Oil Prices Extend Gains As Distillate Inventories Plunge To 17 Year Lows

Oil prices are surging this morning, after COVID infections in Shanghai and Beijing dropped on Tuesday, providing some cautious optimism of improvement after lockdowns sparked growth scares... but that also comes as IIF tweets about global recessions and US inflation prints hotter than expected, prompting fears of a more aggressive Fed stomping on growth.

The oil market hasn’t been “consistent at all as of late, which has turned many away from trading the commodity,” said Rebecca Babin, senior energy trader at CIBC Private Wealth Management.

“Trading crude right now is like trying to figure out the mood swings of a teenager. It can feel like a futile endeavor.”

Traders continue to monitor the EU’s efforts to agree sanctions on Russian oil imports. On Wednesday, Hungary said it will only agree if shipments via pipelines are excluded.

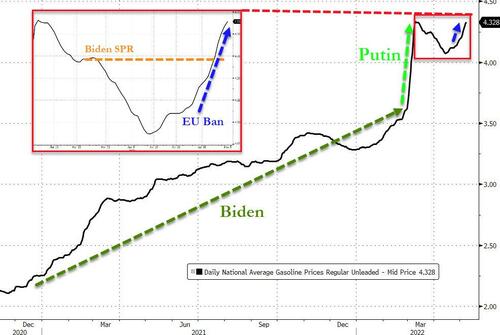

And all of this is happening as US retail gasoline prices peak even before the start of the summer driving season.

API

- Crude +1.161mm (-457k exp)

- Cushing +92k

- Gasoline +823k

- Distillates +662k

- DOE

- Crude +8.487mm (-457k exp)

- Cushing -587k

- Gasoline -3.607mm

- Distillates -913k

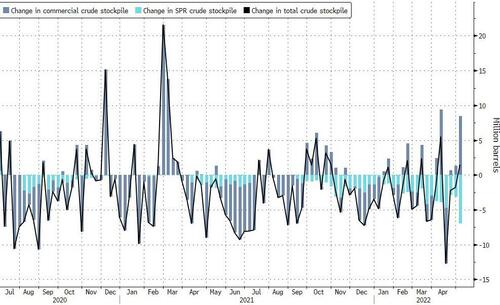

Official data showed a huge US Crude inventory build last week, dramatically different from the small draw expected (and far larger than the API-reported build). Cushing saw stocks reduced and products saw notable draws.

Source: Bloomberg

The headline build in crude stockpiles was largely offset by the withdrawal of nearly 7 million barrels of crude from the Strategic Petroleum Reserve last week. Total nationwide crude inventories (including commercial stockpiles and oil held in the SPR) rose by 1.5 million barrels in the week to May 6, with commercial inventories jumping by 8.4 million barrels. Withdrawals from the SPR hit the Biden Administration’s supply goal last week.

Source: Bloomberg

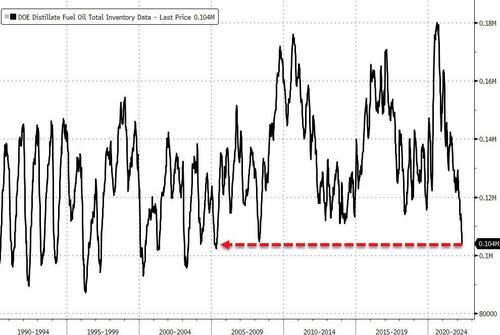

Distillate fuel inventories are now 23% below the five-year average for this time of year, at their lowest since May 2005.

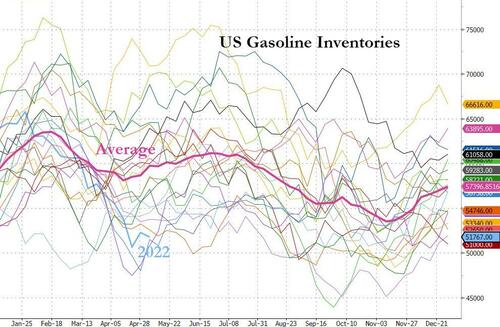

Gasoline inventories continued to fall, well below the seasonal average...

The four-week average of production supplied of the fuel was steady at 8.79 million barrels a day. That is lower than last year at this time by about 100,000 b/d and about 600,000 b/d lower than it was at this time in 2019.

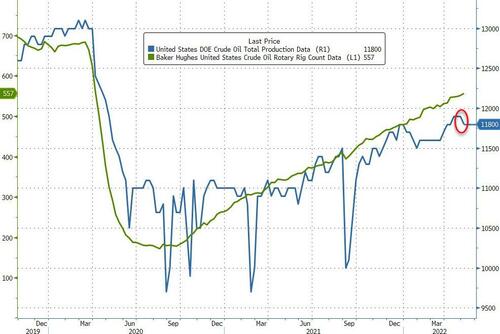

US crude production dipped last week for the first time since January...

Source: Bloomberg

WTI hovered around $105 ahead of the official data and slipped lower on the crude build then rallied to new highs on the day...

“Oil prices are bouncing back strongly from two days of hefty losses amid a tightening supply outlook,” brokerage PVM Oil Associates wrote in a note.

Meanwhile, US retail gasoline prices hit a new record high...

"Americans have never seen gasoline prices this high, nor have we seen the pace of increases so fast and furious," said Patrick DeHaan, the head of petroleum analysis at specialist site GasBuddy.

"It's a dire situation and won't improve any time soon."

Blame Europe, Putin, or 'Ultra MAGA'... but not Biden!

Diesel and jet fuel prices have been rising faster than gasoline, putting further inflationary pressure on agriculture, shipping and travel... also not Biden's fault.

Disclosure: Copyright ©2009-2022 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more