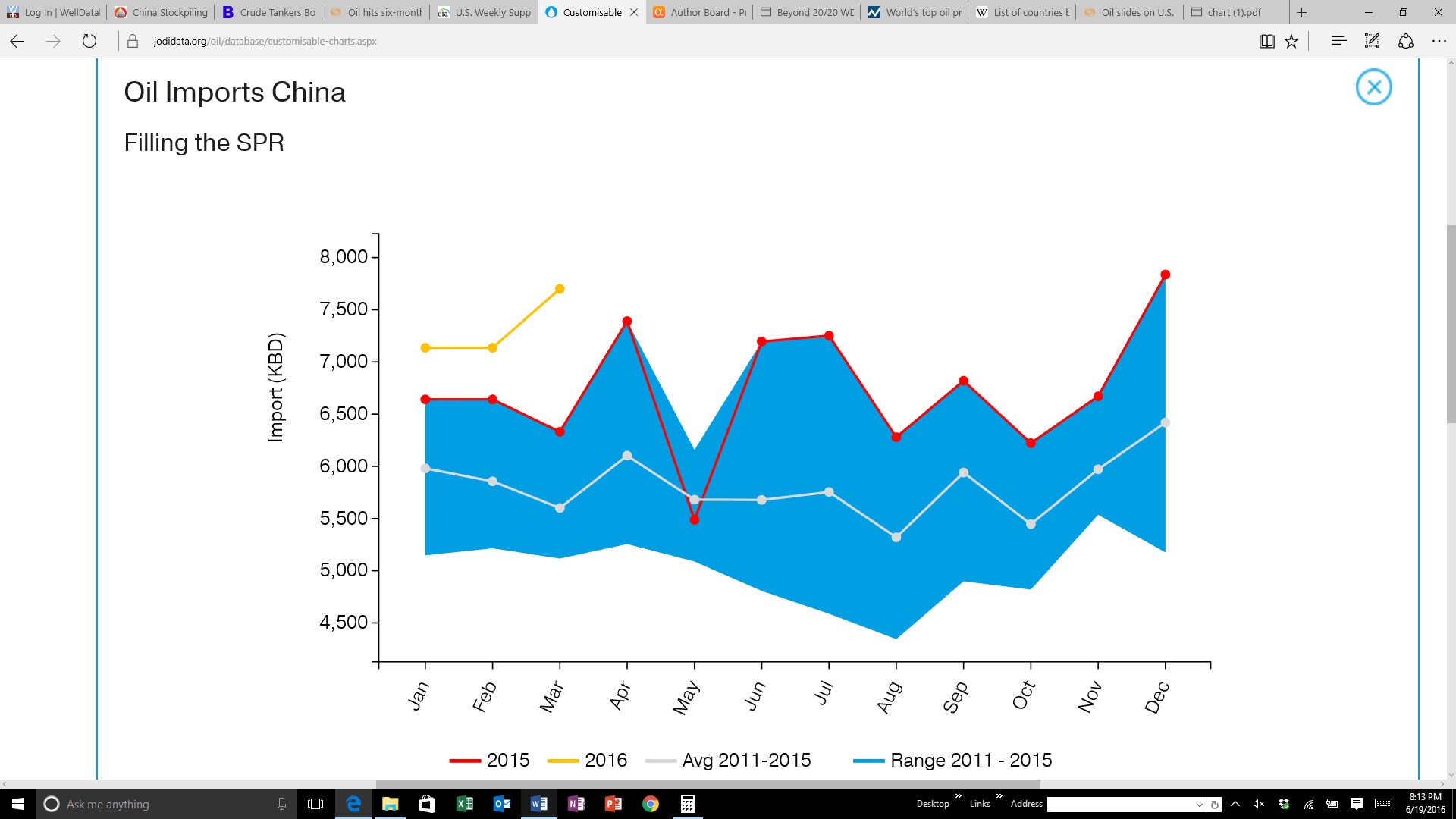

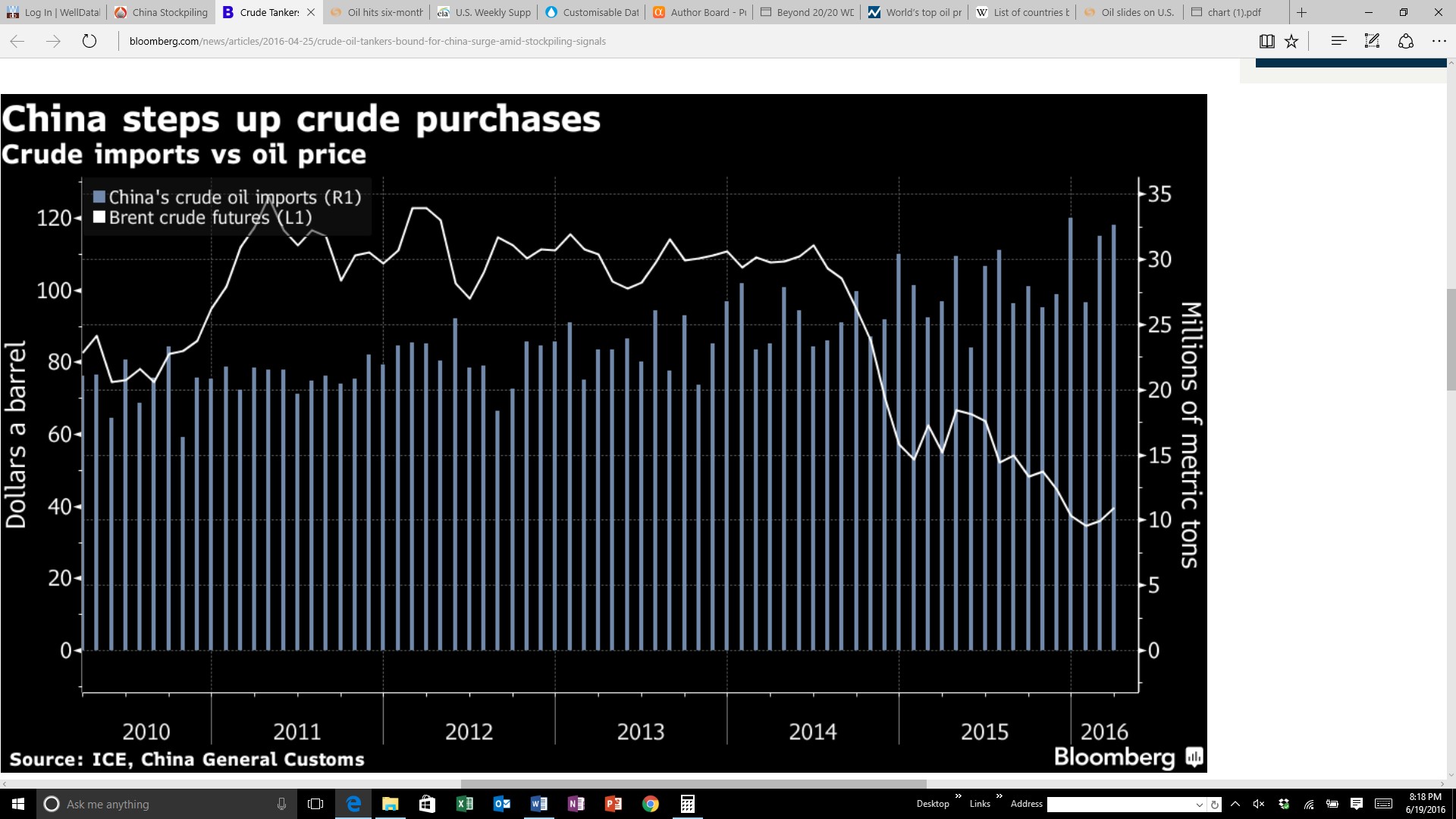

The last issue is one that I feel could weigh more on oil prices than any other current events. China’s current demand for crude has been quite good.Many had thought demand would drop off a cliff in this area of the world. The problems in Europe trickle down to China. GDP growth continues to head lower, and it is possible we could see a larger decline. China is filling up its SPR and has changed rules pertaining to oil imports. China knows low oil prices are not here to stay, so it is capitalizing. This is not new for China or surprising. It has a long history of buying commodities when prices are low.It has generally worked out well.

(Click on image to enlarge)

(Source: JODI)

Although there are no numbers for April and May, one would suspect that imports continued to be strong.In the first quarter of this year, China added an estimated 787,000 bbls/d to its SPR.Approximately 166 million bbls of crude headed to China in 83 supertankers.

(Click on image to enlarge)

This is the most since December of 2014. This may be where the Iranians are able to sell its large volumes of crude. This strong demand from China may be from its recent leniency on rules concerning crude imports. Its teapot refineries, located in north China, are able to import crude.Refinery utilization has increased to 52% from the low 30% to 40% before these restrictions were removed. At least two Chinese teapot refineries have made deals to sell excess refined product. The current Chinese credit stimulus probably means imports will remain high. Barclays estimates imports will average 8 million bbls/d in 2016. That is above the more recent 7.7 million bbls/d.It imported 6.7 million bbls/d in 2015. In April, China was rushed to fill four new storage tanks being completed. It would like to build reserves to 550 million bbls, or a 90-day supply. The recent news that stage 2 of its underground oil storage wouldn’t be completed until sometime next year has created worries that China’s oil storage will fill in the near future.Stage one added 91 million barrels, and stage two would add another 168 million.

We expect significant volatility throughout all of 2016.It may level off some in November or December, but we will need more clarity before we can provide direction.It is going to be very difficult to break above the $52 to $53/bbl price level.Significant resistance may be seen anytime we are at or over $50/bbl as many operators are using this target as a level to hedge. Each time oil makes a move to the upside, significant volumes may be seen helping to decrease upside.Downside may be limited as well now that the market seems balanced, and there is optimism for an industry recovery.Many of the Permian and SCOOP operators began hedging around $40/bbl.Eagle Ford and Bakken operators need a higher oil price.This is closer to $50/bbl for core operators, and where operators in all major plays will want to lock in oil prices.

Currently, we think oil prices will stay in a range of $45/bbl to $53/bbl. We could experience a significant move downward if Brexit does occur. No matter the outcome, oil prices will head higher by the fourth quarter.There is still a good possibility that oil prices correct in Q3. Increased hedging, decreased refinery utilization, and transient production declines coming back on line could all effect prices. In 4Q16, we expect large drawdowns to world oil inventories. We also believe that demand will increase further.We expect oil prices to trade in the $55 to $65 range in 4Q16.

Disclosure: None.