Oil Faces Choppy Trading Ahead, Long-Term Bullish

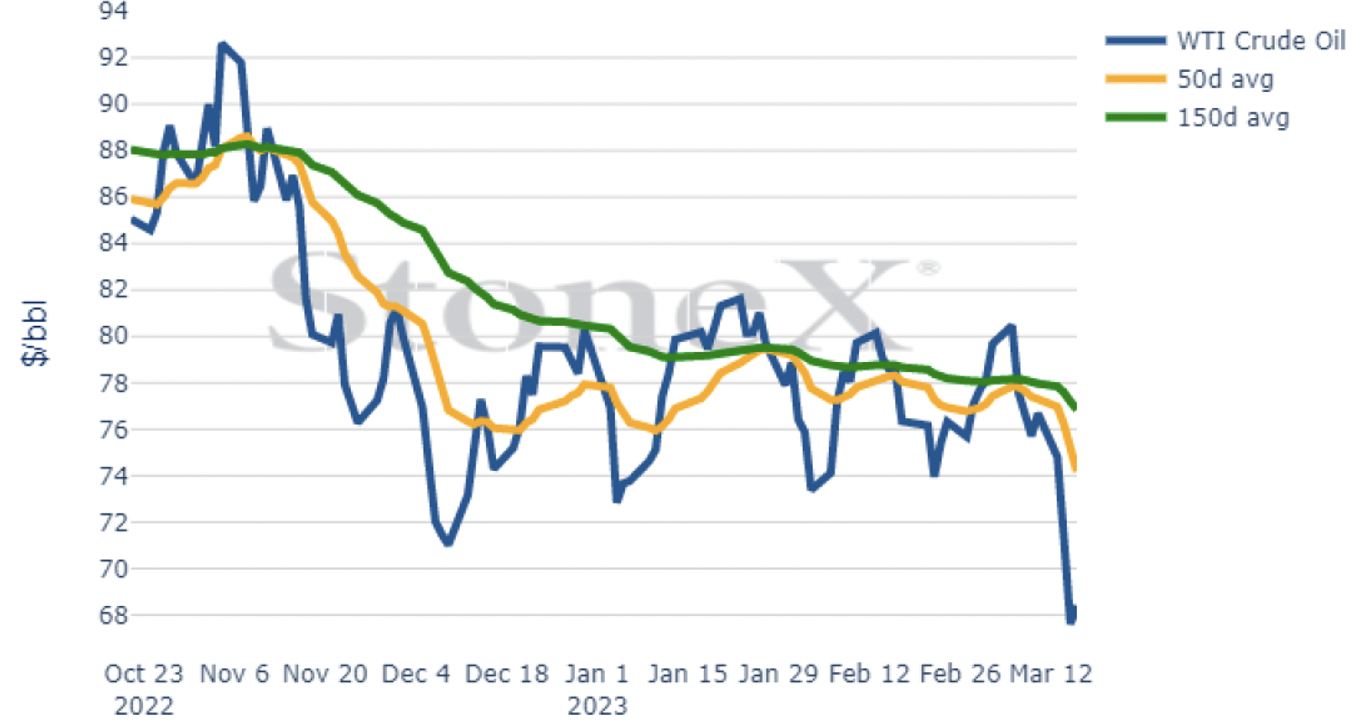

The oil market has been extremely volatile, tracking a volatile equity market. Crude oil was down 5% today, with WTI at $66.45. WTI prices have dropped to their lowest price since December 2021, losing over $14 per barrel in 2 weeks. A long-term bull run is still on the cards. However, current market dynamics point to continued downward pressure on prices.

Fundamental data for nearly all petroleum products has been weakening – the recent aggressive sell off across the oil sector has been heavily driven by broad economic concerns over the economic outlook, and more recently bank liquidity crises. When the dust settles next week after the FOMC meeting, there may be a clearer direction on Fed policy and so the economic outlook going forward.

WTI Crude Oil Chart

(Click on image to enlarge)

Source: StoneX

Highlights

- The most concerning development has been the continued flattening of the futures market structure in crude oil

- Diesel futures market structure has collapsed and is essentially flat outside of the first two months

- Gasoline production margins have held above the 200-day moving average but were still down 4% on the week

- Chinese crude oil demand temporally provided bullish hopes, but imports in China are expected to fall in April-June due to refinery maintenance season

- Inventories in crude oil have recovered significantly

- The heating oil market structure has continued to flatten, and basis remains weak across the US

- Although diesel prices remain in backwardation in the front month, where the current price of an underlying asset is higher than prices trading in the futures market

- The trend of inventory builds and structure collapsing points towards continued pressure on heating oil prices moving forward

Conclusions

The crude oil market is likely oversold at this point, however, until the FOMC meeting next week passes there will be more uncertainty in the broader markets which have been extremely volatile. Prices are likely at good value currently, but there is nothing to point towards strong crude oil prices in the near term.

Prices may be at good value and the current market structure still will make fixed-forward contracts appealing. Long term forward contracts looking ahead to 2024 are priced at levelsthat are almost 30 cents lower than the front month contract.

The spread between NYMEX Heating Oil and ICE Brent Crude Oil, or ‘heating oil cracks’, remains near seasonal highs, and market structure remains inverted, both indicating strength in refined products.

Forecasts are provided by StoneX Financial Ltd. These forecasts represent the views of the StoneX Energy team and not necessarily those of FOREX.com or City Index analysts.

More By This Author:

Markets At A Turning Point On Rate Expectations And The Threat Of Endemic Inflation

Moderating Rate Hikes Silver Lining Of Bank Failures?

Gold Price Forecast: XAU/USD Bulls Ramp Off Support

Disclaimer: Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only ...

more