Oil Bulls Kept In Check By Aggressive Central Banks

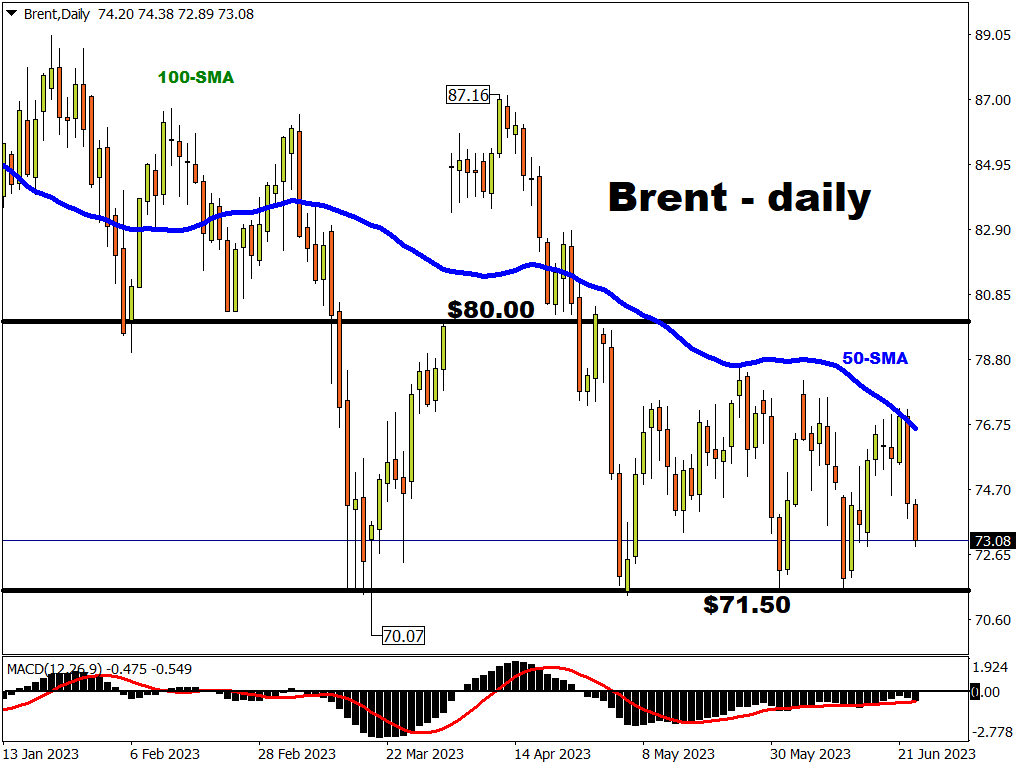

Brent oil has been resisted at its 50-day simple moving average this week, as major central banks made a big show of their aggressiveness in combatting inflation.

The larger-than-expected rate hikes out of the UK and Norway, coupled with the Federal Reserve insisting it has more rate hikes in store, has raised market fears for a global recession.

Macro woes still abound, overshadowing the encouraging signs surrounding US consumption, with crude stockpiles falling while demand for oil products supplied and jet fuel has risen.

The US dollar’s resilience of late has also added to the headwinds for oil prices.

This global benchmark for oil prices is set to register a weekly loss of about 4% - its largest since the week ending May 5th.

Still, Brent oil appears rangebound, with strong support set to arrive around the $71.50 mark which had previously rebuffed oil bears on several occasions since early May.

Although the thought of further Saudi supply cuts may shore up support for Brent, the upside for oil benchmarks should remain capped until markets can get over the recession fears.

More By This Author:

GBPUSD Limbers Up Ahead Of Powell And BoE

Fed May Force USD Index To Test 100-Day SMA Support

Cryptos Slammed By SEC Suit Against Binance

Disclaimer: Forecasts which are made in the review constitute the personal view of the author. Commentaries made do not constitute trade recommendations or guidance for working on financial ...

more