Oil Price And The Impact Of COVID-19

I firmly believe that oil prices (USO) will continue to remain under $35 per barrel during the first half of 2020. In my earlier article on crude oil ( that I wrote last year), I had predicted that oil prices will remain under pressure during 1Q20 because of a supply glut of 0.6 to 0.7 million barrels. Now with COVID-19, this supply glut is set to get even bigger. The entire world is reeling under the impact of COVID-19, with oil prices falling by almost 50% on a Month-on- Month Basis. To gauge the true impact of COVID-19, it is important to analyze its effects on the supply-demand fundamentals of crude oil.

Supply glut will increase in the near future

The supply glut is set to get even worse mainly because of two factors. The first involves fallout between Saudi Arabia led- OPEC and Russia. After OPEC’s supply cut agreement with Russia collapsed, both Saudi Arabia and Russia are planning to ramp up their crude oil production in a bid to capture market share. According to a latest report, Saudi Arabia’s crude oil production in April 2020 will be close to 11 million barrels per day, which is almost 1.3 million barrel per day more than its average monthly production.

Even Russia is preparing to ramp up its production in April 2020. This clearly signals the beginning of an oil price war between Saudi Arabia and Russia. Whoever wins this price war (which itself demands a separate discussion), one thing that is certain is that it will add close to 2 million barrels per day of additional crude oil to the market. This will add more pressure on oil prices that are already impacted by the ongoing global pandemic.

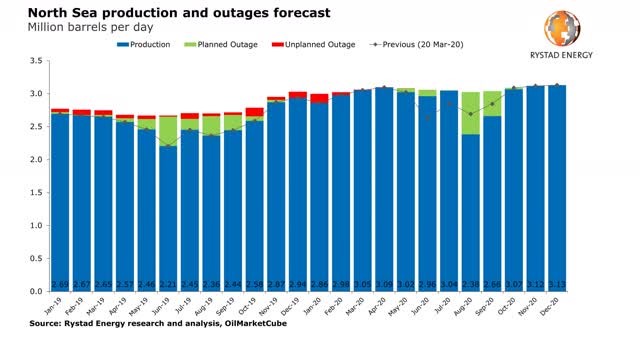

Image Source : Rystad Energy

The second factor that will worsen the supply glut is increase in upstream production by E&P companies in order cut back on their maintenance activities. Because of COVID-19, E&P companies are postponing their maintenance activities in order to prevent an increase in human to human contacts.

“This just adds another ripple to the growing oversupply pool of global liquids – an overhang for 2Q20 that is already so incomprehensibly massive that it will eventually force shut-ins as oil prices fall below short-run marginal costs and logistical challenges arise. Given the current struggle, E&P companies are understandably trying to mitigate the coronavirus risk by implementing their version of social distancing,” said Milan Rudel from Rystad Energy.

Investors must note that the OPEC- Russia fallout and reduced maintenance activities by E&P companies will add close to 4 million barrels per day of additional oil supplies in a market where demand is faltering too!

Oil Demand is going to fall even further

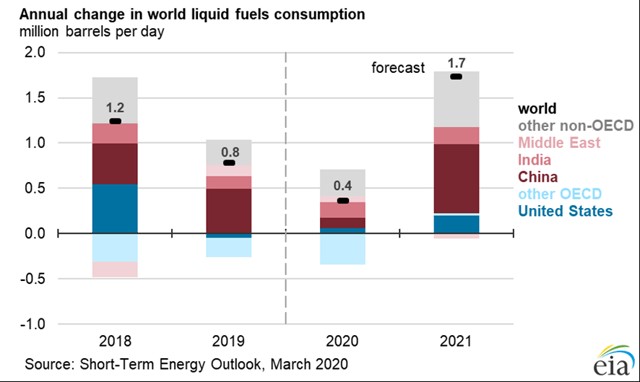

Image Source : EIA

COVID-19 has done what no other pandemic could do in last several decades. With several European and Asian countries in lock down mode, more than 3 billion people are confined to their homes. This has resulted in a massive decline in oil consumption and demand. In fact, Paris based International Energy Agency (IEA), in its latest oil report, states that global oil demand is set to plunge for the first time since 2009’s global economic recession.

The report further states that the global oil demand will drop by 2.5 million barrels per day in 1Q20 and will start picking up only during the second half of 2020. The report states that the global oil demand in 2020 will be around 90,000 barrels per day less than 2019. Even U.S based Energy Information Administration ( EIA) expects global oil demand growth to reduce significantly, resulting in an additional inventory build-up of 1.7 million barrels per day in the first half of 2020.

Conclusion

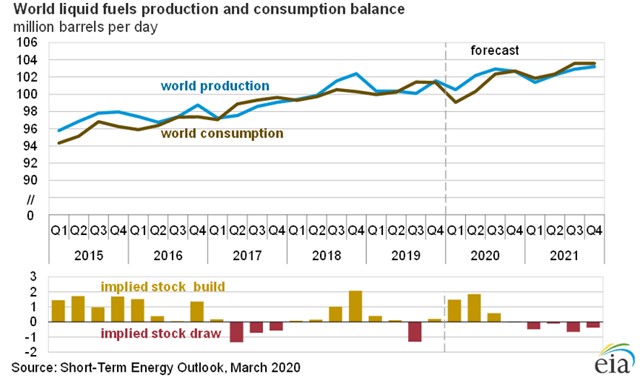

Image Source : EIA

We are living in highly uncertain times that are marked by geopolitical events like the U.S- China trade deal, terror attacks on oil installations and U.S – Iran tensions. These events will only make oil more volatile in 2020. Looking at the above-stated factors, investors can see that the supply-demand re-balancing of crude oil has been severely impacted by the ongoing COVID-19 and fallout between OPEC and Russia.

When I look at the above chart provided by EIA, I notice that production and consumption of liquid fuels will only re-balance in 4Q20, which means that supply gut will continue to put pressure on oil prices till 4Q20. The WTI is currently trading at $21.51 (at the time of writing this article), but I expect oil prices to go beyond $30 and remain under $35 once the demand related-effects of COVID-19 starts fading away ( thereby adding an additional demand of around 2 million barrels per day ) and when E&P companies start taking their turnaround- maintenance activities (by end of 2Q20). Investors must note this.

thanks.

Good article, I followed you. Thanks for sharing.