Oil Price Forecast: US Crude Oil Price Action Indecisive Ahead Of FOMC

WTI Crude Oil has continued to consolidate as bullish momentum appears to have stalled at a key area of resistance, marked by the 76.4% Fibonacci retracement level of the 2020 major move. Although OPEC appears to be on track regarding pledged oil output supply, the delay in both the US Fiscal Stimulus package and the Covid-19 vaccine rollout continue to hinder further progress on the long side.

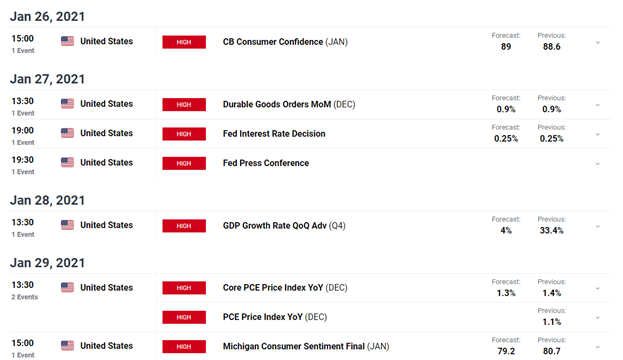

Meanwhile, this week’s major risk events include an array of data that may provide a catalyst for price action. With Consumer Confidence (reported earlier today) falling in-line with expectations, the Federal Reserve policy meeting (tomorrow), Q4 Adv GDP data (Thursday) and Core PCE results (Friday) will likely be the main drivers of the USD for the remainder of the week.

DailyFX Economic Calendar

With global lockdowns further weighing on Oil demand, prospects of additional US Fiscal stimulus combined with optimism regarding a vaccine rollout have weighed on the greenback, helping to keep US Crude Oil afloat.

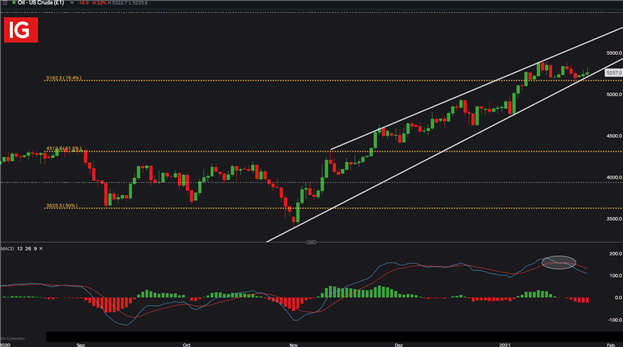

WTI TECHNICAL ANALYSIS

Currently WTI price action remains encapsulated by the channel formation that has provided support and resistance for themajor commodity since November. Simultaneously, the 76.4% Fibonacci retracement mentioned above provides support at 5162.3 while the Moving Average Convergence Divergence (MACD)remains well above the zero line, indicating that the upward trend is still holding for the time being.

WTI – US Crude Oil Daily Chart

(Click on image to enlarge)

Chart prepared by Tammy Da Costa, IG

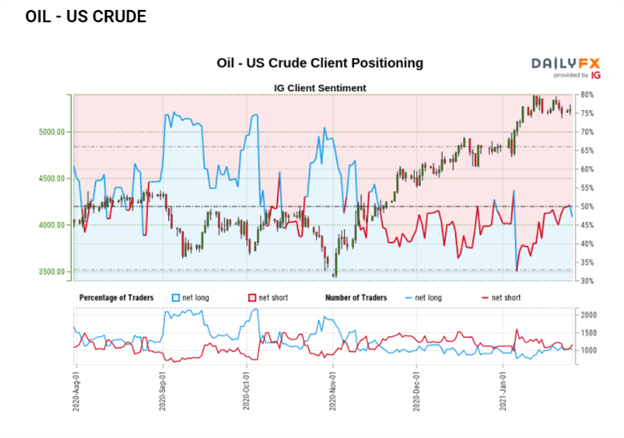

WTI - US CRUDE OIL CLIENT SENTIMENT

(Click on image to enlarge)

At the time of writing, Retail trader data shows 47.10% of traders are net-long with the ratio of traders short to long at 1.12 to 1. The number of traders net-long is 10.26% lower than yesterday and 7.94% lower from last week, while the number of traders net-short is 5.46% higher than yesterday and 1.28% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests Oil - US Crude prices may continue to rise.

Traders are further net-short than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger Oil - US Crude-bullish contrarian trading bias.

Disclosure: See the full disclosure for DailyFX here.