Oil Heads For Worst Annual Loss Since COVID As US Crude Production Hits Record High

Image Source: Unsplash

Oil futures are gaining in early U.S. trade, but on track to end the year substantially lower.

As Dow Jones reports, the unwinding of OPEC+ output cuts, along with higher non-OPEC production, fueled oversupply concerns in 2025, while U.S. sanctions and geopolitical tensions in the Middle East, Russia-Ukraine and more recently Venezuela led to frequent price spikes.

"The crude supply surplus will acquire greater transparency than was the case through most of the fall period as floating storage gradually finds its way into onshore facilities," Ritterbusch and Associates says in a note.

But away from the geopolitical chaos, domestic supply and production remain key...

DOE

-

Crude -1.934mm

-

Cushing +543k

-

Gasoline +5.845mm

-

Distillates +4.977mm

Crude stocks fell for the 3rd week in the last 4 while product inventories saw their 8th straight weekly build in a row...

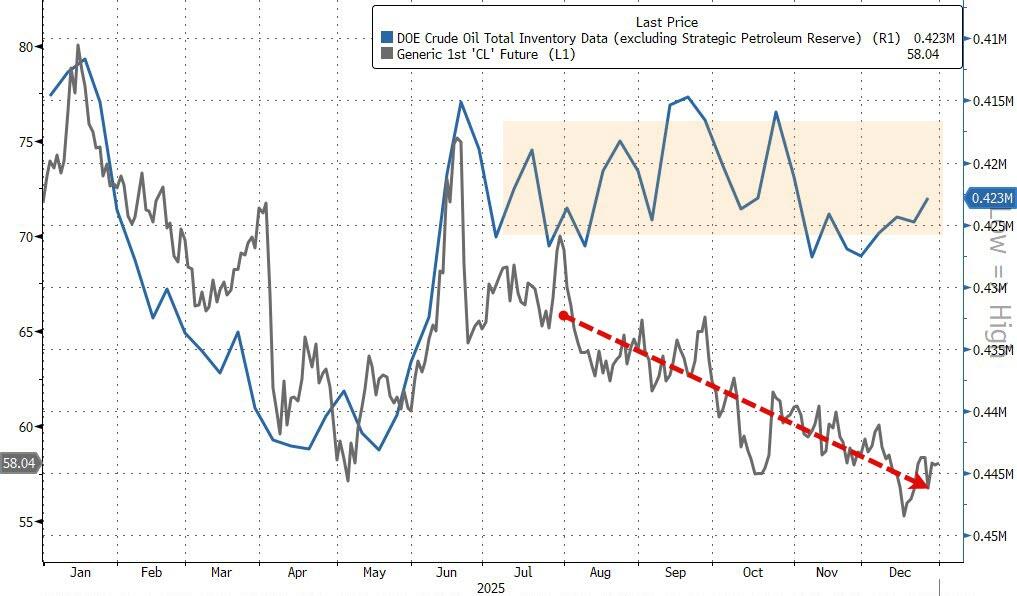

The US Crude Oil Total Inventory (excluding Strategic Petroleum Reserve) fell to 422,888 thousand barrels in the week ending Dec. 26, 2025, lowest since Oct. 31, 2025... decoupling from the crude price...

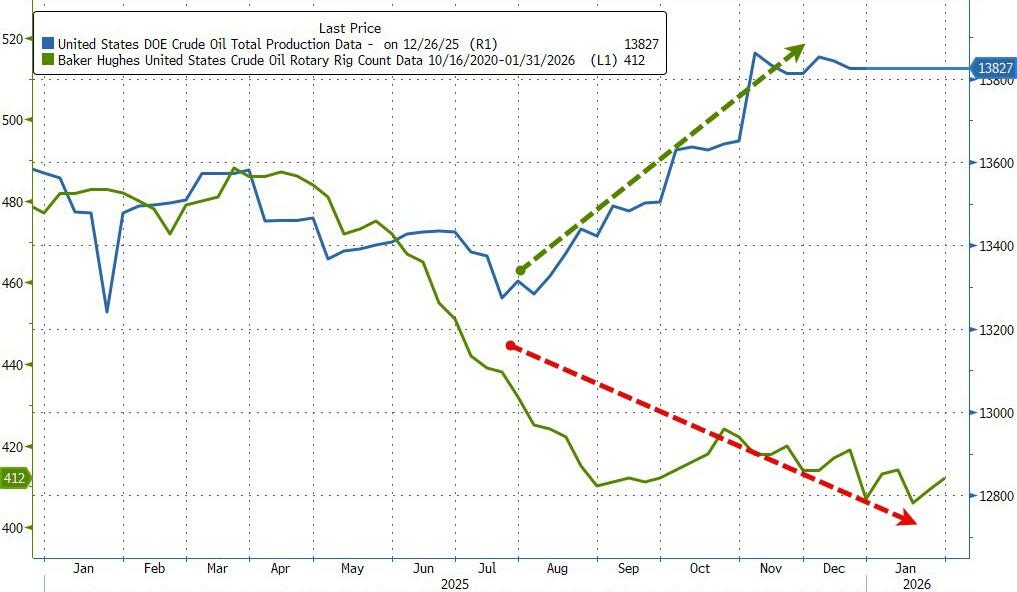

US crude production remains near record highs as the rig count has continued to slide all year...

Oil headed for its steepest annual loss since the start of the pandemic in 2020, in a year that has been dominated by geopolitical risks and steadily rising supplies across the globe.

OPEC+ roiled markets earlier this year by reversing its longstanding policy of defending prices and raised output, seeking to reclaim market share as countries including Brazil and Guyana boosted supply and the US pumped at record levels. The producer group is expected to hold off on output hikes during talks this weekend.

A punishing surplus is expected to weigh on prices in 2026 - Global oil markets have been been oversupplied this year.

“The oil market is set to remain oversupplied into 2026, with strong non-OPEC production from the US, Brazil, Guyana and Argentina outpacing uneven global demand,” said Kaynat Chainwala, an analyst at Kotak Securities Ltd. Prices should stay range-bound between $50 and $70, with risks over Venezuelan or Russian supply remaining supportive, she added.

Both the International Energy Agency and the US government see production exceeding consumption by just over 2 million barrels a day in 2025 and that surplus worsening in the coming year.

More By This Author:

Starbucks Shuttering About 400 Locations, 40+ In New York City AloneFOMC Minutes Confirm 'Most' Fed Officials Expect More Rate-Cuts, Divisions Remain

Meta "Joining Forces" With China-Founded Manus AI In $2 Billion Deal

Disclosure: Copyright ©2009-2025 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies ...

more