Sunday, May 28, 2017 2:16 PM EST

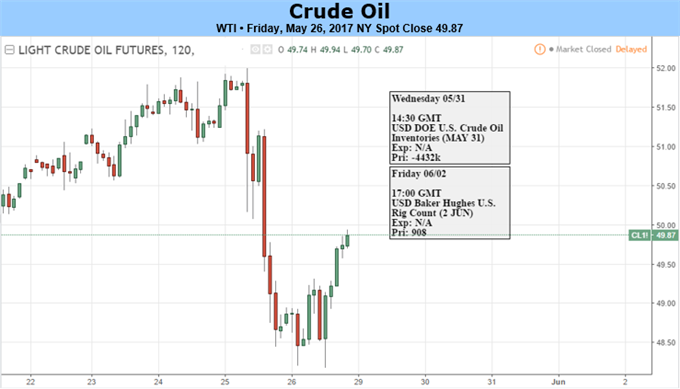

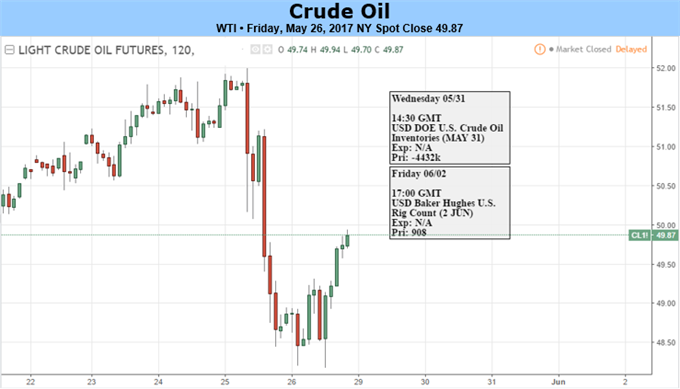

Fundamental Forecast for Oil: Neutral with a Bearish Bias

- A classic example of ‘Buy the Rumor, Sell the Fact’.

- Oil may struggle to get back into its upward channel.

Oil slumped nearly 5% Thursday after OPEC announced that it would extend production cuts of 1.8 million barrels a day for another nine months, ending in June 2018. And while this would normally be taken as a bullish cue for the market, this extension had been mooted around the market since early May, taking the price of oil from a low of $46.72/barrel to a pre-release high of $54.87, a 17%+ rally in just over three weeks. With such a price rise already baked-in to market assumptions, it is no surprise to see the market falling back. And with US shale production hitting just under 10 million barrels a day, according to the latest US EIA data, upside movement in the oil complex may be capped.

And the technical set-up looks slightly worrying as well. As the daily chart below shows, Brent has broken out of its sharp up channel that started on May 5, while the current price is also now below the 20-, 50- and 100-day moving averages, a potentially bearish set-up. To return to the up channel, Brent would need to move back above the 100-dma, currently around $53.70, while continued weakness could see the March 22 low of $49.92 the first target.

Chart: Oil Daily Timeframe (December 5, 2016 – May 26, 2017)

Chart by IG

Disclosure: See how shifts in retail positioning are effecting market ...

more

Disclosure: See how shifts in retail positioning are effecting market trend- Click here to learn more about IG Client Sentiment indicators! Check out our 2Q projections in our Free DailyFX Trading Forecasts. Join Michael for Live Weekly Strategy Webinars on Mondays at 12:30GMT

For more information on retail sentiment, check out the new gaugedeveloped by DailyFX based on trader positioning. Have a question about the currency markets? Join a Trading Q&A webinar and ask it live! How are our Q2 gold and crude oil forecasts holding up with a month left to go? Find out here! DailyFX, the free news and research website of leading forex and CFD broker FXCM, delivers up-to-date analysis of the fundamental and technical influences driving the currency and commodity markets. With nine internationally-based analysts publishing over 30 articles and producing 5 video news updates daily, DailyFX offers in-depth coverage of price action, predictions of likely market moves, and exhaustive interpretations of salient economic and political developments. DailyFX is also home to one of the most powerful economic calendars available on the web, complete with advanced sorting capabilities, detailed descriptions of upcoming events on the economic docket, and projections of how economic report data will impact the markets. Combined with the free charts and live rate updates featured on DailyFX, the DailyFX economic calendar is an invaluable resource for traders who heavily rely on the news for their trading strategies. Additionally, DailyFX serves as a portal to one the most vibrant online discussion forums in the forex trading community. Avoiding market noise and the irrelevant personal commentary that plague many forex blogs and forums, the DailyFX Forum has established a reputation as being a place where real traders go to talk about serious trading.

Any opinions, news, research, analyses, prices, or other information contained on dailyfx.com are provided as general market commentary, and does not constitute investment advice. Dailyfx will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

less

How did you like this article? Let us know so we can better customize your reading experience.

#SUB40crude Bearish